Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Ecodesign laws set to transform smartphones in 2025

20 June 2025 marks a milestone for Europe’s smartphone market. On this date, two directives from the European Commission will come into force and disrupt the industry, through new standards for energy labelling and ecodesigns.

20 June 2025 marks a milestone for Europe’s smartphone market. On this date, two directives from the European Commission will come into force and disrupt the industry, through new standards for energy labelling and ecodesigns.

Smartphone vendors and their suppliers have been adjusting products and roadmaps since drafts of the directives were first published in 2022. In the next nine months, manufacturers will release new and updated devices, as any product intended to stay on the market after 20 June 2025 must be compliant. For example, if Apple wants to keep the next iPhone series on the market beyond June 2025, the changes will likely be made at the next launch events.

Vendors face reduced control of their designs and added operational complexity – but what impact will this have on the industry? And will vendors see the new legislation as a threat or an opportunity?

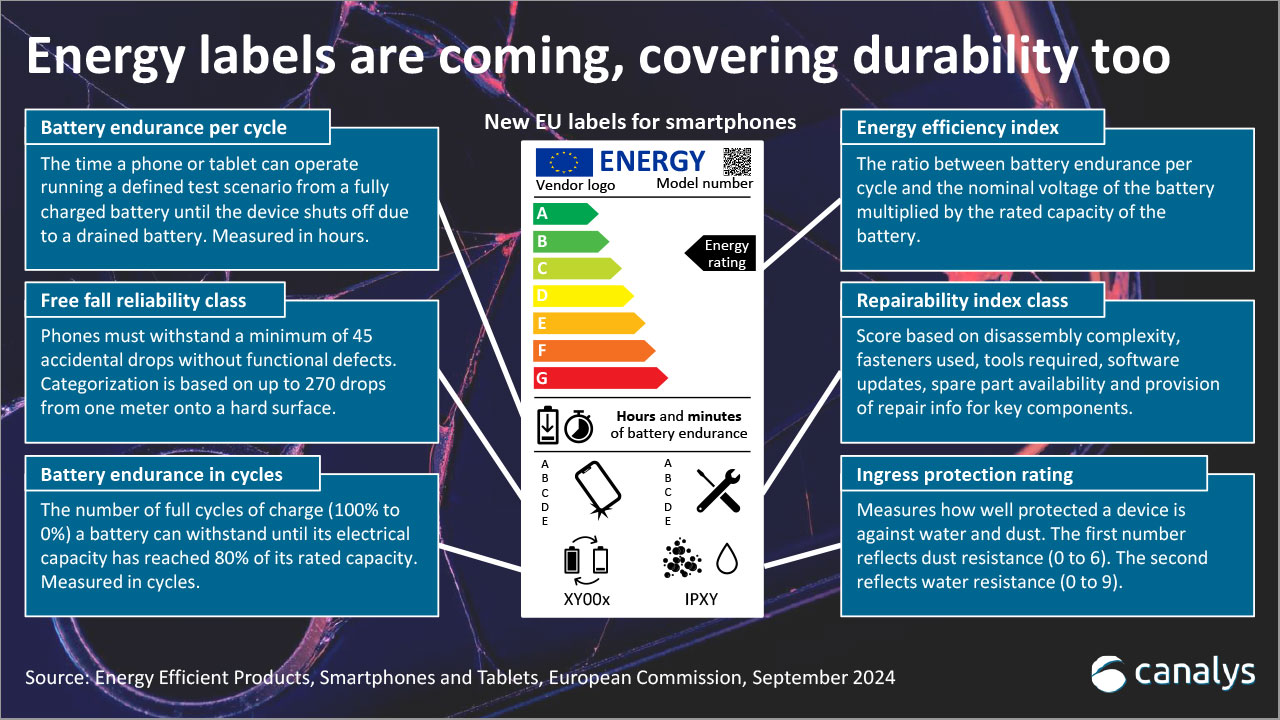

Law 1: Introducing energy efficiency labels on smartphones

Energy efficiency labels are nothing new. They have been used for many product categories since the early 1990s, with coverage ranging from displays to light bulbs to washing machines. From next year, similar labels will appear on all smartphones for the first time.

