Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Breaking the mold: NIO's 5nm ADAS SoC and the future of ADAS SoCs

NIO officially announced its "Shenji NX9031" an in-house developed 5nm ADAS SoC, and unveiled SkyOS, a full-domain EV platform, which achieves deep integration of software and hardware. This move sparked widespread market interest, raising discussions on whether Chinese carmakers' self-developed ADAS SoCs will disrupt the high-level ADAS SoC market.

At the 2024 Innovation Technology Day held on 27 July, NIO officially announced its "Shenji NX9031" an in-house developed 5nm ADAS SoC, and unveiled SkyOS, a full-domain EV platform, which achieves deep integration of software and hardware. This move sparked widespread market interest, raising discussions on whether Chinese carmakers' self-developed ADAS SoCs will disrupt the high-level ADAS SoC market.

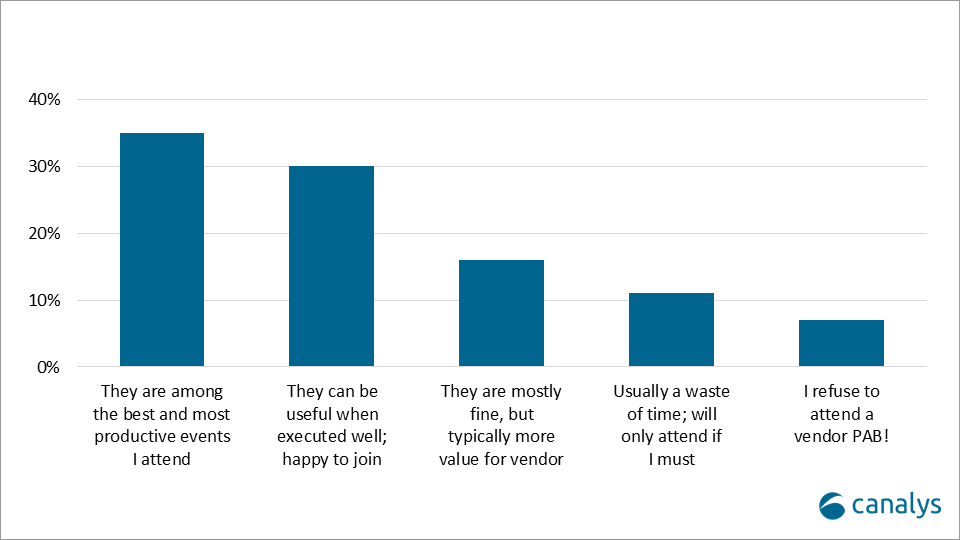

According to Canalys estimates, in Q1 2024 sales of vehicles with L2+ ADAS features in China reached 350,000 units, with a penetration rate of 7.3%. The top three ADAS SoC vendors — NVIDIA, Horizon Robotics, and Huawei — dominate over 70% of that market share.

Chinese carmakers increase focus on investments in ADAS SoCs

Although Chinese carmakers are still in the exploratory phase of developing ADAS SoCs, they aim to gain greater control over core technologies, a trend that is becoming more pronounced. The strategies for ADAS SoC exploration among Chinese carmakers fall into three categories.

- Self-development: NIO, Li Auto, Xpeng.

- Forming joint ventures: Geely Automotive formed SiEngine with ARM China, and Changan Automotive established Changzhi Technology with Horizon Robotics.

- Investing in chip vendors: SAIC investing in Horizon Robotics, Black Sesame, and SemiDrive.

Meeting differentiated demands and reducing supply chain risks drive carmakers to self-develop ADAS SoCs

There is a conflict between carmakers' pursuit of algorithm flexibility and greater SoC algorithm compatibility. Carmakers are therefore driven to design SoCs based on their algorithm architectures, enhancing the coupling between the chipset and algorithms to maximize computational efficiency and improve assisted driving experiences.

