The MSP landscape round-up 2024

18 December 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

2024 has, like any year, been one of peaks and troughs in the IT channel. Some partners have thrived and forged new paths while others have struggled and re-grouped, searching for a new identity. Canalys predicts overall channel growth will be 5% this year, while 2025 is forecast to grow 9%.

2023 saw spectacular growth in managed services globally, up 13% year-on-year. This was helped by 15% growth in the US, the world's most mature managed services market, but 2024 has not been so bold. Growth will hit just under 11% this year with a forecast of 13% for 2025. But what are some of the other key issues that have shaped the year for partners in the managed services world?

This has undoubtedly been the year of AI. It is everywhere. No channel event was complete without multiple, often confused, takes on where it is all going.

2024 has seen massive investment and the development of some important efficiency gains for partners in the managed services space. Vendors have invested in building automated ticketing and response into existing PSA tools, patch management in RMM, backup testing, and improving true positive rates for cybersecurity services like MDR, to name just a few. Partners have been developing their own internal automations around sales and technical workflows, trying to eliminate some of the administrative time to help employees focus on the most valuable areas of their jobs, working to improve the customer’s experience.

These use cases appear relatively basic, though for product managers integrating AI into existing tools used by MSPs has been anything but simple. The impact on sales and technical employees moving forward will be huge, but how the value of their jobs is defined, and with what tools, is still very much to be determined. There is a tendency to talk in grandiloquent terms of the great humanitarian benefits of AI, without ever really defining the day-to-day reality of what it will actually do and how it will make things better.

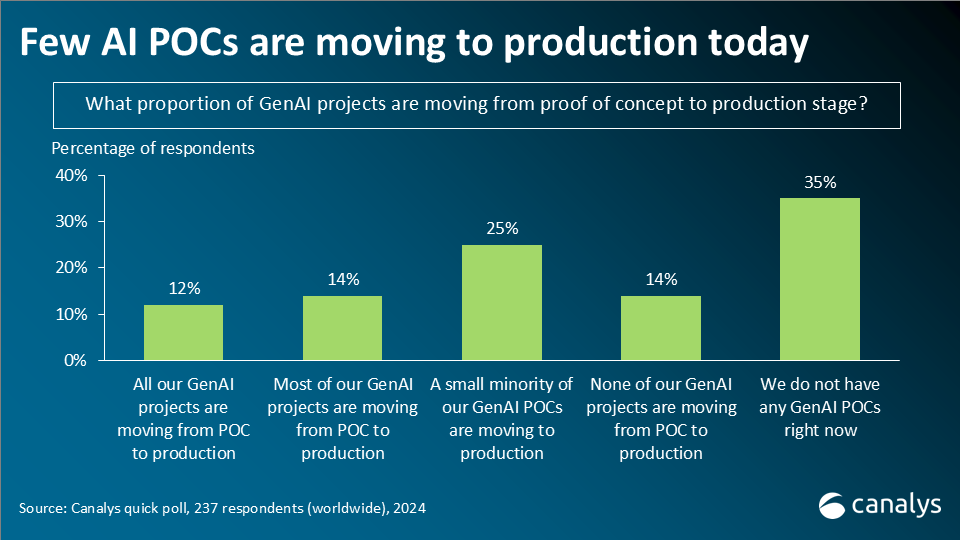

This is also being felt by customers, and it can be seen in the relatively low adoption of tools such as Copilot (particularly given its premium price) and in the proofs of concept developed by partners for customers, 39% of which are almost never going into production. But 53% of partners still see significant opportunities in the future around AI; there will be a lot more adoption, and many new use cases for partners in managed services.

