SaaS businesses are unlocking growth through diversified partner ecosystems

22 May 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

The market of SaaS applications (excluding infrastructure software) is expected to grow from US$215 billion in 2023 to US$278 billion in 2024, representing nearly 30% growth year-on-year, and five-times the growth of the overall ICT sector. SaaS companies aren’t achieving this growth alone; it is accelerated by the strategic use of partners. Leading companies, such as Microsoft, Salesforce, and Autodesk, that attribute 95%, 70%, and 65% of overall business respectively to partners, leverage ecosystems to expand reach and deliver custom solutions to customers. This report explores the multifaceted approaches reshaping the SaaS industry in pursuit of efficient growth.

Although partners currently account for 38.2% of SaaS application revenue, this number is skewed by the dominance of large, established players such as Microsoft. While best-in-class SaaS vendors attribute significantly more of their business to partners, most SaaS companies are relatively immature in their partner journey. However, the percentage of partner revenue is expected to rise significantly over the next decade as the industry matures and embraces new and traditional partner types and procurement models, such as growth in cloud marketplaces.

Escalating costs of sales and marketing as well as changing customer needs increasingly challenge the direct motions that have traditionally defined SaaS businesses. Companies that achieved rapid growth by selling direct to a specific market segment or those that started as an easy-to-use point solution and evolved into a platform, face new difficulties sustaining previous growth. As a result, SaaS leaders are moving away from direct selling motions and product-led growth as their primary growth levers and are instead investing in partner diversification and partner-led growth.

The SaaS approach to partner collaboration has evolved from simple partner models with a focus on direct selling, through the growth of APIs and integrations, to the current landscape of collaborative ecosystems and advanced digital marketplaces. SaaS companies today are growing their partner networks and tapping into new types of partner strategies to extend reach, drive customer innovation, and create a competitive advantage.

The rise of SaaS represented a technological shift (moving from on-premise to a shared resource model) and a significant business model disruption (moving from perpetual licensing to subscription). Yet throughout the 2000s, debates raged about the future success of this business model. The cloud, as the underlying infrastructure of SaaS, was not yet pervasive. Leading software companies including Adobe, Microsoft, Oracle and SAP had built large license-based businesses, and a transactional sales army, both internally and with partners. Salesforce, one of the SaaS pioneers, was experiencing high double-digit growth, but only surpassed the US$1billion revenue mark at the tail-end of the decade.

This framing highlights that in the early days of SaaS, vendors were hyper-focused on net retention and customer success. Most of that burden was shouldered by internal sales and marketing organizations. Partnering was limited, and the strong emphasis was on referral models, allowing vendors to maintain customer relationships and renewals. The nascent state of the industry translated to informal or simplistic partner programs often isolated from other operations.

The following decade saw the SaaS business model mature and grow at a significant scale. Salesforce continued to rise to become one of the largest application companies, while long-standing software stalwarts such as Adobe made significant pivots to subscription-based, as-a-service models. This era highlighted a shift towards product-led growth, with SaaS companies emphasizing ease of use, integration, and utility.

The partnering mindset evolved greatly as the rise of APIs made SaaS easier to integrate, enabling vendors to more effectively partner together. This shifted the focus towards open ecosystems, integration and technology partnerships, strategic alliances, and digital marketplaces. This, in turn, bolstered platforms and created an increased need for Systems Integrators (SIs) and service partners to integrate and manage whole customer solutions. This period saw partner models, infrastructure, strategic alliances, and strategies become more complex and common. Direct transactions continued to dominate, primarily through referral models, with limited resell. Even accounting standards changed, like ASC 606, which altered how revenue from customer contracts was recognized, and had a significant impact on partnership strategies.

Across the landscape, partnering models were emerging. HubSpot, expanded its reach and impact through an Agency Referral Partner Program and focused on strategic, API-based partnerships with the marketing and social media platforms fundamental to its product. Salesforce AppExchange and partner program grew rapidly, illustrating the potential of marketplaces and system integrators to extend functionality, enhance accessibility, and drive customer success for a broad range of users. This era signified a critical stage in the maturation and rapid adoption of SaaS, highlighting the importance of interconnected partner ecosystems and setting the stage for more sophisticated models.

