Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

India smartphone duty cuts aim to boost production competitiveness

The Indian government's move aims to boost the country's manufacturing competitiveness against Vietnam and Mainland China. It aims to attract global players by enhancing the ease of doing business and encouraging long-term investments in the smartphone sector.

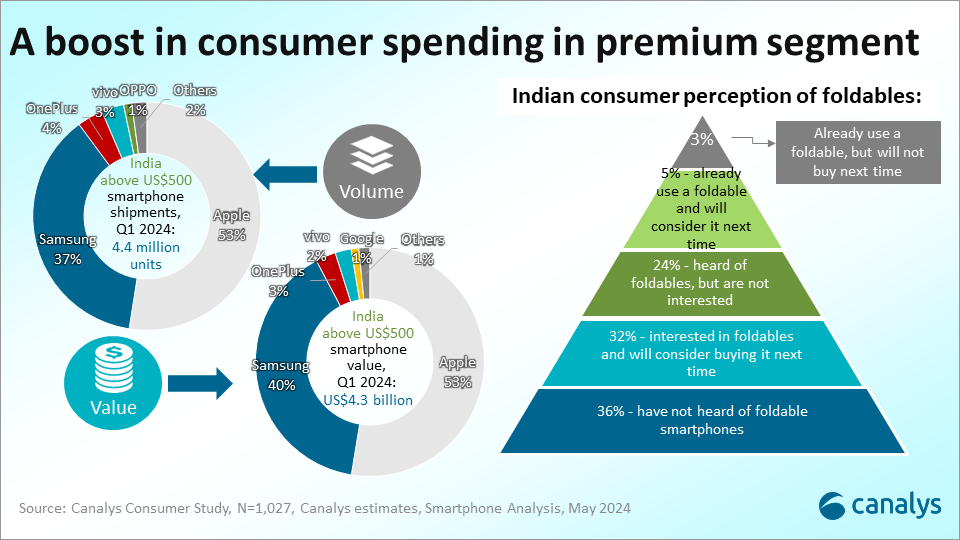

In the union budget, the Indian government plans to cut the basic customs duty on mobile phones, PCBs and chargers from 20% to 15%, while exempting duties on critical minerals. Additionally, exemptions will be extended for inputs and raw materials in smartphone manufacturing, as well as for capital goods in the electronics industry. This move is expected to positively impact the entire smartphone value chain. The smartphone manufacturers have long advocated for duty reductions and simplified tariffs to bolster local manufacturing and enhance India's competitiveness in the global market. For brands, importing completely built units (CBUs) for premium models will benefit from cost reduction. New entrants like HONOR, which entered the market in 2023, will find support in establishing local manufacturing ecosystems. This also presents an opportunity for global Android brands to highlight their premium device portfolios, while Apple might pass on some import cost reductions to consumers. Lastly, consumer demand will not be impacted as 60% of market shipments are still in the sub-US$200 price range, but the premium segment will likely see a boost in consumer spending. Canalys has analyzed the implications of this move on the Indian smartphone ecosystem:

- Apple will benefit directly and pass the benefits on to consumers indirectly: Apple has been importing the Pro and Pro Max models as CBUs in India for three main reasons. First, the Indian consumer market is inclined toward cash cow models such as the iPhone 15 and iPhone 14, with Pro and Pro Max models accounting for just 15% of total shipments in Q1 2024. Second, semi knocked down (SKD) manufacturing for these models in India is challenging due to the need for back-and-forth component fitting with Mainland China, complicating and lengthening production. Lastly, some Pro and Pro Max components are more expensive than those for non-Pro models. The duty cut on CBUs will reduce some of the gray market and hand-carried imports from places like Dubai, Singapore and the US, which earlier affected the government’s revenue from these ultra-premium devices. However, the Pro models are still expensive as the import duty is 15% with a 1% surge charge and 18% GST. Apple should likely rationalize the prices of the latest iPhone Pro and Pro Max models launching in September 2024. However, Canalys expects Apple will not directly cut the prices of these imported models but will be aggressive in terms of promotional discounts.

- Opens up the opportunity for Android brands in the Premium segment: this move will boost the confidence of Android brands as they aim to expand in the premium segment, leading to more high-end devices in their global portfolios. In the near term, premium segments such as Flip/Fold which are critical for Android brands to gain a competitive advantage in the market will see aggressive pricing. In 2023, the Motorola Razr 40 and TECNO V Flip were priced between ₹ 35,000 (US$420) and ₹ 45,000 (US$530) shortly after launch, establishing them as entry-level flip devices. More of these entry-level Flip models are expected during the festival season. Additionally, prices for book-style foldables will decrease, especially from Android brands newly entering the foldable market. In a recent Canalys' consumer study, the majority of Indian respondents were unaware of foldable smartphones but 32% of respondents expressed interest in buying one for the next purchase.

- Unlikely to see price cuts in the budget segment amid higher cost of operation: in the short term, budget device prices will not drop due to high operational costs driven by channel diversification and expensive component supplies, alongside the Indian rupee trading at higher value. Notably, consumers are also willing to pay higher costs due to easy financing options and rising consumer disposable income. In the long term, brands will become competitive enough in manufacturing to pass some benefits to consumers. However, whether they lower prices or enhance hardware for affordable 5G devices will depend on individual brand strategies.

- Manufacturing operations becoming easier while export remains the focus: post-manufacturing and local sourcing push, the Indian government is aiming to significantly boost smartphone export value from India. In 2024, India has exported approximately 30.5 million smartphones year-to-date, with Apple and Samsung accounting for around 94% of this volume. Major models like the iPhone 14/15 and Galaxy A55 5G are primarily shipped to the US and UAE. Brands focusing on budget segments and local assembly face challenges exporting from India due to higher costs compared to Mainland China. However, the government's upcoming review of the rate structure, aimed at simplifying it by removing duty inversion, is expected to make exporting budget models from India more competitive.

This government move aims to boost India's manufacturing competitiveness against Vietnam and Mainland China. In February's interim budget, import duties on mobile phone components like back covers, battery covers, GSM antennas and camera lenses were cut from 15% to 10%. Additionally, customs duties on twenty five critical minerals were fully exempted, and cuts were made on two of them. This strategy is designed to attract global players by enhancing the ease of doing business and encouraging long-term investments in the smartphone sector.