Moreover, while the current E/E architecture is still in the cross-domain integrated stage, the trend towards central architecture is irreversible. This means central supercomputers will eventually become the control center of vehicles, with single high-computing-power SoC being the main processor. This drives carmakers to secure SoC supply chain stability. Controlling core SoC’s technical capabilities also reduces the iteration costs brought by new platform upgrades or switching SoC suppliers.

The need for more success stories

Tesla's success with its self-developed FSD chip set a precedent for Chinese carmakers' self-developed SoCs. However, the ADAS SoC industry environment has significantly changed since Tesla began developing its FSD in 2016. Chipset vendors' product strategies now align more closely with the OEM’s ADAS feature technical development path. NPU and ISP modules have already met the current ADAS functional needs and continue to evolve with carmakers' demands.

While there is room for differentiation in SoC chip design, many parts remain universal and generic. Therefore, cooperation between carmakers and SoC vendors to develop customized SoC solutions can accelerate time to market with lower costs. However, carmakers’ limited sales volumes often restrict SoC vendor cooperation. As chipset vendor strategies evolve, whether self-developed ADAS SoCs can attain long-term cost-effectiveness remains to be seen.

More success stories are needed to support carmakers' decisions to self-develop ADAS SoCs. If we suppose NIO, Li Auto, and Xpeng, along with leading technology vendors entering the automotive market, achieve commercial success with self-developed SoC investments, then more traditional carmakers are expected to join the ADAS SoC self-development race.

Carmakers’ ADAS SoC will not impact the chip industry in the short-term

Typically, new technologies or new designs are first incorporated into high-end models, which are not responsible for sales growth. They gradually trickle down to other vehicles though that do carry sales volumes. For example, Mercedes-Benz's latest design is usually first applied to its S class and E class before being applied to the C class.

The continuous trickle-down strategy of L2+ ADAS functions, coupled with adequate product strength of existing SoCs, leaves considerable market space for SoC vendors. Additionally, the falling prices of SoC chips and shorter delivery cycles make using existing ADAS SoCs more cost-effective. Currently the speed of trickling down flagship ADAS SoCs is comparatively slower than digital cockpit SoCs, however, that may not always be the case.

SoC vendors should improve product compatibility and embrace open collaboration

To enhance their current market competitiveness, SoC vendors need to focus on improving computing power and product compatibility, granting more flexibility to algorithms, and providing more open development environments and toolchains to reduce the time and cost of adapting algorithms to SoCs. Additionally, enhancing software reusability can lower product iteration costs for carmakers during the new generation of product iterations.

As the ADAS market remains in its early stages of competition, carmakers carving out their technology strongholds will adopt two main strategies based on their assessments of self-developed SoCs’ cost-performance ratios and their own software capabilities. The first approach is developing proprietary SoCs, while the second is leveraging established supply chains for functional integration. This strategic divergence will continue to drive diverse market demand.

From a long-term competitive perspective, SoC manufacturers that achieve market leadership may inevitably lose some core customers due to carmakers transitioning to in-house SoC development. However, the high upfront investment, stringent technical requirements, and ongoing commitment involved in developing proprietary SoCs mean not all carmakers will successfully implement this strategy. Helping carmakers establish robust chip capabilities can help SoC vendors quickly gain a favorable position among carmakers with aggressive SoC strategies. Moreover, as new products continuously evolve and high-end ADAS functions penetrate both mainstream and entry-level markets, they will become significant revenue drivers for these SoC vendors.

For SoC vendors eager to disrupt the market, exploring new customized SoC collaboration models with carmakers can help expand market share. Addressing the pain points of traditional Tier-1 suppliers and carmakers by building algorithmic capabilities and offering comprehensive hardware and system solutions can reduce customers’ development challenges and further broaden market impact. Even if the market eventually proves carmakers need to vertically integrate SoCs, there are still opportunities for these SoC vendors to collaborate with existing clients. Joint development of software algorithms and SoC customization based on these partnerships can open new market opportunities.