The labels will include an energy efficiency rating, drop protection categorization, repairability index categorization, battery endurance capacity and IP rating. Currently, vendors are searching for specialists to outsource this tracking to.

With the energy labels, the Commission aims to encourage vendors in a more sustainable direction while giving consumers new tools to guide their buying decisions. But the labels’ usefulness will rely on the distribution of scores. With TVs, for example, over 93% of tracked models score E, F or G on energy efficiency, making it an ineffective comparison tool.

Law 2: Ecodesign for repairability, durability and recyclability

The European Commission’s Ecodesign Directive is more troubling for vendors as its requirements will affect device designs, inventory planning and software support. In brief, the directive covers:

- Repair and reuse: Vendors must provide spare parts and repair information for specified components for at least seven years after sell-in has been discontinued. Some spare parts can only be available to professional repairers, while others must also be available to consumers.

- Durability: Devices must survive 45 one-meter drops without reduced functionality. They must meet scratch resistance level 4 on the Mohs hardness scale and offer protection from water splashes and dust particles. They must also have a minimum battery capacity of 80% after 800 charging cycles and manufacturers must provide OS and security updates for five years after the end of devices’ placement in the market.

- Recycling: Dismantling information (steps, tools and technologies) must be provided for 15 years.

- Transparency: Vendors must provide publicly available information online on scarce mineral use, indicative recyclability score, percentage of recycled content in the product, IP rating and battery endurance. Customers must be able to access battery diagnostic information and recommendations on how to optimize battery lifetimes.

Though the European Commission imposed the compliance obligation on vendors, most changes will require vendors to work with a range of supply chain partners and distributors. For example, assuring that software updates are feasible requires support from the chipset ODMs (such as Qualcomm, MediaTek and UNISOC).

The spare part requirements will add a layer of complexity to vendors’ resource planning, particularly for inventory management, to assure cost and operational efficiency. Closer collaboration with distributors or repair specialists will likely be needed.

Market impact and risks

Design changes, more years of software support and managing spare part inventories will all add costs that will make the balance between price increases and margins even trickier. Though all vendors must comply with the same regulations, the relative impact is not distributed equally.

