Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Lunar Lake to add momentum to Intel’s AI PC goals

With the launch of Lunar Lake processors, Intel is gathering momentum as it moves toward its goal of shipping 100 million AI PCs by the end of 2025. Our exclusive video interview and blog give insights into the opportunities and challenges ahead.

Earlier this year, Intel laid out an ambitious goal to grow its AI PC segment, aiming to ship 100 million Core Ultra-powered PCs by the end of 2025. Now, half a year into this initiative, Canalys Principal Analyst Ishan Dutt sat down with Todd Lewellen, Vice President and General Manager of PC Ecosystem at Intel, to discuss the company’s progress in growing the AI PC category ahead of the launch of Lunar Lake and its outlook for the future.

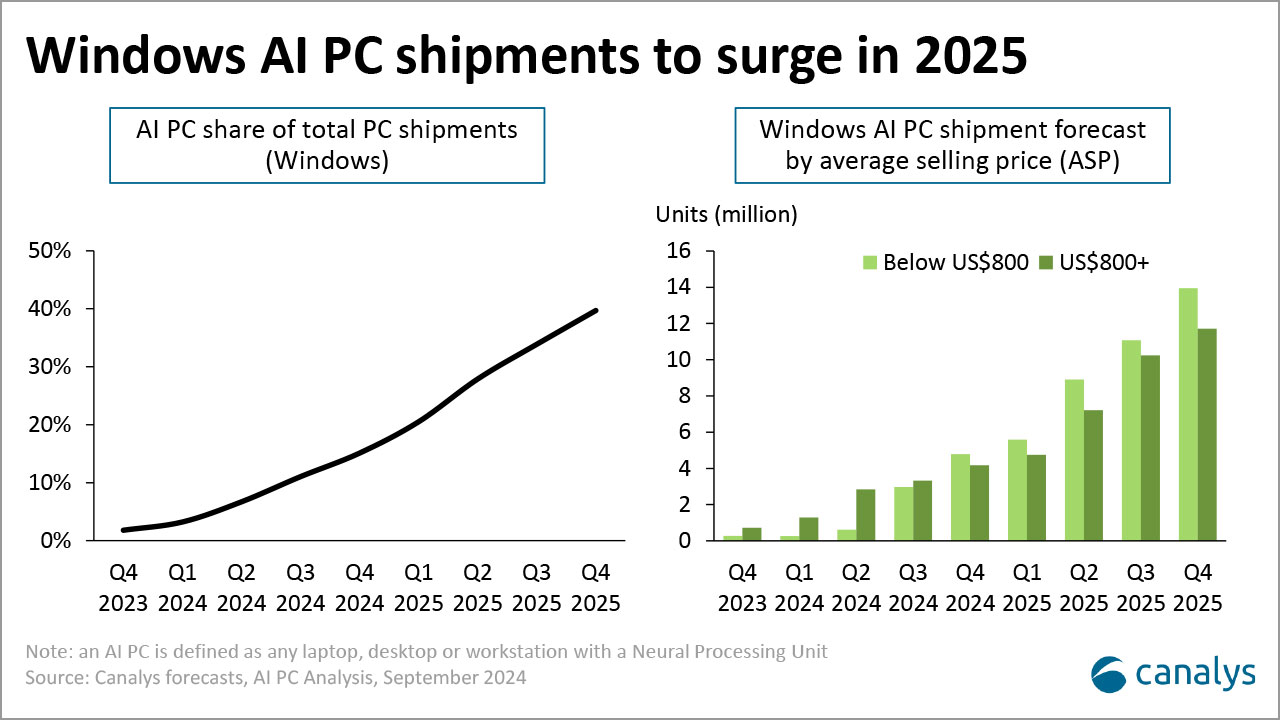

Intel is on track to meet its 100 million target

Shipments of AI PCs with Intel Core Ultra more than doubled sequentially in Q2 2024, with an even steeper ramp-up expected in the second half of the year. Since the December 2023 launch of Meteor Lake, Intel shipped more than 15 million Intel Core Ultra chips to OEMs. Todd Lewellen reaffirmed the chip giant’s commitment to shipping more than 40 million AI PCs by year-end and 60 million in 2025. Canalys forecasts that the AI PC share will grow from less than 10% of the Windows PC market in 2024 to 30% in 2025 and 50% in 2026.

