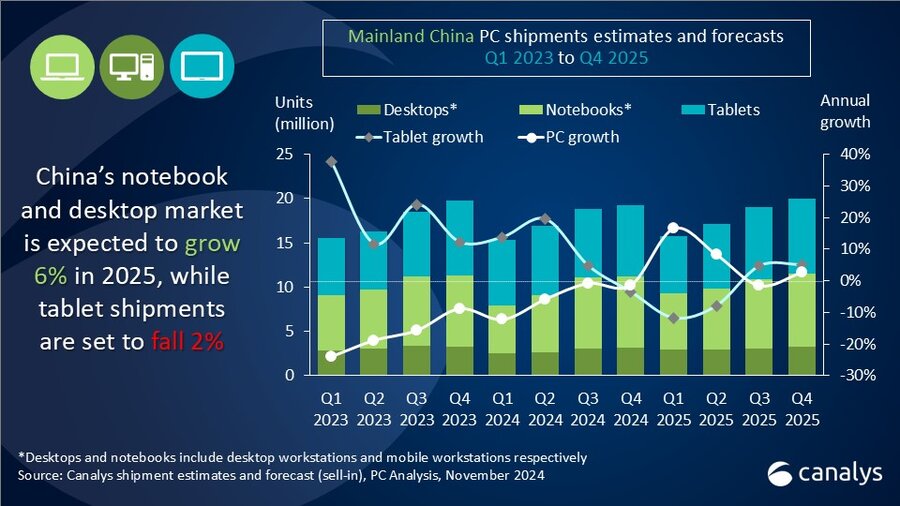

Mainland China’s PC market set for 6% growth in 2025 amid strong public sector stimulus