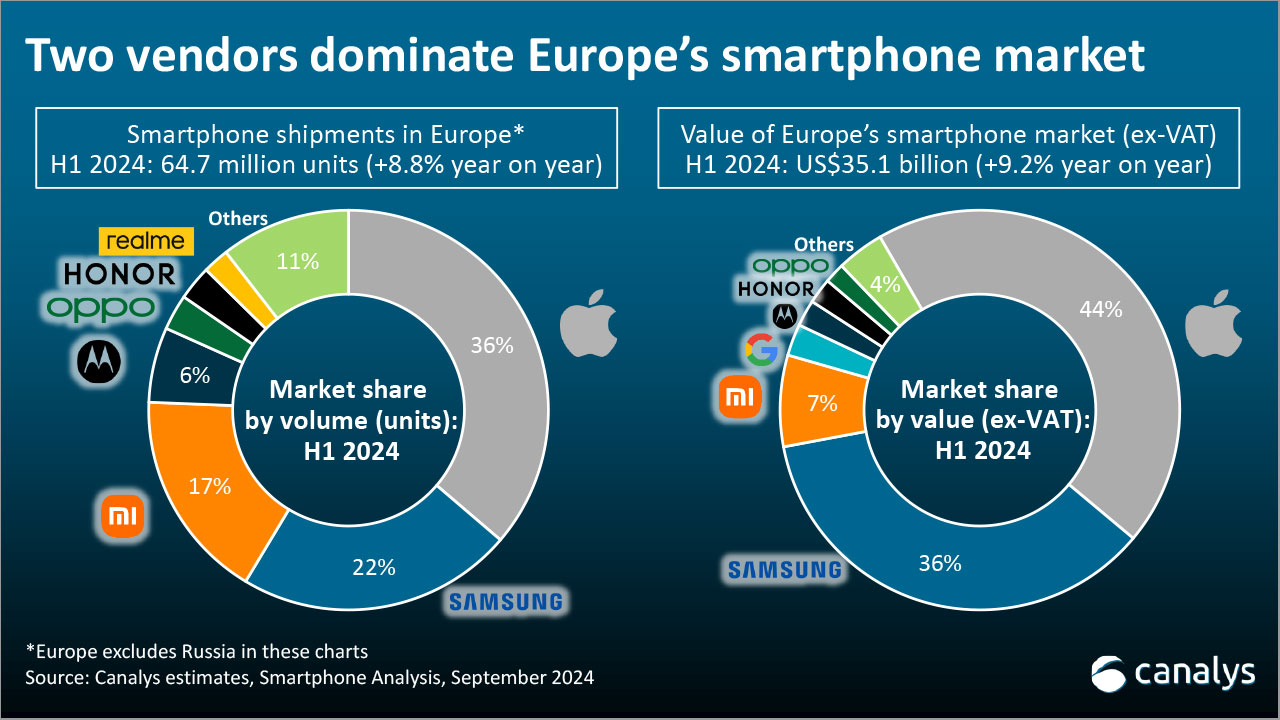

Apple and Samsung dominate in Europe. In the first half of 2024, combined they took 59% volume share and 80% value share of the smartphone market. These vendors have both scale and well-performing high-end portfolios, which can simplify internal justification and limit cost increases (for example, due to existing years of software support on high-end devices that are already compliant). The changes will undoubtedly be a hassle, but Apple and Samsung’s main challenge will be to own the narrative and turn it into a thought leadership opportunity.

The remaining market share is left for numerous vendors to fight over. Here, most vendors face tough competition and narrow margins, particularly because most vendors target the mid-to-low end. Without large volumes, extra costs per device, for example, for more years of software support, will make it harder to operate profitably.

Furthermore, increased device lifetimes and a stronger second-hand market will lead to a smaller total addressable market of new devices and put more pressure on vendors in this segment. Consequently, the vendor landscape is likely to shrink in the long run, as it will only be possible for a few vendors to reach a size that can make long-term operations profitable.

Vendors are also likely to adjust their portfolios tactically. For example, shorter model lifecycles, including early discontinuation, can be used to start the seven-year requirement sooner rather than later. In addition, vendors might consider EU-specific SKUs or models that will comply, perhaps while also matching the requirements to be listed in specific operators’ portfolios (such as eSIMs). But it might be difficult to justify internally without a significant current volume.

Unclear impact on refurbished devices

From an environmental sustainability perspective, the European Commission’s Ecodesign Directive is a landmark move to tackle premature obsolescence in consumer electronics. The rationale behind the directive is that longer-lasting, more durable smartphones will slow refresh cycles and minimize e-waste creation at a time when the planet produces e-waste at five times the rate it is being recycled, according to the UN.

But the Ecodesign Directive’s impact – alongside the right-to-repair regulations emerging in Europe and some US states – on the refurbished smartphone market remains uncertain. On one hand, making spare parts and repair guides available should boost repairability. Long-term OS support is another key step to ensuring smartphones can be refurbished and used again, reducing the risk of an e-waste crisis, such as the one the PC market is facing when Windows 10 support ends in October 2025.

On the other hand, the directive can extend smartphones’ “first life,” potentially reducing residual value. Even if refurbished, the marketability and value of a refurbished smartphone that is five, six or seven years old will be diminished for being many generations behind.

Owning the message is the biggest opportunity

Most vendors will have to choose between quietly complying (or even resisting) and attempting to own the message themselves.

Several vendors have faced greenwashing criticism in recent years, and bringing improved durability and repairability to the fore in messaging can help highlight leadership and forward-thinking. But this messaging comes only as a first-mover advantage. Though Fairphone and HMD sell highly repairable devices, neither is big enough to change the industry.

Additionally, improved durability and repairability can help justify price increases (perhaps even more than complementary AI features) and support the long-term value of products. Perhaps it can even facilitate a stronger push to grow software and after-sales support programs, such as AppleCare+, Moto Care and Samsung Care+.

That is IF a vendor dares to own the message. There would be no surprises if vendors stayed silent and quietly complied amid their many legal battles with the EU.