Heightened threat levels drive cybersecurity spending to US$19 billion in Q2 2023

Tuesday, 17 October 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

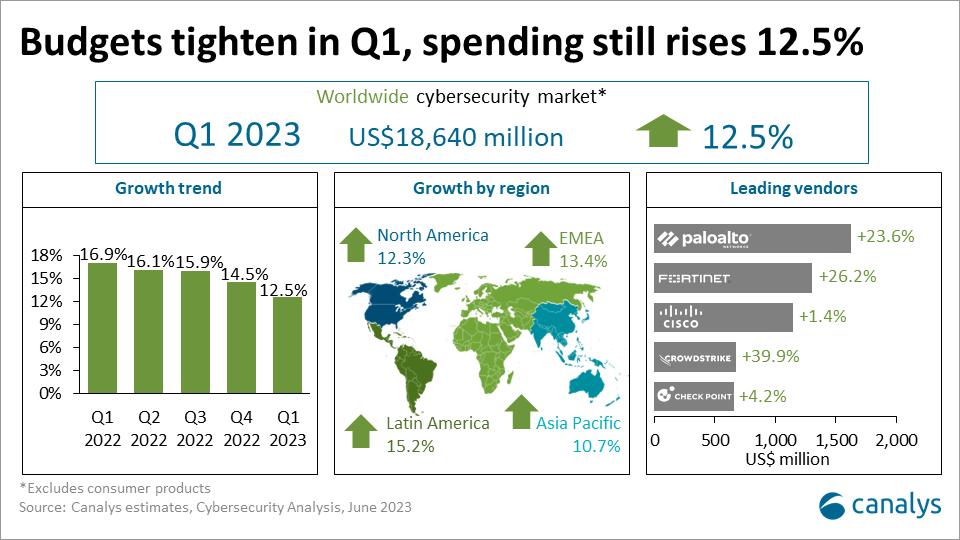

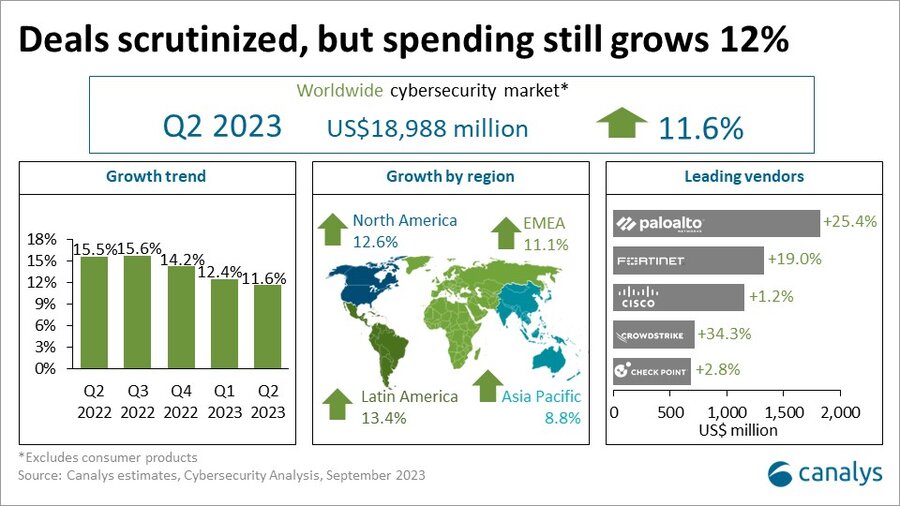

Investment in cyber-resilience remained a top priority for organizations in Q2 2023 as threat levels continued to rise. Overall, the worldwide cybersecurity technology market grew 11.6% year on year to US$19.0 billion, despite ongoing macroeconomic uncertainty and constrained IT budgets.

The top 12 vendors accounted for nearly half of this spending. Leading the market in Q2, Palo Alto Networks grew 25.4%, fueled by demand for SASE, SecOps and cloud security. Fortinet ranked second, having capitalized on further gains in network security. But its growth of 19.0% in Q2 represented a slowdown from 26.2% in Q1. Cisco accounted for 6.1% of total spending, down from 6.7% last year. Its business is transforming under new leadership, with new platform launches and more acquisitions, including its intent to purchase Splunk for US$28 billion. CrowdStrike, Check Point, Okta and Microsoft rounded out the top seven.

