Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

AI-capable smartphones: what drives the Chinese market and where is it heading?

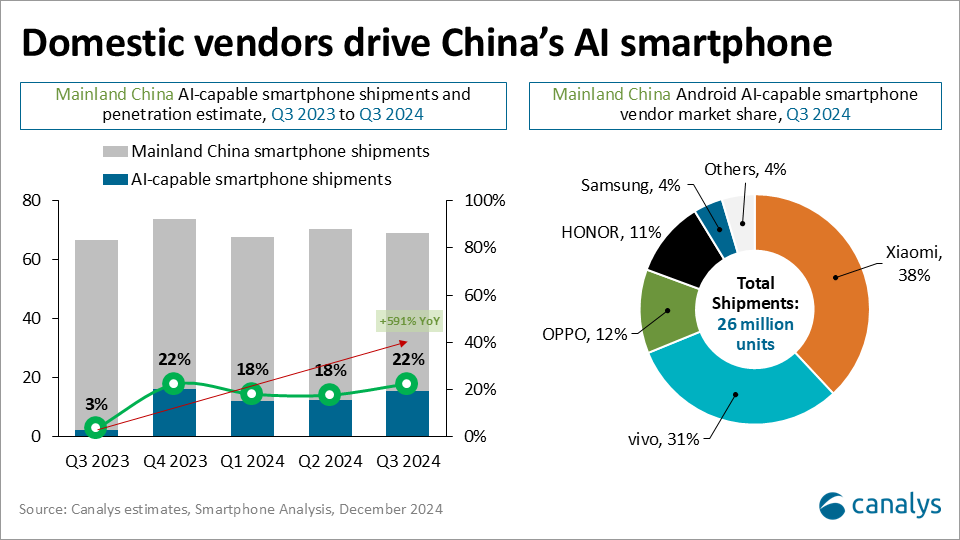

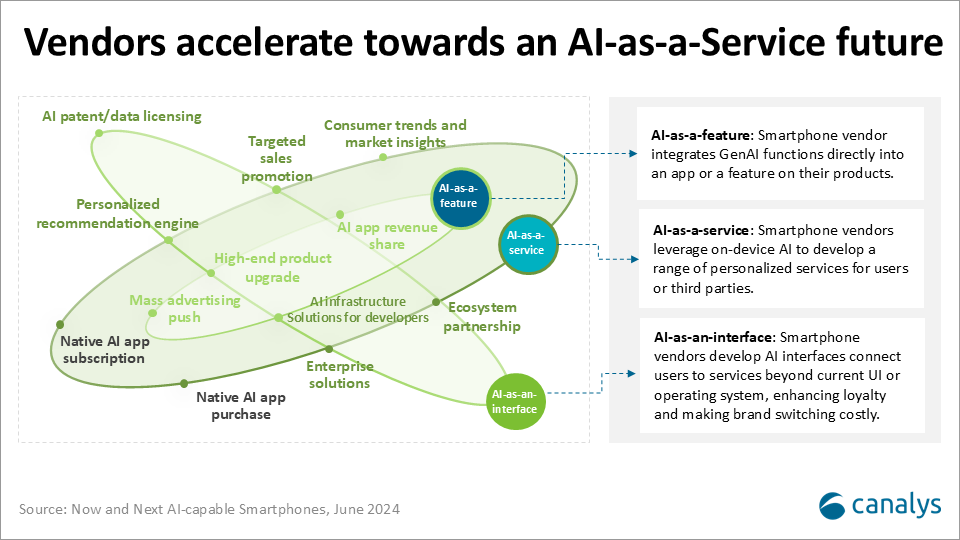

Mainland China’s AI-capable smartphone penetration soared in 2024, driven by local vendors’ rapid progress in model optimization, open ecosystems, and privacy frameworks. Canalys discussed the three development stages of on-device AI product monetization in our “Now and Next – AI capable Smartphones” report. The first stage – "AI-as-a-feature" – is starting to take shape in many consumer apps and user scenarios. Looking ahead, to 2025 and beyond, the shift to "AI-as-a-Service" is a critical opportunity. Leading players should develop their differentiators and user stickiness in areas such as AI agents to secure leadership in the next wave of competition.

