India’s PC and tablet market set to grow 6% in 2025

Monday, 16 December 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

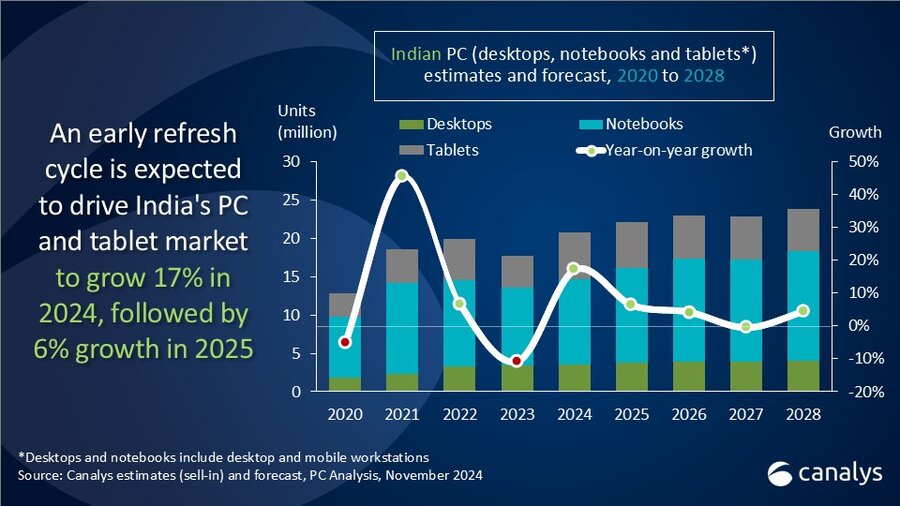

In Q3 2024, the Indian PC market, comprising desktops, notebooks and tablets, recorded an impressive 12% year-on-year growth, with total shipments reaching 6.3 million units. This growth was primarily driven by a 49% increase in tablet shipments, which totaled 1.9 million units. Notebook shipments also saw steady growth, rising by 3% to 3.5 million units, while desktop shipments declined by 12%, falling to 780,000 units. According to the latest Canalys forecast, PC and tablet shipments in India are expected to grow by 17% in 2024 and an additional 6% in 2025.

In Q3 2024, the Indian PC market (excluding tablets) remained relatively stable and had a flat year-on-year performance. The commercial segment performed well, posting a 2% increase driven by strong demand from the enterprise sector. In contrast, the consumer segment experienced a slight decline, mainly due to overstocking from the previous year, prompting vendors to adopt a more cautious inventory approach. Despite this, aggressive discounts toward the end of the quarter, particularly in online channels, helped mitigate the decline.

Meanwhile, the tablet market saw an impressive surge, growing by 49% year on year, marking its best-ever quarter. This growth was largely fueled by the completion of the Uttar Pradesh education tender by Samsung and Acer, significantly boosting the education segment, which saw triple-digit growth. Additionally, an early start to online festive sales and steady stock levels in online channels contributed to 7% year-on-year growth in consumer tablet sales.

Looking ahead, the Indian PC market is set for robust growth, projected to expand by 17% in 2024, with a more moderate 6% growth expected in 2025. “The surge in 2024 was primarily driven by continued strong demand from the education sector, which has become a key pillar of market expansion,” said Ashweej Aithal, Analyst at Canalys.

“In 2025, growth is expected to shift toward SMBs and enterprises, driven by a refresh cycle from the end of support for Windows 10 devices and the rising availability of AI PCs,” said Aithal. Additionally, consumer refresh cycles are expected to play a key role in driving demand for both PCs and tablets, adding further momentum to the market. The tablet segment will continue to be significantly influenced by government-driven education tenders, with a substantial influx of tenders anticipated in the coming quarters.

“The Indian government’s initiatives are playing a pivotal role in shaping the PC and tablet market,” added Aithal. A crucial policy now mandates that vendors and OEM partners ensure that 50% of devices are locally sourced to participate in government tenders. This regulation is expected to strengthen the “Make in India” initiative, giving domestic manufacturers an edge over international competitors. “While the policy has created short-term challenges due to infrastructure and supply chain readiness, it is ultimately positioned to reduce import dependency and bolster local manufacturing,” said Aithal. “The government’s openness to industry feedback signals a commitment to refining the policy, ensuring it aligns with market realities.”

|

India desktop and notebook forecast Canalys PC Forecast: 2023 to 2025 |

|||||

|

Segment |

2023 |

2024 |

2025 |

2024 |

2025 |

|

Consumer |

6,017 |

6,434 |

6,997 |

7% |

9% |

|

Commercial |

6,824 |

7,341 |

8,273 |

8% |

13% |

|

Government |

236 |

272 |

332 |

16% |

22% |

|

Education |

430 |

571 |

527 |

33% |

-8% |

|

Total |

13,507 |

14,619 |

16,129 |

8% |

10% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

India tablet forecast Canalys PC Forecast: 2023 to 2025 |

|||||

|

Segment |

2023 |

2024 |

2025 |

2024 |

2025 |

|

Consumer |

2,788 |

2,991 |

3,229 |

7% |

8% |

|

Commercial |

648 |

568 |

648 |

-12% |

14% |

|

Government |

188 |

203 |

228 |

8% |

13% |

|

Education |

597 |

2,369 |

1,823 |

297% |

-23% |

|

Total |

4,221 |

6,130 |

5,928 |

45% |

-3% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

India desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q3 2024 |

|||||

|

Vendor |

Q3 2024 |

Q3 2024 |

Q3 2023 |

Q3 2023 |

Annual |

|

HP |

1,300 |

30.1% |

1,320 |

30.7% |

-1.5% |

|

Lenovo |

778 |

18.0% |

764 |

17.8% |

1.9% |

|

Acer |

660 |

15.3% |

524 |

12.2% |

25.9% |

|

Dell |

481 |

11.1% |

521 |

12.1% |

-7.8% |

|

Asus |

433 |

10.0% |

531 |

12.4% |

-18.5% |

|

Others |

662 |

15.4% |

641 |

14.9% |

3.3% |

|

Total |

4,315 |

100.0% |

4,301 |

100.0% |

0.3% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), November 2024 |

|

||||

|

India tablet shipments (market share and annual growth) Canalys PC market pulse: Q3 2024 |

|||||

|

Vendor |

Q3 2024 |

Q3 2024 |

Q3 2023 |

Q3 2023 |

Annual |

|

Samsung |

769 |

39.8% |

357 |

27.4% |

115.6% |

|

Acer |

266 |

13.7% |

75 |

5.8% |

253.3% |

|

Apple |

230 |

11.9% |

211 |

16.2% |

8.7% |

|

Xiaomi |

227 |

11.8% |

85 |

6.5% |

168.4% |

|

Lenovo |

168 |

8.7% |

169 |

13.0% |

-0.5% |

|

Others |

275 |

14.2% |

405 |

31.1% |

-32.1% |

|

Total |

1,936 |

100.0% |

1,302 |

100.0% |

48.7% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), November 2024 |

|

||||

For more information, please contact:

Ashweej Aithal: ashweej_aithal@canalys.com

Ishan Dutt: ishan_dutt@canalys.com

Canalys' PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © 2024 TechTarget, Inc. or its subsidiaries. All rights reserved.