“Threat levels are at unprecedented heights, with the number of publicly reported ransomware attacks up by more than 50% and breached data records more than doubling in the first eight months of this year. At current rates, 2023 will be the worst year on record, far exceeding 2021 levels, when ransomware came to the forefront after a series of high-profile events,” said Matthew Ball, Chief Analyst at Canalys.

In Q2 2023, total cybersecurity technology spending through the channel accounted for 91.5%, up from 90.5% in the same quarter a year ago.

Customers need channel partners with cybersecurity expertise more than ever to help build cyber-resilience. This is a key theme at the 2023 Canalys Forums. At the EMEA event in Barcelona, sessions discussing the threat landscape and neutralizing attack surfaces, as well as a panel of CEOs from Proofpoint, SonicWall and Trend Micro, emphasized the need for partners to build more service-led engagements with customers and collaborate more with specialists to expand capabilities in areas such as red teaming and MDR. It was also highlighted that vendors needed to improve collaboration with each other, especially around integration and sharing data.

More partner and vendor sessions will be held at the Canalys Forum North America in Palm Springs next month and at the Canalys Forum APAC in Bangkok in December.

|

Vendor |

Market share Q2 2022 |

Market share Q2 2023 |

Revenue growth |

|

Palo Alto Networks |

8.5% |

9.6% |

25.4% |

|

Fortinet |

6.6% |

7.0% |

19.0% |

|

Cisco |

6.7% |

6.1% |

1.2% |

|

CrowdStrike |

3.1% |

3.8% |

34.3% |

|

Check Point |

3.9% |

3.6% |

2.8% |

|

Okta |

3.1% |

3.4% |

24.5% |

|

Microsoft |

2.9% |

3.4% |

31.1% |

|

Symantec |

3.1% |

2.9% |

5.6% |

|

IBM |

3.1% |

2.7% |

-2.0% |

|

Trellix |

2.9% |

2.7% |

3.0% |

|

Zscaler |

2.0% |

2.5% |

37.7% |

|

Trend Micro |

2.3% |

2.2% |

7.8% |

|

Others |

51.9% |

50.2% |

8.0% |

|

All vendors |

100% |

100% |

11.6% |

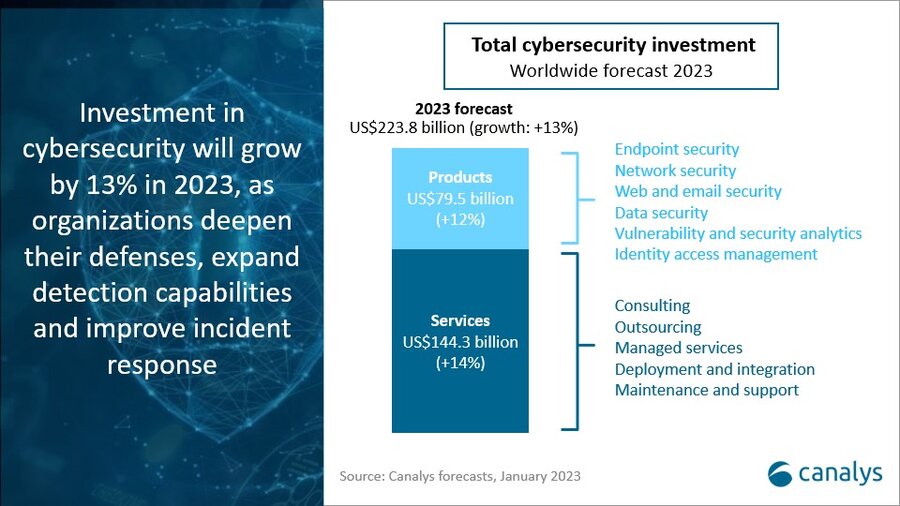

“Discovering vulnerabilities and establishing asset inventories, as well as categorizing them based on the level of risk, is critical to prioritize investment in protection. This is also an important foundation for partners in creating remediation plans for customers when attacks take place,” added Ball. “The cybersecurity services opportunity for partners will be larger than selling cybersecurity technology this year, with spending forecast to grow 13.2% to US$143.2 billion in 2023. Managed security services and integration services will be the fastest growing areas.”