Mainland China’s AI-capable smartphone market experienced a remarkable 591% year-on-year growth in devices shipped in Q3 2024. This tremendous growth highlights not only the scale of the Chinese market but also the amount of early investments and innovations driven by Chinese companies in advancing AI smartphone capabilities. This blog explores three key trends shaping China’s AI smartphone market in 2025 and evaluates its current development stage, and discusses the path ahead.

Key trends driving AI-capable smartphone adoption in 2025

1. Optimized smaller on-device AI models enhance usability and efficiency

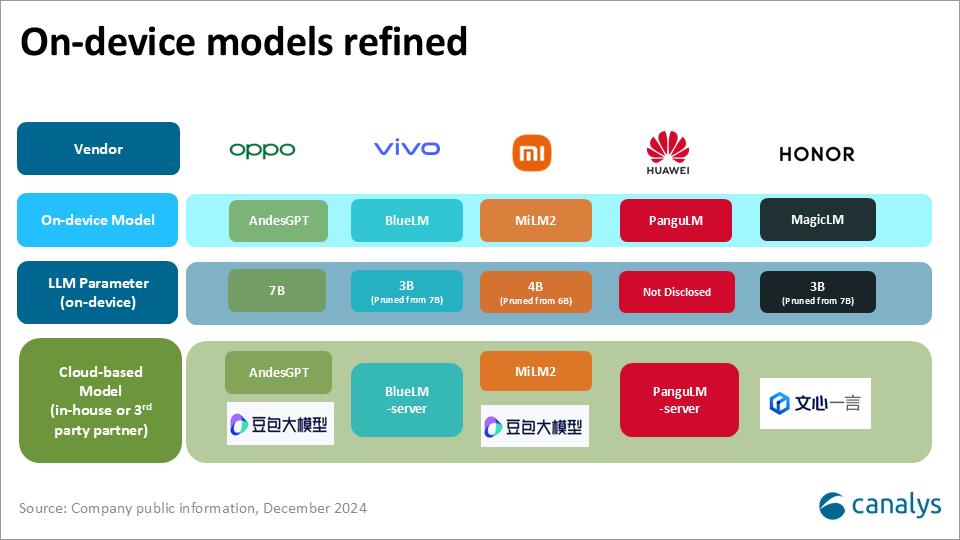

In 2024, Chinese vendors achieved significant advancements in AI model optimization by employing state-of-the-art quantization and pruning techniques. Xiaomi’s MiLM2, for instance, reduced model parameters from 6B to 4B, while HONOR and vivo trimmed their models from 7B to 3B parameters. These optimizations have substantially lowered computational costs and improved inference speeds, making AI functionalities on flagship devices more user-friendly. Additionally, reduced memory and performance requirements are accelerating the vision of “democratizing AI”, paving the way for broader adoption across different price bands.

2. Transition to open ecosystems and strategic collaborations

Initially, Chinese smartphone vendors focused on building proprietary on-device and cloud-based LLMs to establish technological leadership. However, as AI-capable smartphones continue to gain market penetration, the constraints of a fully closed ecosystem – particularly in scaling across diverse product lines amid persistent cost pressures – have become evident.

In 2024, vendors began adopting open model ecosystems, as demonstrated by OPPO and Xiaomi’s collaboration with ByteDance to integrate the Doubao LLM for cloud-based tasks. This shift allows broader delivery of meaningful AI functionalities, enhancing user engagement while addressing cost and scalability challenges. Open ecosystems are poised to drive large-scale AI deployment, balancing innovation with operational feasibility.

3. Maturing privacy protection frameworks

Data security and privacy concerns remain a top priority for Chinese consumers and regulators. In 2024, local vendors have further enhanced cloud AI privacy protection. OPPO introduced its Private Computing Cloud at ODC in 2024, enhancing data security and privacy, while vivo refined its Trusted OS framework to ensure end-to-cloud protection. Vendors such as HONOR, which collaborate closely with third-party partners, have empowered users with greater transparency and control over cloud-based AI features. With more industry players and stakeholders joining the ecosystem, efforts to address critical privacy challenges will establish a robust foundation for AI development.

