Global smartphone market declines 1% in Q3 2023 as major players on path to recovery

Tuesday, 17 October 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

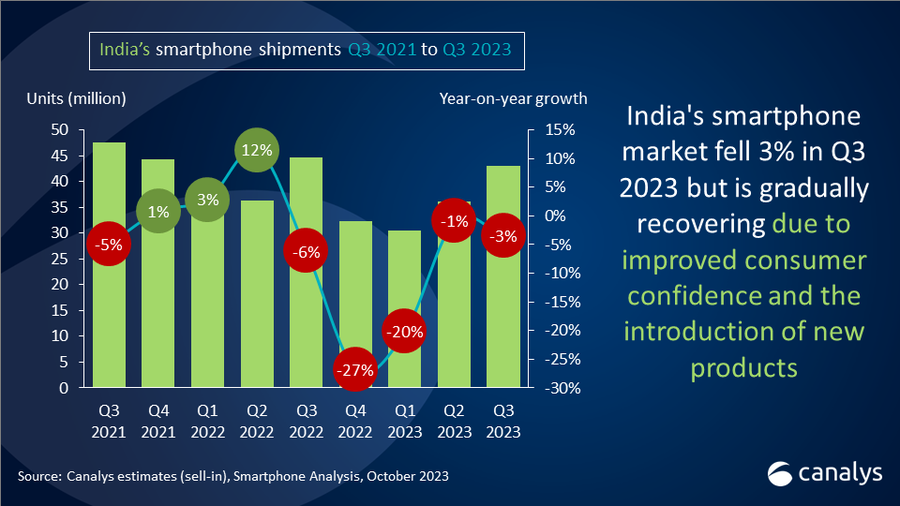

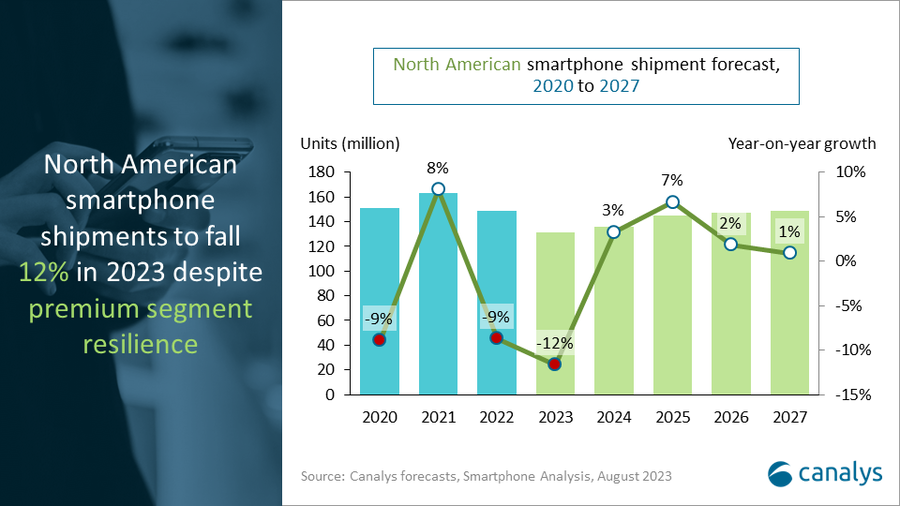

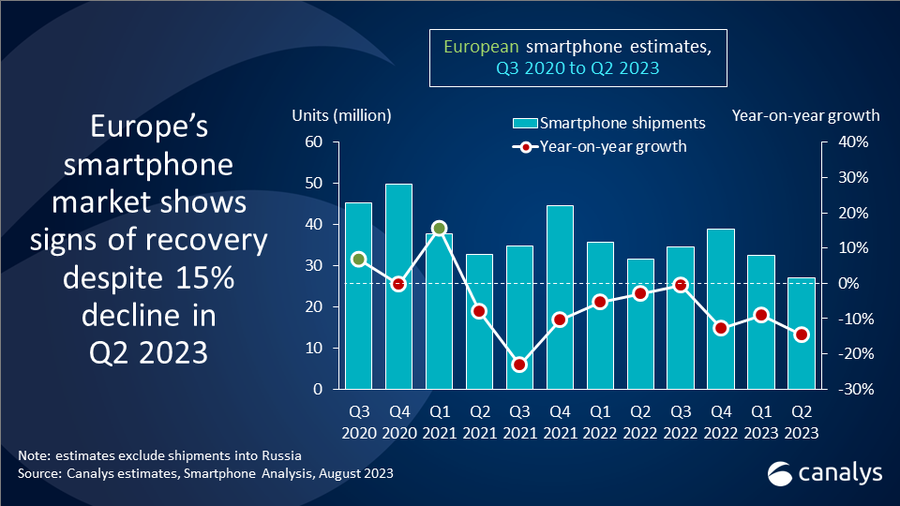

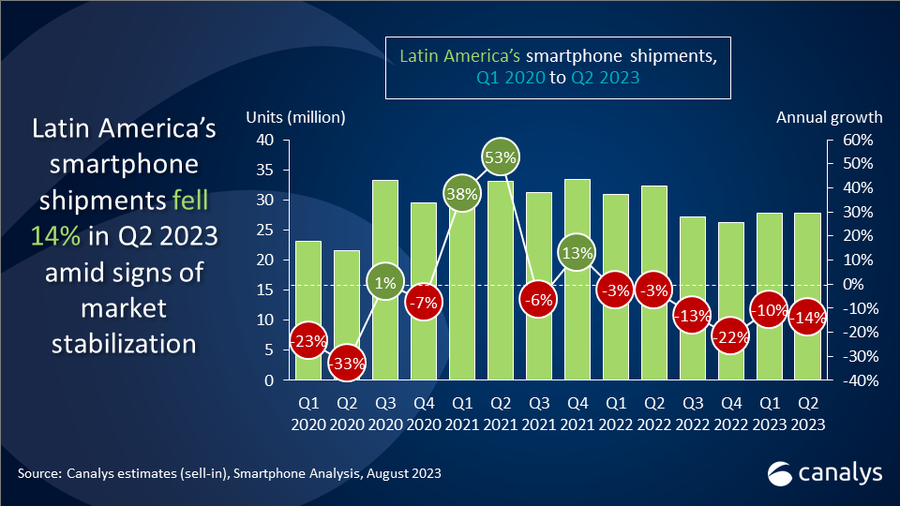