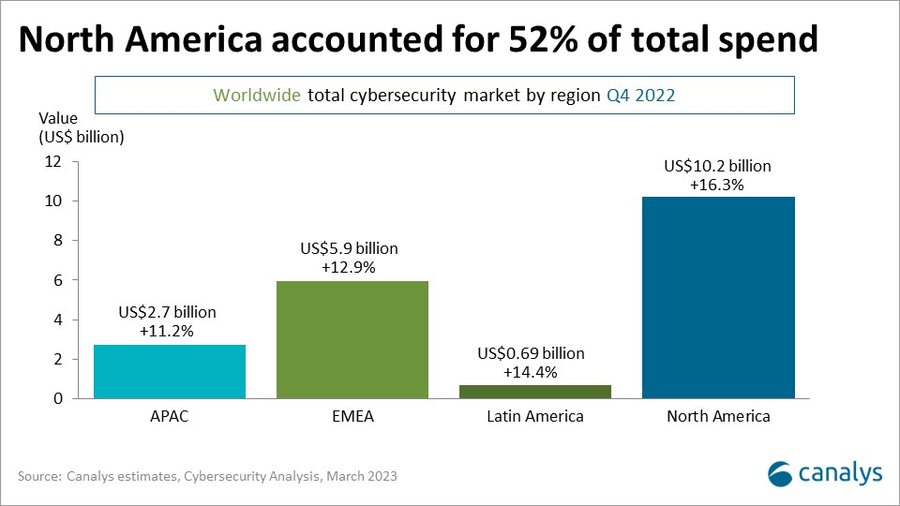

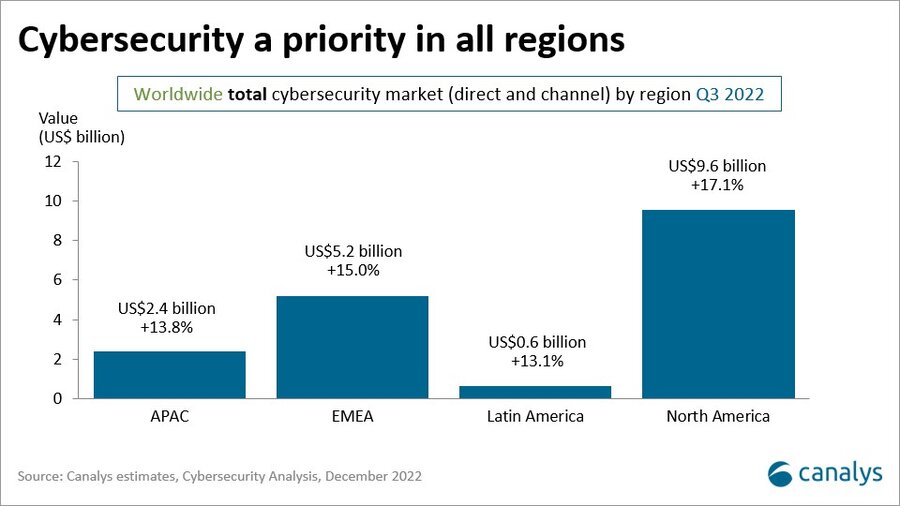

On a regional basis, spending remained resilient in North America (+12.6%), which is the next destination of the Canalys Channel Forums (13 to 15 November), EMEA (+11.1%) and Latin America (+13.4%). But growth rates slowed in Asia Pacific (+8.8%), as organizations scaled back their spending.

NORTH AMERICA: Palm Springs, California, 13-15 November 2023

APAC: Bangkok, Thailand, 5-7 December 2023

For more information, please contact:

Matthew Ball: matthew_ball@canalys.com

Srikara Upadhyaya: srikara_upadhyaya@canalys.com

Cybersecurity Ecosystems Analysis is a comprehensive service that offers qualitative and quantitative analysis on route-to-market, end-user and technology deployment for the leading cybersecurity vendors, and insights into new emerging vendors. Canalys provides competitive intelligence information across six security segments: endpoint security, network security, data security, web and email security, vulnerability and security analytics, and identity access management. Quarterly deliverables focus on identifying and analyzing the latest cybersecurity market and vendor trends, and providing updates to the segment’s short-term quarterly and longer-term five-year forecasts.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.