Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Device financing – a catalyst for smartphone growth in Africa

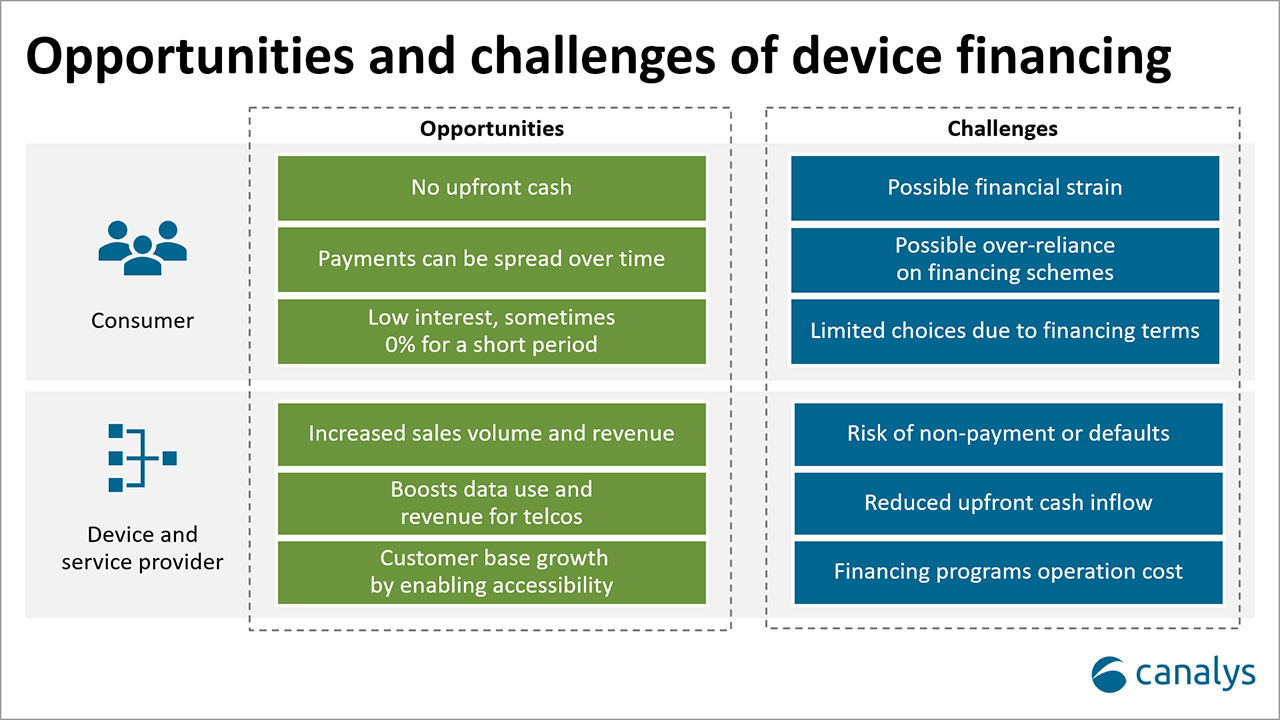

Device financing has emerged as a transformative solution to increase smartphone accessibility across Africa, particularly for underserved customers. Models such as Buy-Now, Pay-Later (BNPL) and Pay-As-You-Go (PAYGO) are redefining affordability, enabling broader smartphone ownership and driving digital inclusion.

Device financing has emerged as a transformative solution to increase smartphone accessibility across Africa, particularly for underserved customers. Models such as “Buy Now Pay Later” and “Pay As You Go” are redefining affordability, enabling broader smartphone ownership and driving digital inclusion.

