Global PC shipment decline narrows to just 7% in Q3 2023

Tuesday, 10 October 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

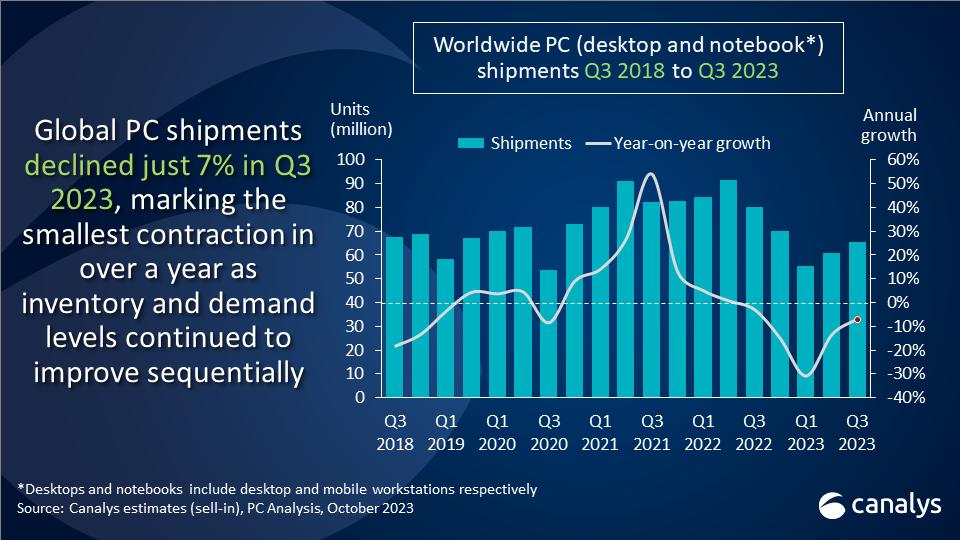

According to Canalys’ latest data, the worldwide PC market posted another sequential improvement in Q3 2023. While total shipments of PCs amounting to 65.6 million units were down 7% year-on-year, they rose 8% compared to Q2 2023. This represents the smallest annual shipment decline for the industry in over a year and is a further sign of recovery in both inventory levels and underlying demand. Shipments of notebooks dropped 6% annually to 52.1 million units, while desktop shipments were down 8% to 13.5 million units.

“After a tough start to the year, the third quarter of 2023 brought about more positive signs for the global PC market,” said Ishan Dutt, Principal Analyst at Canalys. “Amid some improvements in the macroeconomic environment, key players across the industry are now expressing cautious optimism as their inventory correction efforts have been largely successful. As a result, pockets of underlying demand strength across all end-user segments are now better reflected in vendors’ sell-in shipment performance. Most major OEMs posted sequential growth in shipments, even after accounting for the demand boost from the education sector that largely materialized last quarter. Looking ahead, Canalys expects this positive trend to continue, with the market set for a return to growth during the highly anticipated holiday season.”

|

Worldwide desktop and notebook shipments (market share and annual growth) |

|||||

|

Vendor |

Q3 2023 |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual |

|

Lenovo |

16,031 |

24.5% |

16,698 |

23.8% |

-4.0% |

|

HP |

13,512 |

20.6% |

12,689 |

18.1% |

6.5% |

|

Dell |

10,255 |

15.6% |

11,963 |

17.0% |

-14.3% |

|

Apple |

6,421 |

9.8% |

9,063 |

12.9% |

-29.1% |

|

Asus |

4,882 |

7.4% |

5,466 |

7.8% |

-10.7% |

|

Others |

14,445 |

22.0% |

14,372 |

20.5% |

0.5% |

|

Total |

65,546 |

100.0% |

70,250 |

100.0% |

-6.7% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), October 2023 |

|

||||

Lenovo topped the market rankings in Q3 2023, shipping 16.0 million units and posting a relatively modest annual decline of 4%. Second-placed HP enjoyed another quarter of growth, with its shipments up 7% annually to 13.5 million units. Dell took the third spot, undergoing a heavier shipment decline of 14%. Fourth-placed Apple posted the largest year-on-year drop in shipments, down 29% to 6.4 million units. However, this was largely driven by the comparison to a strong quarter last year, when it was able to fulfill pent-up demand following supply chain disruptions. Asus rounded out the top five vendors, shipping 4.9 million units.

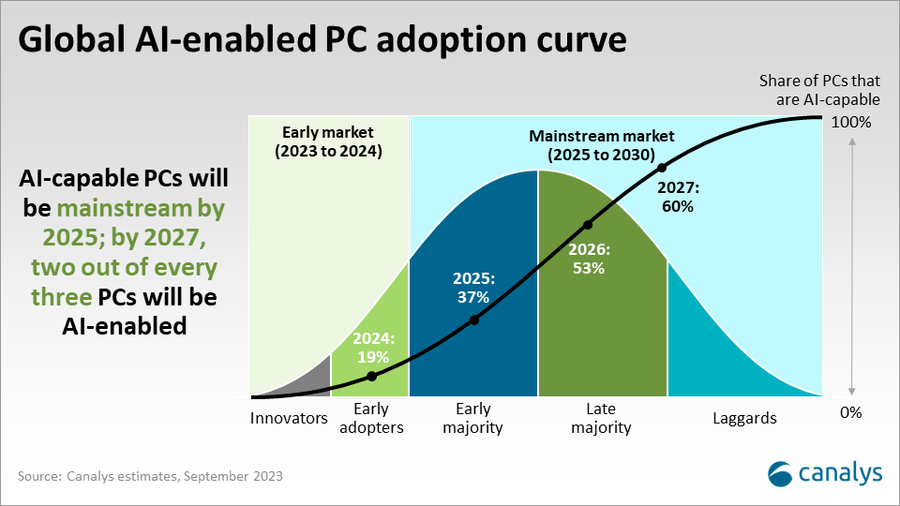

“With many of the issues that have plagued the market now easing, vendors across the PC ecosystem can now look forward to an additional demand boost from AI,” said Kieren Jessop, Research Analyst at Canalys. “Roadmaps for integration of on-device AI capabilities have already been outlined, with several products showcased at the HP Imagine event earlier this month and other vendors set to follow suit. Canalys forecasts that adoption of AI-capable PCs will accelerate from 2025 onward, with such devices accounting for around 60% of all PCs shipped in 2027. Vendors and channel partners who seize this opportunity will benefit from both the higher prices AI-capable PCs command and the wider opportunities to provide services and solutions in addition to hardware.”

For more information, please contact:

Ishan Dutt: ishan_dutt@canalys.com

Kieren Jessop: kieren_jessop@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

.jpg)