Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

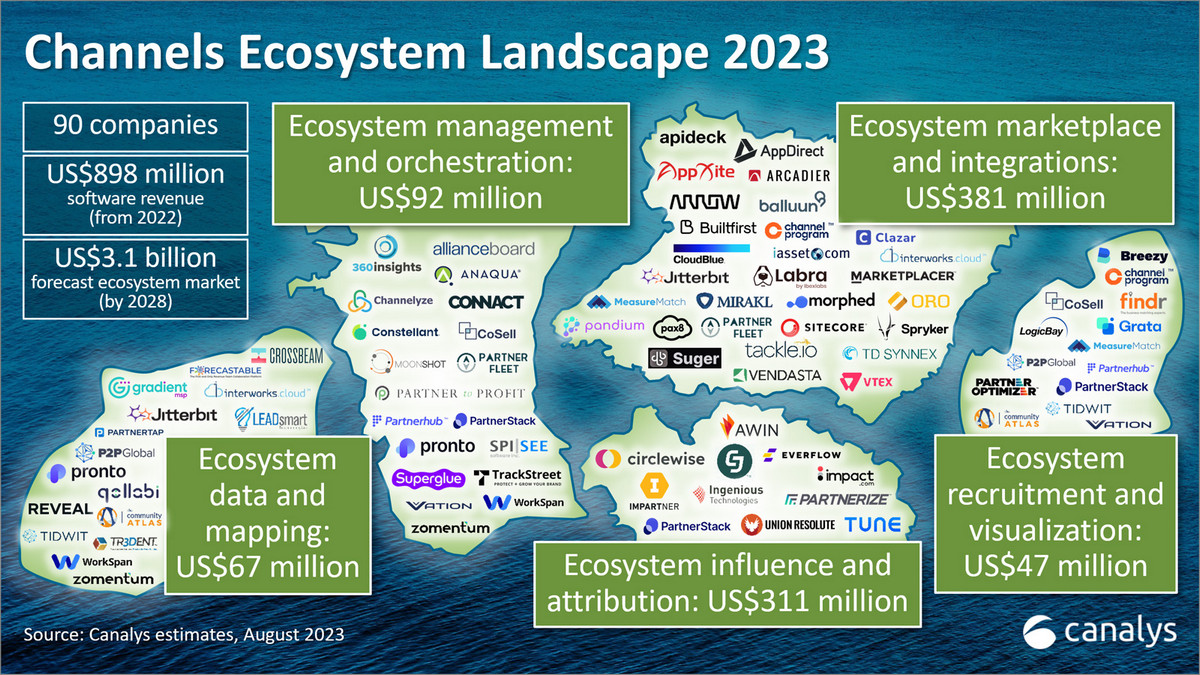

What is the Canalys Channels Ecosystem Landscape?

We have developed this "tech stack" research to bring focus to the underlying technologies that will drive competitive advantage for channel and partnership leaders in the decade of the ecosystem. The hundreds of software companies represented in the landscape are providing automation and advanced digital capabilities to help companies design, develop, execute, and manage a broad channel partner and alliance ecosystem.

There are increasing demands on channel leaders to find, recruit, onboard, develop, incentivize, co-sell, co-market, co-innovate, measure, manage and report on partner value at scale. Automation of partner-related workflows, deeper integrations, and data-driven decision-making are creating measurable competitive advantage (through partnerships) and are quickly becoming table stakes in the industry.

Canalys research shows that there are now 233 companies forming the ecosystem software landscape represented here. These companies represented US$5.3 billion in channel category revenue last year (2022). The latest Canalys forecasts show that this channel software market will reach US$11.8 billion in revenue by 2028. This research has expanded into China and work is underway to incorporate more of India and SE Asia as Canalys continues to examine the markets and robustly apply its global research methodology.

Some interesting facts about the 2023 landscape:

- There were 37 changes from last year’s landscape – this includes new companies, M&A, companies shutting down or pivoting away, and re-brandings.

- We are watching 38 additional startup companies in the channel/ecosystem tech space vying for a spot on next year’s landscape. We look for a minimum of 5 full time employees and a fully shipping product with delighted/recurring customers.

- From a revenue perspective, 14 of these companies are driving over $100 million in channel software revenue, and roughly half the list is north of $10 million.

- There is not the 80/20 revenue split that you find in most lists. The Fortune-sized companies such as IBM, Oracle, SAP, Salesforce, and Adobe (combined) drive only 13% of the total revenue.