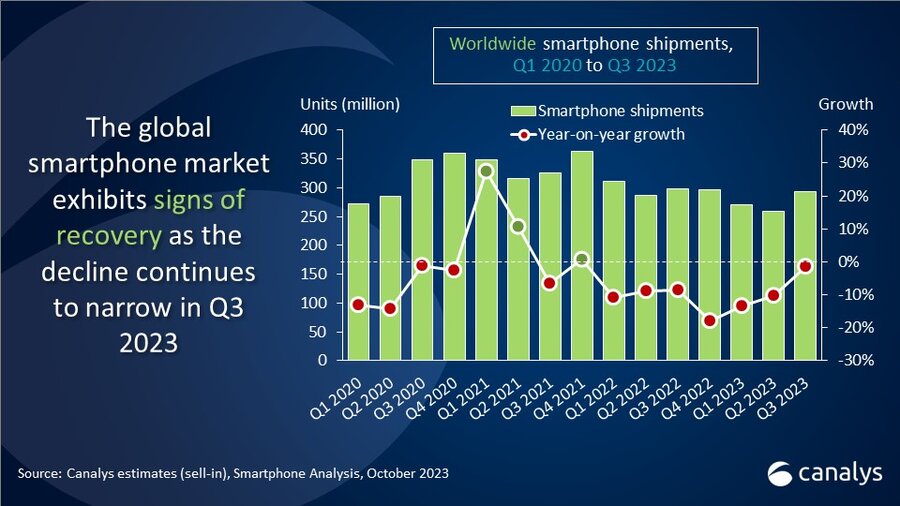

According to the latest Canalys’ data, the global smartphone market underwent a slight drop of 1% in Q3 2023, signaling a slowdown in its decline. Bolstered by regional recoveries and new product upgrade demand, the smartphone market recorded a double-digit sequential growth in Q3, ahead of the sales seasons.