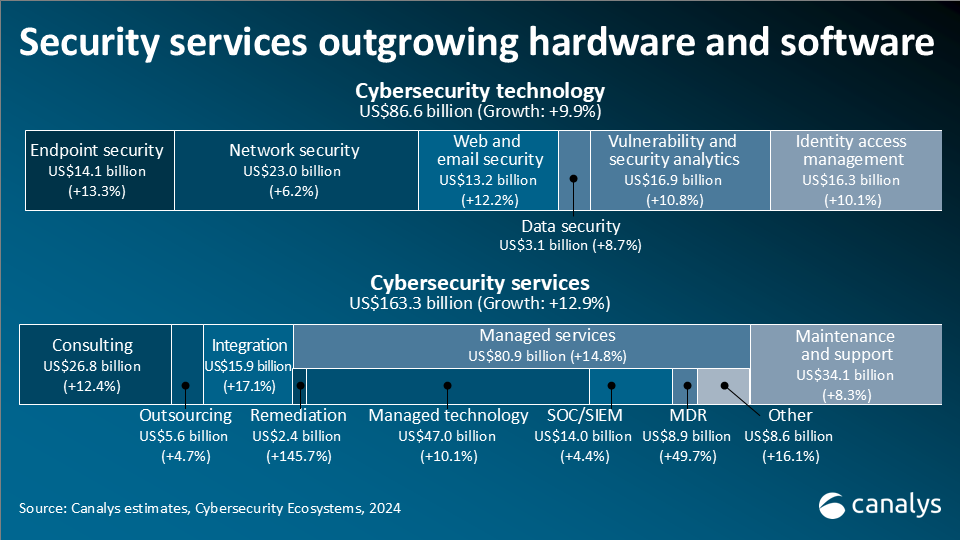

Canalys estimates 2024 cybersecurity product growth at 10%, while overall cybersecurity services are up 13%, with managed cybersecurity services up 15%. Partners and vendors wonder if this growth can be sustained. This year saw slower product growth than 2023, but the overall reason for cybersecurity's strong performance is simple. Cybersecurity is the only area of tech with an adversary. Ransomware continues to rise; cyber criminals are adopting AI (and attacking AI tools), and it is clear cybersecurity products alone cannot keep up with the breadth of the threat.

As business risk has shifted from physical to digital, so the dearth of skills has pushed more customers to outsource to MSPs and MSSPs. But there is also an issue with the balance of profitability. Customers today understand better the value of cybersecurity managed services, but that understanding does not extend across every customer and in this difficult year budget constraints have placed burdens on the number of customers able to invest, which in turn places a strain on some partners’ profits.

Partner CEOs have long complained about the cost of cybersecurity employees, and while certified and trained analysts in cybersecurity are still in high demand the cost of keeping them on has become very hard for some partners to grow those teams, which has led to pressure on existing employees as they take on more clients. This has also led to the current wave of growth in managed detection and response services delivered by vendors and sold by partners, where the partner provides deployment, integration, and some monitoring services, but also relies heavily on the vendor to provide the more costly analysis, alerting, and remediation services. So, the cost of the skilled employee has been extended to the vendor side, some of whom are more able to pay for those skills, but this also creates a risk.

Partners and vendors are trying to save costs to improve profits which creates a situation where the customer may not be getting the product, or service, they thought they were paying for, and it is only when there is a breach and they require remediation services, that they realize the issue. Customer churn has increased massively in 2024 as partners lose customers to lower cost rivals, some of whom may not be providing a significantly better service than the original partner. Partly this is to do with overall cost constraints on the customer, but there is a smaller contingent of customers switching their MSP following a breach (sometimes even a small one).

Meanwhile vendors are fighting over the small pool of talented MSPs and MSSPs who can deliver profitable and high-quality services to customers, and this has given those partners some leverage to demand more from those vendors. And once again, the vendors complain about the demands of partners, while partners and vendors complain about the cost of skills. However, the skills issue won’t go away because many are not willing to invest properly to solve the problem. The equation is simple. Pay highly skilled employees properly or you will lose them, but you must also find enough customers willing to pay for the service these employees can help you deliver.

The explosive growth of hyperscaler marketplaces as a route to market for software and SaaS companies, led by AWS Marketplace, Microsoft Azure Marketplace and Google Cloud Marketplace, is reshaping enterprise procurement behavior, vendor go-to-market strategies and channel models. The ability for customers to use third-party marketplace purchases to “burn down” their commitments with hyperscalers is driving both large software procurement deals and run-rate software transactions through marketplaces.

Hyperscaler marketplaces are rapidly becoming a critical route to market for software and SaaS vendors across numerous technology categories. This is changing enterprise procurement behavior, as customers start to build marketplace purchasing strategically into their cloud spending commitments with hyperscalers. Canalys predicts that more than 50% of hyperscaler marketplace sales will be via channel partners by 2027, as AWS, Microsoft and Google Cloud expand their respective channel partner private offer models. Distribution faces a growing threat from hyperscaler marketplaces, but distributors are attempting to define new roles by integrating their own digital platforms with those of the hyperscalers.

For managed services partners, there are a number of marketplace avenues they can choose to procure from, whether it be hyperscaler, distributor, partner, or vendor. For MSPs particularly, one of the fastest growing areas, and an important differentiator for vendors, is through RMM and PSA vendor marketplaces. A strong integration strategy is key for these vendors, as the more alliance partners they have, the better it is for partners to buy, resell, and bill these SaaS products for their customers through their PSA tools.

Read more on this subject in our Now and Next for Hyperscaler marketplaces report.