- There are 25 companies on the landscape founded in the past 5 years. On the other side of the maturity scale, there are 23 companies over 30 years old. Four of them are over 100 years old! (ACB, Ansira, IBM, and Maritz)

- Consistent with other SaaS categories, there was a sizable drop in private equity funding. In 2021, the funding totaled over $3.1 billion, while in 2022 it dropped 75% to $763.4 million. Current year (2023) funding is at $441.8 million by August so is tracking to be similar to 2022.

- Given recent HR trends around the great resignation, return to work, and half a million tech layoffs over the past 10 months, the Glassdoor ratings remain unchanged (compared to 18 months ago) with a weighted average 3.866 for these 233 companies. The global average on Glassdoor is 3.3 (according the company itself) so working in the channel tech industry is a better experience overall for these 30,306 workers (Canalys estimate).

- Almost two thirds of companies are headquartered in the US. The UK is next with 20 companies, then Canada with 14, then France and Germany with eight each.

- Top headquarters cities are San Francisco with 21 companies, London with nine, New York with seven, Boston with six, and Chicago and Paris each with five.

Canalys Channels Ecosystem Landscape 2023

The channels ecosystem ‘‘islands’’

Channel data management

Channel finance, pricing and inventory

Channel incentives management

Channel learning and readiness

Partner relationship management

Through-channel marketing automation

Channel Ecosystem Management

There are five 'islands' within this -

- Ecosystem recruitment and visualization - Assists in planning, identifying, targeting and recruiting non-traditional partners to drive the expansion of the channel ecosystem and the total addressable market. Provides actionable go-to-market and route-to-market expansion beyond current buyer, industry, geography, segment, delivery or product boundaries.

- Ecosystem influence and attribution - Supports marketing attribution in the post-cookie marketing environment, delivering recognition and incentivization of affiliates, advocates, ambassadors and influencer partners. Helps vendors’ data-driven platforms quantify partner influence and activities and their effect on marketing, sales and retention.

- Ecosystem data and mapping - Enables data-sharing opportunities with and between partners in a controlled and secure manner. Automates account mapping to leverage network effects and streamlines collaboration, co-marketing, co-selling, value creation and co-innovation.

- Ecosystem marketplace and integrations - Helps B2B-centric organizations with the planning, design and execution of internal and external digital marketplaces to expand market opportunities. Supports changing business models toward subscription and consumption models and provides frictionless execution of customer procurement and provisioning of solutions. Assists in marketplace deployment, storefront customization, API integration and listing support, among other aspects, to streamline the workflows of all stakeholders.

- Ecosystem management and orchestration - Automates and simplifies various activities of multi-directional partnerships across the broader channel ecosystem. Supports ecosystem planning, programs, processes and people, including partner onboarding, training and development, co-selling, enablement, collaboration, performance reporting and insights. Often seamlessly integrates with other channel and ecosystem tools.

Channels ecosystem software vendors 2023

Channel data management

Channel finance, pricing and inventory

Channel incentives management

Channel learning and readiness

Partner relationship management

Through-channel marketing automation

Channel ecosystem managment

Channels Ecosystem Landscape methodology and definitions

Canalys publishes channel-related data on a regular basis. It standardizes on a common methodology across all data-led continuous services. The methodology centers on the tracking of the people, processes, programs, partners and underlying technology that drives the global channel ecosystem.

The goal is always to provide the best possible, consistent and meaningful view of a market, even when it encompasses a diverse set of products, technologies, geographies, vendors and business models. For each market studied, Canalys uses a clear set of rules and definitions to classify data sets unambiguously. From time to time, as markets develop, a classification scheme may require updating. Canalys conducts regular reviews to ensure it continues to deliver the maximum value to clients and any changes are always communicated clearly. Across its services, Canalys uses consistent terminology, definitions and segmentation to avoid double-counting and to facilitate comparison and analysis.

Canalys employs a number of techniques to generate its estimates; the most appropriate information sources will depend on the specific research but may include vendor, distributor and partner public disclosures, Candefero surveys, government reports, public/private financial analysis, industry media and social sentiment.

![categoryImages[i]](assets/images/channel-ecosystem/sm-channel-cdm.jpg)

![categoryImages[i]](assets/images/channel-ecosystem/sm-channel-finance.jpg)

![categoryImages[i]](assets/images/channel-ecosystem/sm-channel-cim.jpg)

![categoryImages[i]](assets/images/channel-ecosystem/sm-channel-clr.jpg)

![categoryImages[i]](assets/images/channel-ecosystem/sm-channel-prm.jpg)

![categoryImages[i]](assets/images/channel-ecosystem/sm-channel-tcma.jpg)