The current era has been shaped by global macro challenges including the COVID-19 pandemic, economic uncertainties, and mass layoffs, leading SaaS companies to prioritize efficient growth and the expansion of their ecosystems. SaaS vendors are making large-scale investments in new routes to market, the diversification of partner types, and specialized partners to deliver customer innovation.

Top SaaS companies are announcing partner-led growth strategies: Salesforce announced a focus on “partner-led sales” to drive margin expansion; Cisco unveiled the “Age of the Partner”; ServiceNow announced plans to add 250,000 new partners and significantly increase partner revenue in just one year (2024); Workday plans to double partner capacity by fiscal 2026.

To thrive in this era, SaaS vendors must not only recruit and manage a diverse mix of partners, but also deeply understand and support the specific needs, dynamics, and synergies of each business model and relationship. This complexity requires a robust framework for integrating partners into the DNA of the company, its culture, products, operations, and business, and necessitates a scalable infrastructure to streamline partner management and critical co-selling, co-servicing, and co-innovating motions.

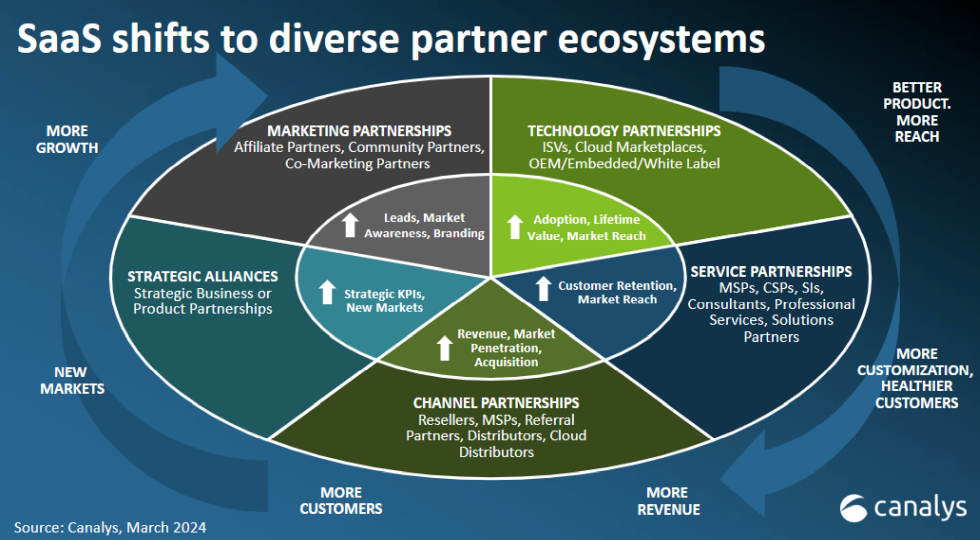

This era is also defined by the continued investment in traditional SaaS partner models, margin-based channel models, and emerging partner models. Vendors must invest strategically and simultaneously across the broad spectrum of partners including in technology partners, ISVs, and marketplaces to extend product functionality; in service partners to fill customer gaps and improve retention; in distribution and reseller channels to extend reach; in strategic alliances to unlock new markets and innovation; and in marketing partnerships to amplify the brand and credibility. Each type of partner plays a unique role in the SaaS ecosystem, contributing to a holistic strategy that enables deep competitive advantages:

Technology partners and ISVs (Independent Software Vendors) are central to the SaaS ecosystem model. These partnerships serve to extend core product functionalities, enhance customer value, drive user adoption and retention, and increase market reach. 91% of Salesforce customers have installed at least one app from Salesforce AppExchange and Atlassian noted that dollar churn reduces by approximately half when customers add one app or integration.

One of the most significant trends in technology partnerships is growth in cloud marketplaces, with Canalys forecasting cloud marketplaces to exceed US$45 billion by 2025. This momentum is fueled by lower marketplace fees, co-sell incentives from hyperscalers, increased demand, a desire for streamlined procurement, and customers’ ability to “burn down” committed cloud spend. AWS Marketplace has over 4,000 sellers and provides comprehensive programs for SaaS partners to build and grow with them, from programs such as AWS SaaS Factory, to AWS Partner Paths, and the AWS ISV Accelerate co-sell program. SaaS companies, such as CrowdStrike and Nerdio, have had significant business growth in marketplace sales. CrowdStrike exceeded US$1billion of software sales through AWS Marketplace in 2023, and Nerdio boosted leads by more than 100% in Azure Marketplace.

