Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Buy with AWS

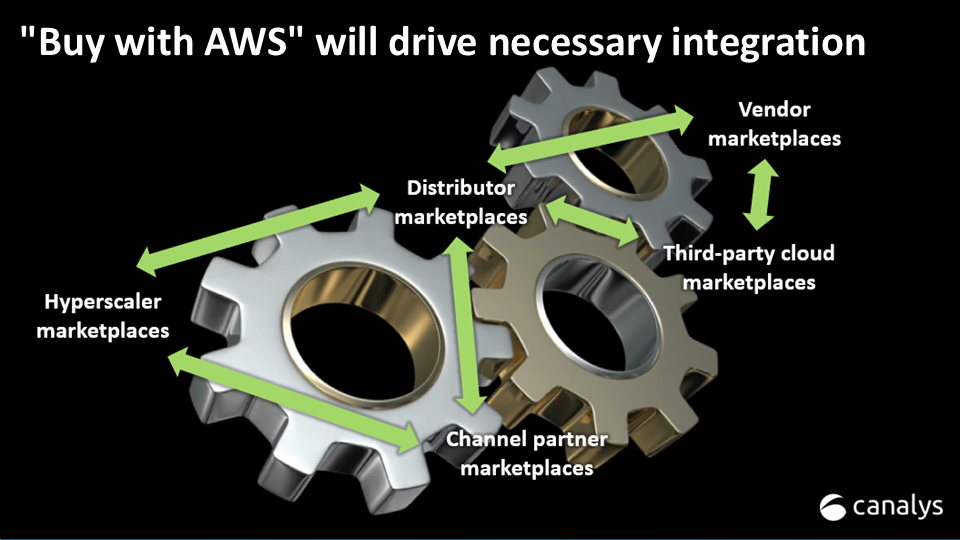

AWS has announced the general launch of “Buy with AWS” which enables customers to purchase third party vendor offers via AWS Marketplace from the website of a channel partner, using their AWS account.

Dr Ruba Borno VP Global Specialists and Partners, announced the general launch of “Buy with AWS” in her keynote at AWS re:Invent in December 2024. AWS had already piloted this with over 50 partners globally, combining a mix of channel partners, distributors and ISVs, including Bytes, Carahsoft, Ingram Micro and TD SYNNEX.

More than 99% of AWS’ top 1000 customers already have at least one active marketplace subscription and public sector clients are set to spend more than US$1 billion on AWS Marketplace in 2024. The expansion beyond the initial group is further validation of the role the partner community plays across the customer lifecycle.

Canalys expects that by 2027, more than half of all marketplace procurement will be conducted via channel partners. Early vendor leaders selling on AWS Marketplace include CrowdStrike, Palo Alto Networks, Splunk, Snowflake and Trend Micro, all recording over US$1 billion dollar cumulative, multi-year sales. Most of these vendors are seeking to take a partner-first approach to selling through AWS marketplace. According to a recent Canalys study, 80% of partners already co-selling view AWS Marketplace as an important part of their co-sell strategy, which is why many partners are already successfully working on marketplace private offers and “Buy with AWS” will enable further extension of this. Crucially, it means partners creating private offers will be able to support customers’ marketplace transactions within their own website, rather than having to send the customer to AWS Marketplace, and away from their own digital estate.

Partners will have dashboard access to AWS Marketplace analytics, which will provide detailed insights into customer behavior, dwell time, purchasing patterns, solution choices, clicks and conversion rates. This data will enable partners to analyze and optimize sales strategies as they can see how their customers engage with the AWS Marketplace.

Embedding “Buy with AWS” into a partner's website will help them understand when and how customers are procuring via AWS Marketplace. Partners have frequently highlighted to Canalys that their customers had already procured via marketplaces before they became aware of the opportunity. This will provide greater visibility to partners engaging and reduce partner concerns over the impact of marketplace procurement.

One category of partner where sentiment is shifting most strongly is within the distribution community. There is a tangible shift from competition fears to identifying clear differentiation and value add opportunities. Ingram Micro’s Strategic Collaboration Agreement with AWS has driven the integration of the “Buy with AWS” within the new Ingram Micro Xvantage platform. Similar features have been added to the TD Synnex StreamOne platform enabling resellers to maximize their support from both their distribution partners and AWS.

Customer benefits are a key driver for marketplace adoption

Enterprise customers continue to invest heavily in upfront, multi-year commitments with AWS (and the other major hyperscalers), in order to access discounts and in anticipation of increased cloud consumption to support AI workloads. As of Q3 2024, committed future spend with AWS alone totaled US$165 billion. But customers will be under greater pressure to show how they are leveraging these commitments. Greater macroeconomic pressures and increased board scrutiny are creating new challenges for business leaders. This makes the ability to use a proportion of these commitments to purchase third party vendor SaaS products even more attractive. AWS currently allows customers to use up to 25% of their committed spend for marketplace procurement, effectively equating to over US$40bn of pre-approved, available spend to ‘burn down’ via AWS Marketplace.

“Buy with AWS” further simplifies the customer journey; customers are able to buy using their existing payment and subscription details (rather than needing to create a new account with the partner), providing centralized billing and by engaging with partners, this increases customer support throughout the procurement process.

Challenges remain

The growth in hyperscaler marketplaces represents an important shift in customer procurement, but creates clear risks for the channel. One of the biggest fears is being cut out of the procurement process in the future. Partners express concerns that “Buy with AWS” does to some extent lock both customer and partner into the AWS ecosystem and for those with hybrid or multi-cloud environments this presents some challenges. However, this new feature should provide partners with a greater degree of control over the marketplace transaction, helping to retain the relationship with the customer.

As partners add the “Buy with AWS” functionality into their websites, some are concerned as to how that impacts the competitive landscape. Smaller, less prominent partners may struggle to remain competitive or relevant. A number of partners with the digital capability to support “Buy with AWS" (as well as distributors) will adopt this, but there are many partners who do not have sufficient digital capability and will not support this procurement motion. Partners will need to continue to evolve and monitor customer buying habits in order to remain relevant to their rapidly evolving buyers and buying points.