Along with AI, 2024 was also the year of the platform. Partners delivering managed services have seen 2024 as the year of consolidation. Which vendor, or ecosystem of vendors, should a partner choose to invest in? Is not a simple question to answer, because, in cybersecurity for example, there are two platform battles happening at once. In the enterprise sector, Palo Alto Networks, Fortinet, Cisco, CrowdStrike, Microsoft, Google and SentinelOne are leading the charge, while the SMB MSP market is being fought over by a diverse array of companies. WatchGuard, SonicWall and remote monitoring and management (RMM) providers such as Kaseya/Datto, ConnectWise, N-able, NinjaOne and Syncro are all jostling to be one of the primary control planes that partners invest in.

Certifications have been a big point of debate this year for partners, primarily due to the same budgetary and spending issues which affected everything else. There has been a real drive to bring certification spending down. In some cases, partners have allowed certifications to lapse because of cost or because those vendors have ceased to be a priority. But Thoma Bravo and H.I.G Capital’s acquisition of the brand, certification, and training elements of CompTia is a key indicator of the importance of certifications moving forward. For example, it is likely we will see many more vendors building partner programs which require two sets of certifications. One, an industry-wide certification (such as Cyber Essentials) which is recognized by customers and can be used to demonstrate capability with multiple vendors, and another vendor-specific certification which fulfills its requirements to deliver a particular service on a product from that vendor. It is this second, outsourced vendor certification, which CompTia is likely to target for growth moving forward.

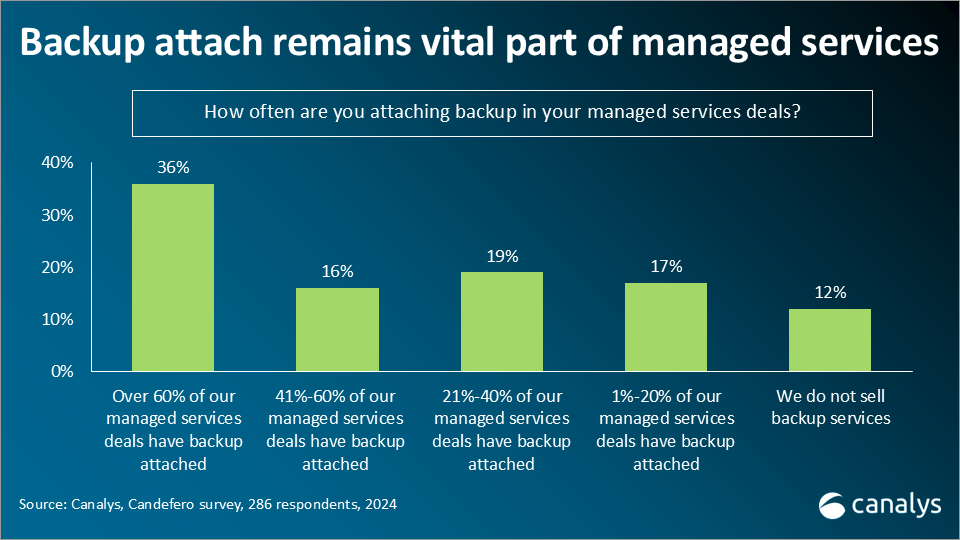

Backup had become a commodity in the eyes of some in the MSP space, but this has changed significantly over the last two years. Two-thirds of partners in a recent Canalys poll said they would see growth in their backup product sales in 2024, with half of those saying that growth would be over 20% so demand is clearly strong. But it is the attach rates of backup on managed services which show how much more closely the story is now linked to cybersecurity and risk management. 36% of partners said they were attaching backup to over 60% of their managed services deals, with a further 35% saying they were attaching it to between 20-60% of managed services deals.

2024 was the year when backup was more strongly linked to cyber after years of trying to convince customers backup is not just about commoditized data recovery but is now about disaster recovery. Compliance pressures have been a big part of this drive. Government regulation, vertical-specific requirements, cyber insurance stipulations (and some high-profile IT outages) have all driven demand from customers that now see backup and disaster recovery tools as an intrinsic part of their risk management strategies. This also led to the growth in AI-driven backup, which uses AI to improve and automate some of the more manual areas of backup failure management, testing, and troubleshooting, helping to boost employee efficiency in managing backups. As we move forward, inevitably, the demand will be for much more automation in these processes, possibly to the point where people are barely necessary even in the disaster recovery phase.