Vendors are also enhancing their marketplaces to boost the value of their platform, improve customer success, and deliver streamlined procurement and more integrated solutions. For instance, the HubSpot App Marketplace has expanded quickly, now hosting over 1,000 apps, with customers installing an average of seven apps. In a similar vein, Workday announced a new AI Marketplace aimed at facilitating the adoption of AI and ML solutions by its customers. This trend is contributing to the rapid expansion of marketplace development platforms that help companies build, launch, support, and scale application marketplaces.

Other technology partnerships, including embedded, white-label, and OEM (Original Equipment Manufacturer) models, enable vendors to enhance their offerings by integrating partner technology into their own. Litify is a SaaS platform built on Salesforce offering custom functionality for legal teams. Salesforce benefits from distribution and margins, while Litify fills product gaps, speeds market entry, and fills verticalized gaps. Similarly, platforms including Looker and Domo allow their technologies to be embedded or white-labeled by partners, enhancing product value.

Rapid change of the technology stack, customization needs of complex enterprises, and growing skills gaps have made service partners indispensable to the growth and scalability of SaaS companies. Companies, such as Snowflake, that increased service partners 53% year-over-year, are actively investing in recruiting, enabling, and growing different types and sizes of service partners to scale operations and customer innovation.

Managed Service Providers (MSPs) and Managed Security Service Providers (MSSPs), deliver a range of outsourced IT management services, from network management to cybersecurity solutions, ensuring optimal performance of SaaS applications and infrastructure, and manage everything from licensing to technical support. Dedicated MSP programs like Okta’s MSP program or Acronis MSP Academy highlight their value to vendors.

For SaaS companies, Cloud Service Partners (CSPs) are critical services partners, providing cloud infrastructure services and ensure SaaS solutions perform reliably. In some cases, the integration with CSPs becomes so tightly aligned that they deliver first-party services on their behalf, simultaneously becoming the technology, delivery and support partner. The growing importance of MSPs and CSPs is prompting SaaS vendors to put more investment into these types of partners.

Likewise, Professional Services Partners and Solutions Providers provide specialized and industry-specific implementation, integration, consulting, training, and services to meet specific business needs. HubSpot’s Solutions Partners are primarily marketing and CRM agencies; Gong’s partner network is comprised of niche sales optimization and revenue consulting partners; and Intuit has a range of specialized tax, accounting, and financial services partners. In each case, these partners deliver highly specialized services pertaining to their expertise and will either leverage or recommend technology as part of their delivery.

Systems Integrators (SIs) and Global Systems Integrators (GSIs) are another critical and growing layer of partners. Globally, SIs grew by nearly 7% in 2022, and the top 20 GSIs captured 9.4% of total global IT spend. GSIs represent a fast-growing route to market for SaaS vendors aiming to access enterprise clients and elevate their position in the market via world-class expertise. For some vendors, SIs are the dominant route. For example, SIs lead 70% of all Salesforce implementations. Successful investment and management of these relationships can yield significant gains; for instance, Google Cloud worked to ensure that 15 of the top 20 GSIs have dedicated Google Cloud practices and has seen GSI revenue grow by 150%. Stripe’s recent Partner Ecosystem launch announced partnerships with leading firms including Accenture and IBM to support customers integrating modern payment infrastructure into complex systems.

SaaS has long relied on referral partners to protect the end customer relationship, and this model is still widely used today. Hubspot and Shopify were early adopters of referral partners, building two of the most effective agency referral partner networks in the industry. While Shopify continues to focus on digital agencies and development firms to refer business, it recently announced it is also investing in new types of partners to support its next era of growth.

As Resellers, Value Added Resellers (VARs), and Distributors transition towards offering cloud services, subscription models, and more services around their customers’ technology investments, their businesses align better with SaaS companies. Historically, SaaS has done a relatively small percentage of business through resellers and distributors, but as the business continues to shift and CIOs become more involved in SaaS purchases, SaaS vendors are embracing these partners for their extended reach.