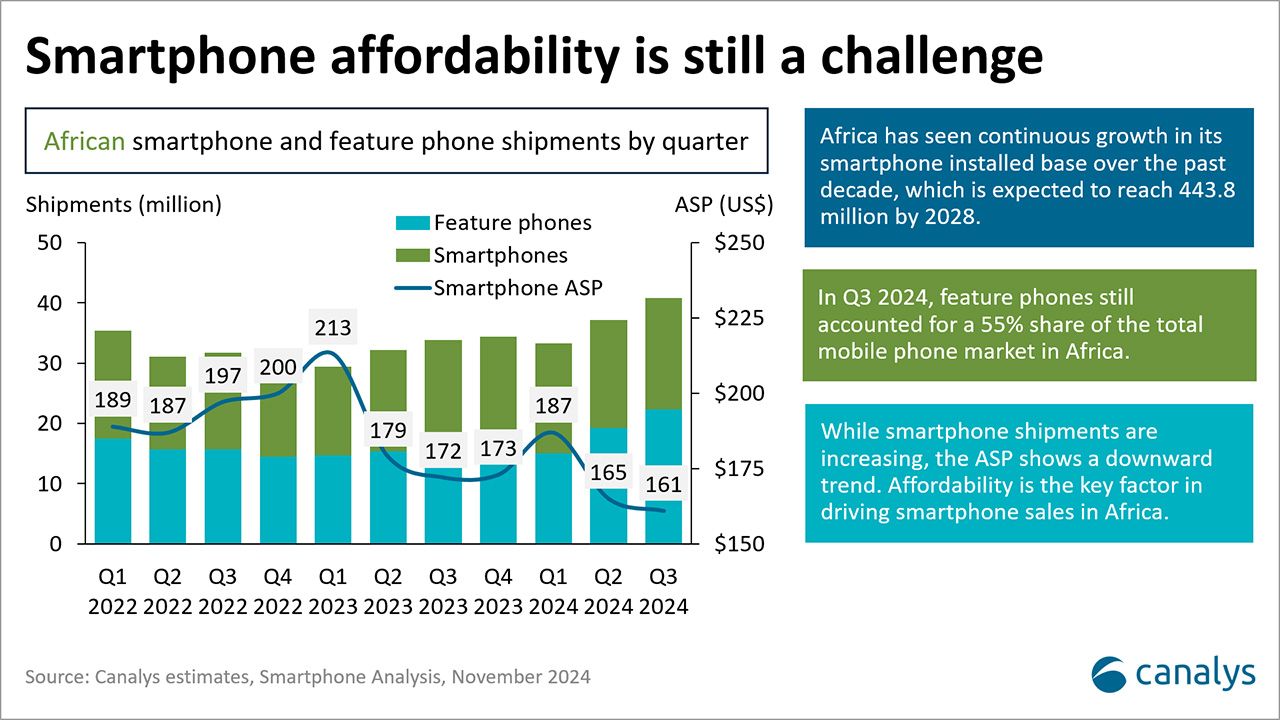

In Q3 2024, as per Canalys estimates, feature phones still accounted for a 55% share of the total mobile phone market in Africa, underscoring affordability challenges. Smartphones, however, are vital for Africa’s development, serving as gateways to financial inclusion, education, healthcare and entrepreneurship. Traditionally, Africa’s pre-paid environment has limited access, as cash-based distribution restricts affordability. While device financing offers a straightforward solution, success requires a robust ecosystem to onboard customers effectively.

The current state of device financing in Africa

Device financing enables individuals to purchase smartphones through installment plans or loans, allowing them to spread the cost over time. This approach makes devices more accessible to those who may not have the upfront funds. In sub-Saharan Africa, where a significant portion of the population is unbanked or underbanked, only 49% of adults have a bank account, according to the World Bank. Though this figure has doubled since 2011, it is still behind the global average of 76%.

In Nigeria, several providers, such as Easybuy, CDCare, Jumia Flex, Slot Nigeria and the Device Finance Scheme by Access Bank, offer financing options. These typically involve a down payment with flexible repayment terms. M-Kopa, which has financed millions of smartphones across African markets since 2020, is another key player in this space. Additionally, in 2023, MTN South Africa partnered with the FoneYam device financing program, capturing 37% of device sales through the FoneYam initiative at Pep, a South African low-cost retailer.

Consumer demographics

Primary customers are underbanked individuals lacking formal credit scores. Programs such as M-Kopa’s require only a national ID card, ensuring broad accessibility. Customers range from first-time smartphone buyers transitioning from feature phones to those upgrading to higher-quality devices. A significant portion of the population in Africa is under 35, with many in this group actively seeking devices for connectivity, education and employment opportunities. The majority of consumers opting for device financing fall into the low-to-middle-income brackets, making financing a vital enabler of smartphone ownership. With a large informal economy, many consumers finance devices as tools for business and productivity.

Pricing and payment models

Devices are typically financed with a 15% to 30% initial deposit, followed by daily payments over six to 12 months. East African plans often span 360 days, while West African plans are limited to six months. Device-locking mechanisms enforce payment compliance by rendering phones inoperable until payments are made.

Key players and partnerships

Companies such as M-Kopa collaborate with HMD and Samsung due to their robust device security platforms, vital for mitigating fraud and ensuring credit recovery. Partnerships with financial institutions such as Stanbic provide capital for financing programs. Collaborations also extend to mobile operators (Safaricom, for example) and repair service providers.

What opportunities will device financing bring to the African smartphone market?

Market expansion: Expanding into emerging markets such as Egypt, Ethiopia and Côte d’Ivoire offers untapped growth opportunities. Local assembly initiatives in Uganda and other regions can reduce import duties and stimulate economic growth.

Technological advancements: Proprietary device locking and credit risk management platforms can enhance security and reduce fraud. Collaboration with mobile operators to accelerate 4G and 5G adoption will further increase smartphone penetration.

Consumer demand: Government initiatives for digital transformation and telecom operator efforts to transition users from 2G/3G to 4G/5G are creating strong demand for affordable smartphones.

What challenges will vendors and channels have to overcome while facilitating device finance?

Fraud and bad debt: Fraudulent activities, such as hacking and identity theft, remain significant concerns. Device-locking mechanisms offer protection but are not foolproof. Customers often revert to feature phones when locked devices become inaccessible, leading to repayment challenges.

Regulatory and policy uncertainty: Shifting government policies and subsidies create operational uncertainties. High import duties, as in Kenya, Egypt and Morocco, increase costs, though local manufacturing provides some relief.

Infrastructure gaps: Limited mobile money adoption in markets such as South Africa and Nigeria hampers scalability.

Device financing is shaping Africa’s digital future, enabling millions to access smartphones and fostering greater digital inclusion. For device and service providers, device financing will serve as a gateway to establishing differentiated competitiveness. Vendors and channel partners that can collaborate to offer competitive financing solutions, build the early mover advantage and effectively manage risks such as financial policies, currency fluctuations and default risks will seize opportunities in this emerging market. Success stories like M-Kopa highlight the power of innovative models and strategic partnerships in overcoming these barriers. With a focus on regional adaptability and innovation, device financing is set to transform Africa’s digital landscape. Canalys projects a modest CAGR of 1.2% from 2025 to 2028, with 4G smartphones still accounting for 55% of shipments.