Looking ahead: building AI agent as differentiators

In the “Now and Next for AI-capable Smartphones” report, we outlined a three-stage vision for smartphone AI: AI-as-a-Feature, AI-as-a-Service, and AI-as-an-Interface. Based on what we have observed in 2024, leading Chinese brands have started their “AI-as-a-Feature” development, with some integrating deeper into the OS platform and User Interface level faster than others. This is evident in flagship devices launched over the last year, where features like “AI Eraser” and “AI Summary” have been seamlessly integrated into pre-installed apps such as Photos and Notes. These standalone AI features can enhance product appeal and capture consumer interest, providing a competitive edge. However, the true differentiator lies in the next phase: AI-as-a-Service.

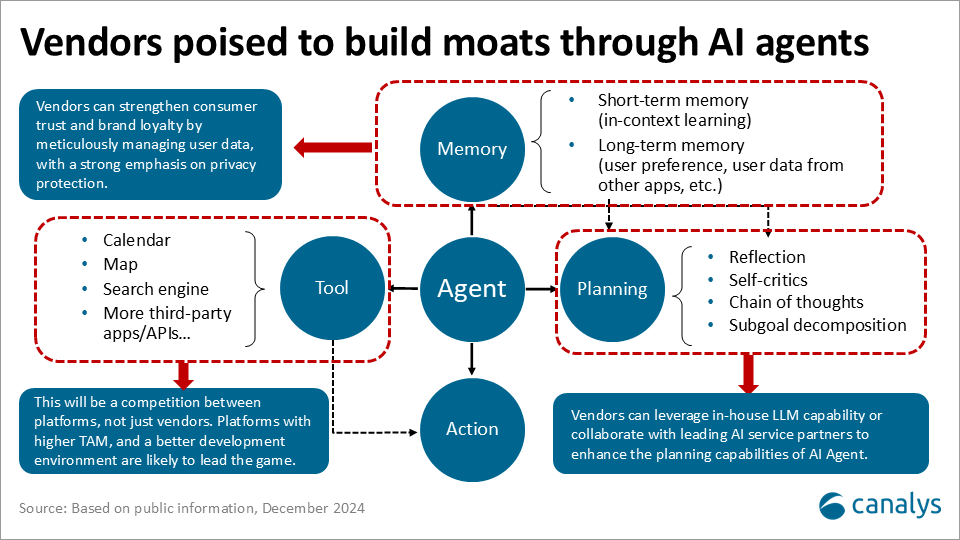

With the AI Agent concept at its heart, we believe AI-as-a-Service will serve as the key for vendors to build core AI competitiveness over the next two or three years. Several vendors have recently introduced early-stage use cases with some AI Agent capabilities in China, such as OPPO’s “One-Tap Screen Search,” vivo’s “PhoneGPT,” and HONOR’s “MagicPortal.” However, limitations in model capabilities and application ecosystems mean these features still fall short of the ideal “AI Agent” vision.

Even though we are still navigating the early stages of AI-as-a-Service, the “AI Agent framework” chart above shows how vendors can secure long-term differentiation in the AI-capable smartphone market. Vendors must strategically invest and leverage the four elements of AI Agents – memory, planning, tools, and action. For example, the setup of long-term memory of an AI agent, which stores user behavior, preferences, and personalized data, is inherently private and difficult to migrate, which will be a crucial area of development to create user stickiness and foster brand loyalty. Prioritizing privacy protections will be key to winning user trust. In the “Planning” capability area, vendors could enhance task interpretation and execution capabilities by developing strong in-house models or collaborating with leading AI service providers, ensuring robust functionality across diverse use cases. The “Tools” module, encompassing system-level features and third-party integrations, will be a key battleground at the platform level for leading device vendors. Similar to building an OS ecosystem, future leaders will focus on growing their device installment base and developer support, as well as an effective collaboration process.

As this paradigm shifts towards “AI-as-a-service”, vendors must strike a balance between openness and competitive differentiation, solidifying their core strengths while fostering ecosystem collaboration. The race to define the AI-capable smartphone future has just begun, and those who innovate boldly while protecting user trust are poised to lead the next wave of technological evolution.