Wednesday, 18 December 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

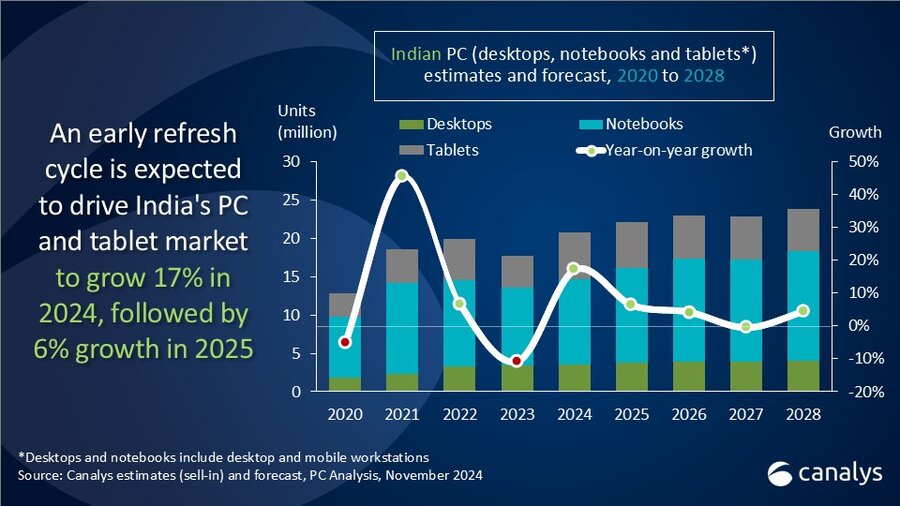

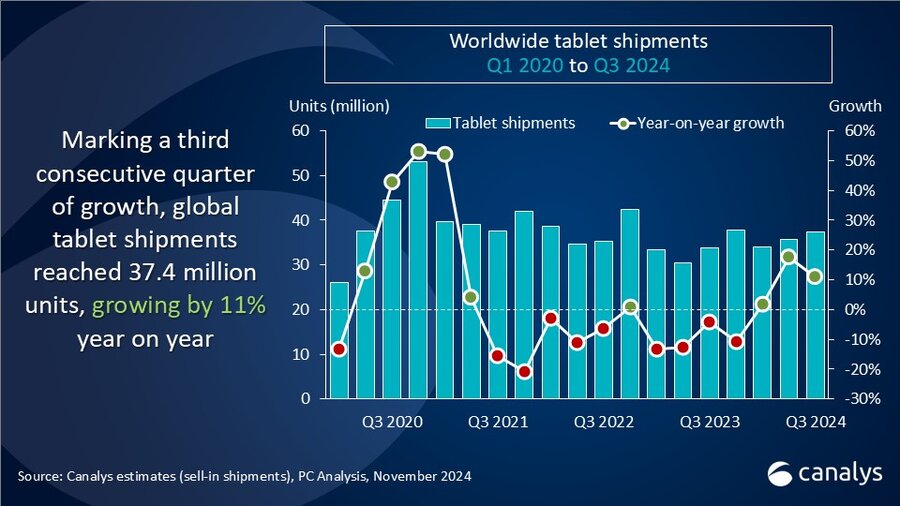

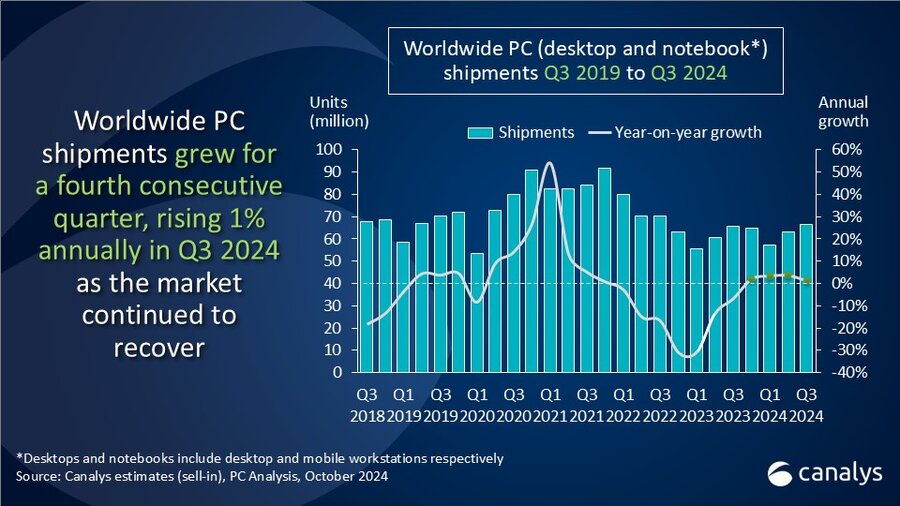

In Q3 2024, Mainland China’s PC shipments (including desktops, notebooks and workstations) saw a slight year-on-year decline of 1%, reaching 11.1 million units, with 4% year-on-year growth in the consumer segment driven by pre-seasonal stockpiling and government incentives. Meanwhile, tablet sales continued their upward trajectory, growing 5% year on year to 7.7 million units, supported by new product launches and promotional efforts throughout the quarter. In 2025, Canalys expects the PC recovery to be sustained, with desktops and notebooks growing by 9% and 4% respectively, backed by stimulus to support both consumer and business spending. Tablet shipments are set to decline slightly by 2% next year following a strong 2024, but the integration of AI capabilities will continue to drive penetration within the consumer and education segments.

Since 2023, China’s PC market has experienced significant shifts, with the growing presence of domestic vendors. The government’s encouragement of “Xinchuang” (indigenous innovation) has created a favorable environment for domestic vendors to thrive. Local vendor iSoftStone (previously known as Tongfang) jumped to second place in the shipment rankings in Q3 2024 with strong performances in both the public sector and education market, as well as with its gaming PCs. The commercial sector remains challenging, showing a 7% decline in Q3 2024, due to weak demand from SMBs and large enterprises amid a difficult economic environment. In contrast, the public sector showed growth, with a 3% increase driven by recoveries in government and education sector spending. This top-down policy is expected to continue and will lead to a broader recovery for China’s PC market in the year to come.

“Stimulus policies and government guidelines have become the key elements shaping China’s economic performance in the latter half of 2024,” said Emma Xu, Analyst at Canalys. “Incentives from both central and local governments have boosted the retail sector and have also driven higher-value PC sales, a trend we expect to have a positive effect on Q4 shipment performance. Moreover, this top-down approach is driving more investment from the domestic industry into local CPUs, GPUs, platforms and OEMs.” With ongoing stimulus boosting the economy in Q4 2024 and 2025, Canalys anticipates a further recovery in both public and private sector spending.

