Global tablet market returns to growth in Q1 2024

Monday, 6 May 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

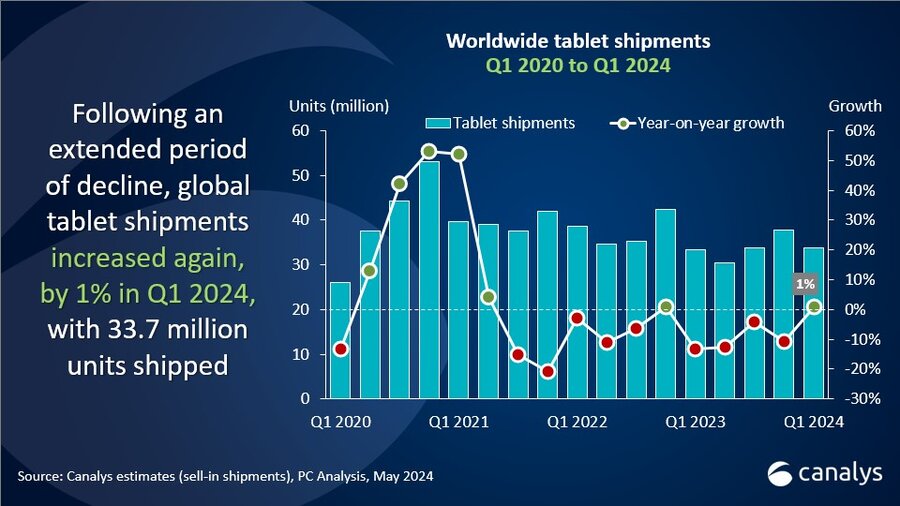

According to the latest Canalys data, worldwide tablet shipments increased modestly by 1% in the first quarter of 2024, reaching 33.7 million units. This growth follows four consecutive quarters of year-on-year declines and is thanks to a revival in consumer spending and the stabilization of global economies.

“The tablet industry has had a positive start to 2024, and the rest of the year should bring further relief after a difficult 2023,” said Canalys Research Manager Himani Mukka. “Despite the extended period of cautious consumer spending on tablets, vendors have remained ambitious. New market entrants have kept investing in the category while the traditional heavyweights are delivering on innovation to excite customers and drive new use cases.”

“Of particular note is Apple’s anticipated move to incorporate OLED screens in the iPad Pros, signaling a significant landmark in display technology preference across the top vendors’ tablet portfolios. Additionally, 2024 is set to bring about a rise in new tablet form factors and functionality, with manufacturers focusing on both foldable designs and eye-wear-free 3D content viewing. The tablet market is on track to stabilize above pre-pandemic levels, supported by a gradual recovery trajectory. The realization of postponed commercial and government deployments from last year and the rapid expansion of 5G infrastructure in untapped markets will bolster refresh demand for tablets.”

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

|

Apple |

12,012 |

35.6% |

13,954 |

41.8% |

-13.9% |

|

Samsung |

6,801 |

20.2% |

6,721 |

20.1% |

1.2% |

|

Huawei |

2,735 |

8.1% |

1,607 |

4.8% |

70.2% |

|

Lenovo |

2,135 |

6.3% |

1,892 |

5.7% |

12.9% |

|

Amazon |

2,045 |

6.1% |

2,502 |

7.5% |

-18.2% |

|

Others |

7,969 |

23.6% |

6,689 |

20.0% |

19.1% |

|

Total |

33,698 |

100% |

33,365 |

100% |

1.0% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), May 2024 |

|

||||

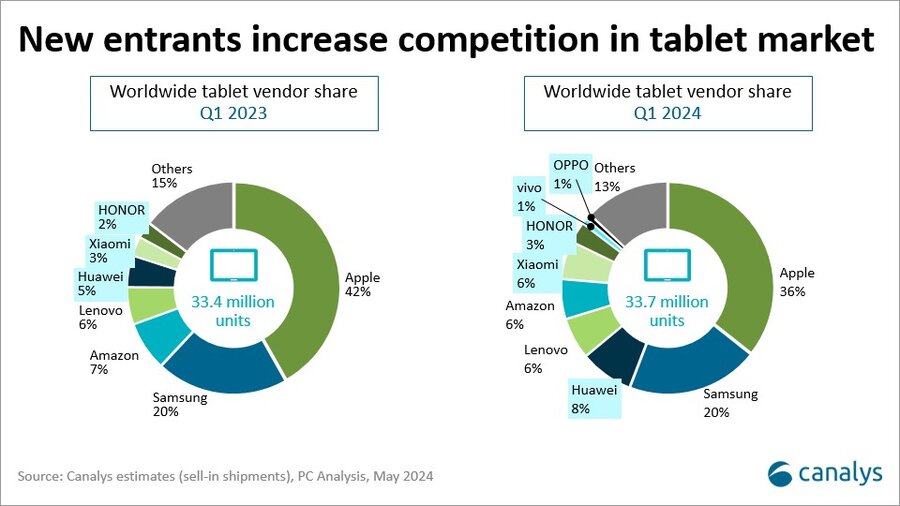

Apple stayed at the top of the worldwide tablet market in Q1 2024, with 12.0 million iPads shipped, giving it a 36% market share. Samsung grew by a modest 1% to hold second place with 6.8 million units shipped. Huawei kept third place for a successive quarter, shipping 2.7 million units with strong annual growth of 70%, propelled mainly by demand in its home market of China and across the Asia Pacific region. Lenovo and Amazon took fourth and fifth place, respectively, both shipping over 2 million tablets.

For more information, please contact:

Himani Mukka: himani_mukka@canalys.com

Ishan Dutt: ishan_dutt@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology, and broken down by market, vendor and channel, and additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.