Intel’s next-generation AI PC chip series, Lunar Lake, was launched at IFA 2024. Based on the announcement, it meets Microsoft’s requirements to classify the devices it powers as Copilot+ PCs and will be featured in more than 80 new PC models from 20 OEM partners. Positioned in the premium notebook category, Intel’s latest chip will be up against Qualcomm’s Snapdragon X series and AMD’s Ryzen AI, and delivers a significant increase in TOPS performance compared with Meteor Lake. This is an important milestone on Intel’s roadmap as it ensures its vast customer base can be equipped to take advantage of the latest and greatest on-device AI features while also benefiting from improvements in performance and efficiency. As Intel and others release further generations later this year and throughout next year, Canalys forecasts that the price premium for AI PCs will fall. Even by Q4 2024, Windows AI PCs with an ASP under US$800 will overtake shipments of those above US$800 in volume.

ISV enthusiasm bodes well for AI PC differentiation

Intel’s size and significance in the PC ecosystem make it a vital player in driving adoption and encouraging developers to build on what Intel views as a new platform. Lewellen emphasized the excitement in the industry, saying, “We’re working with 150 ISVs right now, driving a little over 350 new AI features on our AI PC platforms.” Intel’s engagement with ISVs, which includes sharing co-engineering and design resources alongside technical expertise, has led to the development of hundreds of AI features, indicating strong ecosystem buy-in. This will be vital to bring significantly differentiated experiences to the AI PC category. Lewellen notes that over 130 AI features are being developed just to run on the NPU. But if there is going to be a single “killer” feature or suite of applications that drives interest, it will likely be from upcoming Windows capabilities rather than from third-party applications, making the announcement of Lunar Lake’s alignment with Microsoft’s Copilot+ PC requirements a much-needed development for Intel.

Intel’s progress has been promising but challenges remain

Intel and its partners have shown that, from a hardware perspective, AI PCs will deliver on performance improvements and unlock new use cases. But work remains to be done on clarifying to different customer segments exactly why they need these new machines and how the hardware improvements translate to tangible benefits.

In the commercial space, this challenge may be easier to navigate as the advantages of AI PCs are more readily visible to end-user productivity. Paired with an upcoming commercial PC refresh cycle, driven primarily by the end of Windows 10 support in October 2025, IT decision-makers’ awareness of these devices is increasing. Their potential to be a more cost-effective endpoint for enterprise AI projects, allowing for hybrid inferencing between client and cloud, is an appealing benefit. Additionally, fleet manageability and security are also improved with these devices. These are important factors as businesses start to explore ways to augment general-purpose LLMs with proprietary data or content to run Retrieval-Augmented Generation (RAG) for purpose-built AI assistance.

In the consumer space, the barriers are likely to be harder to overcome. Consumer spending on PCs remains relatively weak, and the use cases for AI PCs are still not clear and compelling. Other factors, such as improved performance and, particularly, battery life, are more likely to win consumers over. Additionally, a concern for the Windows ecosystem is that at these price points, Apple’s leadership in premium consumer markets could lure some users away from Windows.

As we move into 2025 and beyond, the success of Intel’s strategy will depend on its ability to execute on its product roadmap, promote awareness of relevant use cases for different user personas and quantifiably demonstrate benefits, such as increasing ROI and reducing TCO for commercial customers. With the launch of Lunar Lake, the next few quarters will be vital to determine whether Intel can build momentum to truly ignite the era of the AI PC it has envisioned and fight back against the renewed competitive threat posed by its rivals.