This shift was also visible in the M&A activity which saw ConnectWise acquire Axcient and SkyKick to build its platform story, SalesForce acquired Own Company (which had started as a Salesforce backup specialist and was closely linked with the company already), Veeam acquired SaaS backup company Alcion (a company it had already invested in), while cloud backup company CrashPlan went the other way and acquired enterprise data protection vendor Parablu. In the MSP vendor space backup technology expands the TAM to the resell and end-customer spaces in a way that is attractive to vendors, but the breadth of all these acquisitions shows the technology is relevant to so many customers, particularly as SaaS and cloud backup become greater parts of the overall market.

Compliance services delivered by channel partners grew 66% in 2024 as customers looked for clarity and expertise on the multiple compliance issues they now have to manage. From government regulations to more sector-specific requirements, as well as IT and supply chain compliance, and cyber insurance rules, customers are swamped.

Legal practices, accountants, MSPs, and consultancies have been the most prominent players helping SMB customers navigate these issues, but now cyber insurers are taking more business in the MSP market. Some are offering risk management services, which can be an (outsourced) MDR, cyber training, and compliance service stack. Despite potential conflicts of interest, it is another example of how areas not obviously relevant to IT can drive competition and change the structure of the managed services ecosystem.

There have been far too many new MSP programs announced in 2024 to name them all here, but there have been big changes. Infrastructure and PC companies like Lenovo have been adding (or in some cases resurrecting) MSP programs, and MSP-focused vendors such as Kaseya have been updating or codifying certain practices and standards to improve their partner engagement.

MSP programs outside the traditional MSP vendor space, such as vendors in RMM or backup where they are used to billing on recurring revenue, can be difficult to manage. This is mostly due to the differing financial practices, which impact both vendors and resellers as they transition to recurring revenue models. Moving from an upfront financial system to a recurring one has been a problem for over a decade as partners and vendors have tried to reap the investor benefits of recurring revenue models but without incurring the risk of a full month-to-month billing model.

This means vendors’ MSP programs have to juggle many different partner types, and often partners that are a hybrid of different consulting, resell, integration and managed services practices. Building a program to suit these partners will always be a difficult practice, but some appear to be getting there. Lenovo’s new MSP program, for example, is still relatively new and will surely evolve over time, but it appears to do a good job of balancing lots of competing interests while also carefully navigating the obvious problems. Crucially, these programs must remember they are there to incentivize the partners to work with the vendor and so must serve those partners in the ways they want to do business.

M&A activity in the channel is always a hot topic. 2024 saw an interesting slowdown in North America as partners and private equity investors waited to see how the political and macro-economic changes would affect their businesses. However, Europe and parts of Asia Pacific were still quite strong. Despite facing exactly the same issues as other regions, small MSPs were being acquired at a decent rate and larger resellers were adding to their businesses with strategic acquisitions for skills. The global level of M&A growth was still slower than in previous years, but the channel is now ready to invest and as private equity loosens its purse strings following a year of political and economic turmoil, 2025 is likely to see high levels of acquisitions across all regions once again.

2024 has been a year of political, economic and social dislocation. Half the world’s population will have voted by the end of the year, from Bangladesh in January to Ghana in December. In many cases, incumbents have lost or seen their power eroded. Conflicts have re-ignited, and the world seems a less stable place than it did five years ago. This has all had a direct impact on the IT channel.

Businesses have been cautious, waiting to see how their countries and economies would react to this upheaval. Channel revenue growth will be in mid-single digits in 2024 but for those in the IT managed services space, this time has also been one of re-appraisal, of reflection, and in many cases growth. This has been the year of technology and services rationalization, of investment in automation, and of specialization.

Cybersecurity, cloud, or AI partners have seen strength and demand as customers looked to their trusted advisors to help them navigate these choppy waters and manage their IT spending. Unfortunately, it has also been another year of mass layoffs by tech vendors with over 150,000 people losing their jobs. In some ways, this has placed even greater importance on the channel to maintain service capability and to deliver value to their customers.

For those delivering managed IT services, 2025 will likely look a little better. There is hope for stability on the horizon. Canalys forecasts that overall channel growth will hit 9% in 2025, while managed services revenue could rise 13%. Once again, cybersecurity, cloud, and AI will be top of the agenda. So too will the continued importance of compliance and cyber insurance, as regional regulations take greater effect. Channel partner certifications will see an upheaval as more partners look to industry-wide certifications to demonstrate their value to customers, and vendors start to outsource more of their program certifications to third parties. Consolidation in the vendor space will also continue and several IPOs are expected in the RMM, backup, and cyber technology areas. We will also likely see a large uptick in channel acquisitions as larger resellers and systems integrators acquire specialists and private equity-backed managed services providers build for global domination. And there will be some surprises too. All this and more will be analyzed in the upcoming Managed Services 2025 Forecast Report which will be released in the new year.