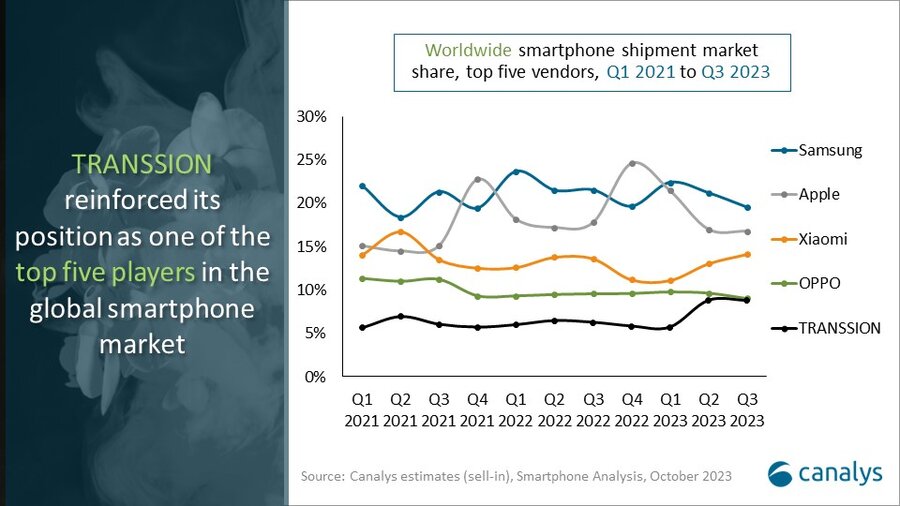

Samsung held onto the leading position with a 20% market share, despite a small dip from Q3 2022, while Apple claimed second place with a 17% market share. Xiaomi took the third position with a 14% market share, with unit shipments recovering both annually and sequentially. OPPO (including OnePlus) captured the fourth spot with a 9% market share, owing to its strong position in Asia Pacific. TRANSSION rounded out the top five with a 9% share and remarkable year-over-year expansion. Outside the top five, Huawei made a major comeback in its home market, driven by the new Mate series.

“Huawei and Apple's new launches electrified the market this quarter, outshining many other vendors' flagship series renewals,” said Amber Liu, Analyst at Canalys. “Huawei's new Mate series, featuring the latest Kirin chipset, has drawn enthusiastic consumer response in Mainland China. Operators are racing to stock up on Huawei devices to meet the surging demand. Meanwhile, Apple is bolstering its new iPhone 15 series with much-enhanced performance and features to continuously stimulate demand. On the other hand, while Samsung is reducing exposure in the entry-level segment to focus on profitability, Xiaomi and TRANSSION have swiftly capitalized on the rebound in the emerging markets with competitive products and channel engagements. These short-term wins might turn into more sustainable long-term success if Xiaomi and TRANSSION play their cards well.”

“Vendors should remain cautious about the rebound,” added Toby Zhu, Analyst at Canalys. “The global macroeconomic and geopolitical uncertainties brought fragility into the nascent recovery and channel operations. Canalys forecasts suggest decelerating medium-to-long-term smartphone market growth. Meticulous monitoring of stock turnover and end demand is critical to avoid turbulence from high inventory. We see vendors strategically rebuilding channel and component inventories to prepare for potential resurgent demand and supply chain cost hikes. The current short-term order surge alongside reduced supply capacity may cause component shortages, challenging planning and production.”

|

Worldwide smartphone shipments and growth |

|||

|

Vendor |

Q3 2023 |

Q3 2022 |

|

|

Samsung |

20% |

22% |

|

|

Apple |

17% |

18% |

|

|

Xiaomi |

14% |

14% |

|

|

OPPO |

9% |

10% |

|

|

TRANSSION |

9% |

6% |

|

|

Others |

32% |

31% |

|

|

|

|

|

|

|

Preliminary estimates are subject to change on final release |

|

||

For more information, please contact:

Toby Zhu: toby_zhu@canalys.com

Amber Liu: amber_liu@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.