This is particularly true for international or non-core markets. For instance, Atlassian derived over 40% of revenue from channel partners’ sales efforts in 2023 and plans to put more investment in international resellers in regions that require local language support. Sprinklr doubled the number of reseller partners over the previous fiscal, and Autodesk drove approximately 65% of indirect channel sales through its 1,500 distributors and resellers in fiscal 2023.

To meet this demand from SaaS vendors, resellers are investing significantly in their capabilities across different SaaS and Cloud solutions, often through acquisitions. Insight Enterprises is one of the leading examples of this change within the reseller community. In the past six months it has announced the acquisitions of SADA (a leading GCP partner) and Infocenter (a leading ServiceNow partner). It is looking to redefine the reseller category, dubbing itself a Solutions Integrator.

SaaS companies are increasingly tapping into new-age cloud distribution models, such as Cloud Service Distributors and Marketplaces. Platforms offered from Pax8, Ingram Micro Cloud, and herweb are simplifying the procurement and delivery of cloud services for MSPs, Resellers, and other Professional Services firms. While these partnerships require resources and demonstrable value, SaaS business platforms are investing in them to empower partners to more easily package and deliver comprehensive solutions. Ingram Micro Cloud’s Business Application partners include SaaS leaders such as Adobe, Autodesk, DocuSign, FreshBooks, IBM, Microsoft 365, Salesforce, and ZoomInfo.

In an increasingly competitive market, vendors are investing more resources in Strategic Alliances to differentiate, expand market reach, and accelerate innovation. Box announced on its Q4 ‘24 earnings call that it will focus on strategic partners as a key part of its goal to drive profitable growth at scale. ServiceNow recently announced a five year Strategic Collaboration Agreement with AWS, making its full platform available as a SaaS offering within AWS Marketplace and co-developing industry specific applications. Similarly, Okta announced a strategic agreement with SoftBank to expand into the Japanese market, reaching over 16,000 Japanese companies and 2.4million devices through the partnership.

The growth of AI is also driving new, large-scale alliances, such as those between Snowflake and Nvidia to help businesses harness data for Gen AI, or between Salesforce and Accenture to create an acceleration hub for Gen AI. AI is even creating entirely new categories of alliances and partnerships, including Foundation Model Partnerships and GPU Reselling, opening doors for the next generation of partner models.

As the customer journey evolves, SaaS platforms must surround target buyers early in the sales cycle with trusted experts that can influence the purchase decision, such as affiliates, advocates, ambassadors, experts, and super connectors. Co-marketing, affiliate, and advocacy partnerships targeting industry experts, like HubSpot’s Affiliate Program, or community and industry partnerships such as Hubspot’s Startup Program, enhance the brand and typically convert into paying customers at above average conversion rates long-term. These programs require the tooling, content, and recruitment resources to scale, but are ever-growing in their importance.

In the modern, diverse ecosystem, partner roles converge and overlap in new ways. Partners often straddle multiple partner categories and offer a blend of services that traditionally fell into distinct buckets. For example, many resellers and distributors are offering a broader range of services, consultancies are offering agency services, and systems integrators are offering more consulting, advisory, and managed services. The market is also consolidating, with larger firms acquiring smaller, niche firms to expand services, offerings, and reach. Not only are partner roles converging, but partners with specialized skills and roles are collaborating to deliver customer outcomes.

For scalable and efficient growth, SaaS platforms must diversify their partner networks and invest in ecosystems of hyper-specialized partners. This shift necessitates a company-wide commitment and strategic investments in infrastructure, automation, and partnerships that amplify impact. It requires surrounding the customer with trusted experts, partners, and procurement platforms. And it requires strong executive support with a mindset shift in how SaaS products are marketed, bought, and serviced.

As the SaaS cloud application market continues to grow past the US$300 billion mark next year, both the competitive importance and overall revenue contribution of partners are poised to become even more significant. With technology advancing at an unprecedented rate, vendors must collaborate with a broad array of partners who can help customers navigate and leverage these rapid changes. The era of isolated growth strategies is transitioning to an era of ecosystem-driven expansion, and vendors that embrace the shift will lead the future of SaaS.