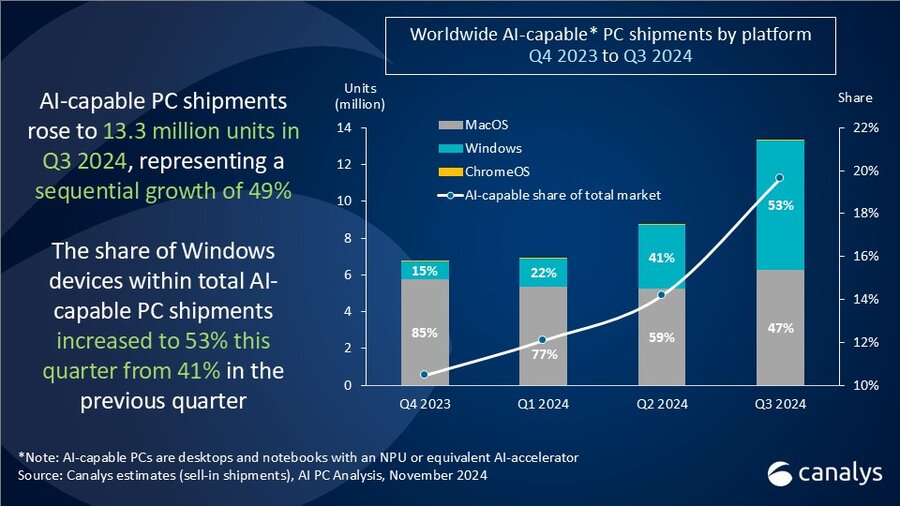

The gaming and AI-capable PC segments both experienced substantial growth in Q3 2024, with sequential increases of 24% and 70%, respectively. The average selling price of PCs rose by 4% sequentially to US$800. Notably, the share of AI-capable PCs surged to 15% of the total PC market, up from just 7% in Q4 2023. “Higher-value PCs with AI or gaming capabilities have been resilient despite broader market downturns, driven by heightened expectations for strong user experiences,” said Xu. “As the market evolves, vendors will need to strengthen their product competitiveness in these high-value categories to maintain competitiveness and profitability.”

Tablets in Mainland China maintained their momentum during the pre-holiday season, with year-on-year growth of 5%. “New trends are emerging in the tablet space, including products designed for kids’ education and cloud-based user experiences,” said Xu. “These trends are increasingly leveraging AI to enhance functionality, with focuses on education, government and home-based use. AI-driven innovations are creating new opportunities in the tablet market, offering the potential for significant growth in specialized sectors.”

|

People’s Republic of China (mainland) desktop and notebook forecast Canalys PC Forecast: 2023 to 2025 |

|||||

|

Segment |

2023 |

2024 |

2025 |

2024 |

2025 |

|

Consumer |

23,390 |

22,950 |

22,751 |

-2% |

-1% |

|

Commercial |

15,066 |

13,632 |

15,861 |

-10% |

16% |

|

Government and education |

2,784 |

2,750 |

2,926 |

-1% |

6% |

|

Total |

41,240 |

39,332 |

41,537 |

-5% |

6% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

People’s Republic of China (mainland) tablets forecast Canalys PC Forecast: 2023 to 2025 |

|||||

|

Segment |

2023 |

2024 |

2025 |

2024 |

2025 |

|

Consumer |

23,758 |

26,214 |

25,306 |

10% |

-3% |

|

Commercial |

3,516 |

3,428 |

3,375 |

-2% |

-2% |

|

Government and education |

1,048 |

1,365 |

1,619 |

30% |

19% |

|

Total |

28,322 |

31,007 |

30,300 |

9% |

-2% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

People’s Republic of China (mainland) desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q3 2024 |

|||||

|

Vendor |

Q3 2024 |

Q3 2024 |

Q3 2023 |

Q3 2023 |

Annual |

|

Lenovo |

3.9 |

35% |

4.3 |

38% |

-9% |

|

iSoftStone |

1.1 |

10% |

0.5 |

4% |

123% |

|

Huawei |

1.1 |

10% |

1.0 |

9% |

12% |

|

Asus |

0.9 |

9% |

0.8 |

7% |

23% |

|

HP |

0.9 |

9% |

1.2 |

11% |

-23% |

|

Others |

3.1 |

28% |

3.4 |

31% |

-10% |

|

Total |

11.1 |

100% |

11.2 |

100% |

-1% |

|

|

|

|

|||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding. |

|

||||

|

People’s Republic of China (mainland) tablet shipments (market share and annual growth) Canalys PC Market Pulse: Q3 2024 |

|||||

|

Vendor |

Q3 2024 |

Q3 2024 |

Q3 2023 |

Q3 2023 |

Annual |

|

Huawei |

2.2 |

29% |

1.8 |

24% |

25% |

|

Apple |

2.0 |

26% |

2.3 |

31% |

-13% |

|

Xiaomi |

0.9 |

11% |

0.8 |

11% |

8% |

|

HONOR |

0.6 |

7% |

0.5 |

7% |

8% |

|

Lenovo |

0.5 |

7% |

0.4 |

6% |

18% |

|

Others |

1.6 |

20% |

1.5 |

21% |

1% |

|

Total |

7.7 |

100% |

7.4 |

100% |

5% |

|

|

|

|

|||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Emma Xu: emma_xu@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2024 TechTarget, Inc. or its subsidiaries. All rights reserved.