Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

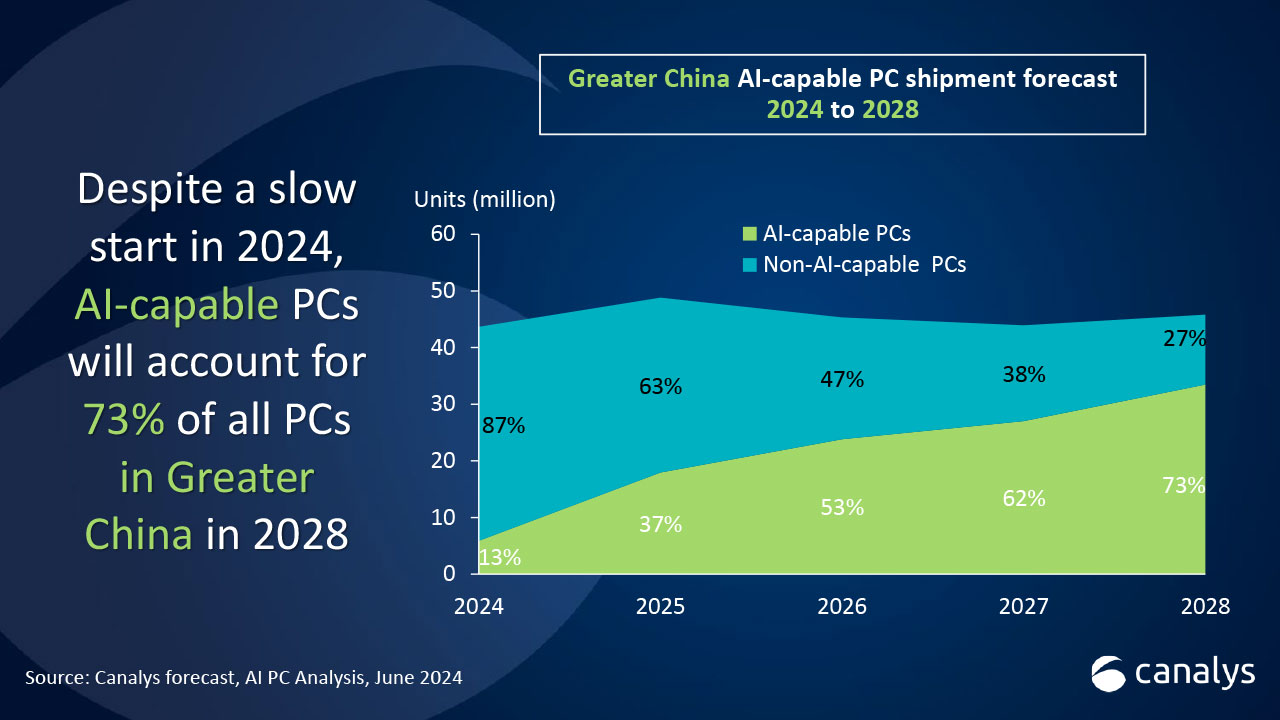

Exploring generative AI PC opportunities in Mainland China

This blog explores the go-to-market strategies of the leading AI PC vendors in Mainland China.

Canalys forecasts that AI-capable PCs in Mainland China will start to take off in 2024, and shipments will reach 33 million in 2028, representing 73% of the PC market. PC vendors have unique and unprecedented opportunities in Mainland China in the AI PC era. The absence of a local implementation roadmap for Microsoft Copilot in Mainland China significantly limits consumer and enterprise interest in adopting AI features and products. This gap presents substantial opportunities for PC vendors and other industrial players to innovate, experiment and refine strategies for introducing AI PCs to the Mainland Chinese market.

Early AI sentiment among consumers and businesses

Since 2023, China’s central government has promoted the “new productive force”, emphasizing innovation across many industries, sparking enthusiasm among industries to adopt new technologies and innovate within traditional economic sectors. Tech companies and government initiatives have fostered a generally open and optimistic attitude toward adopting AI technologies in Chinese society.

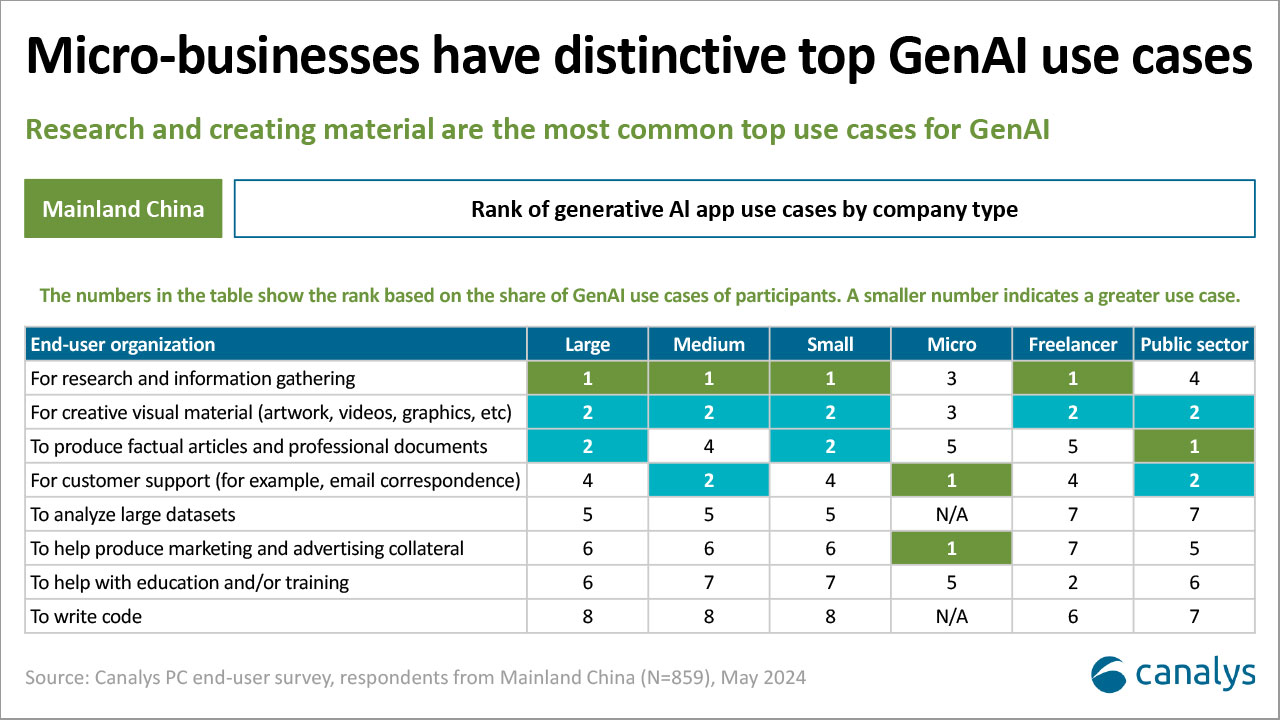

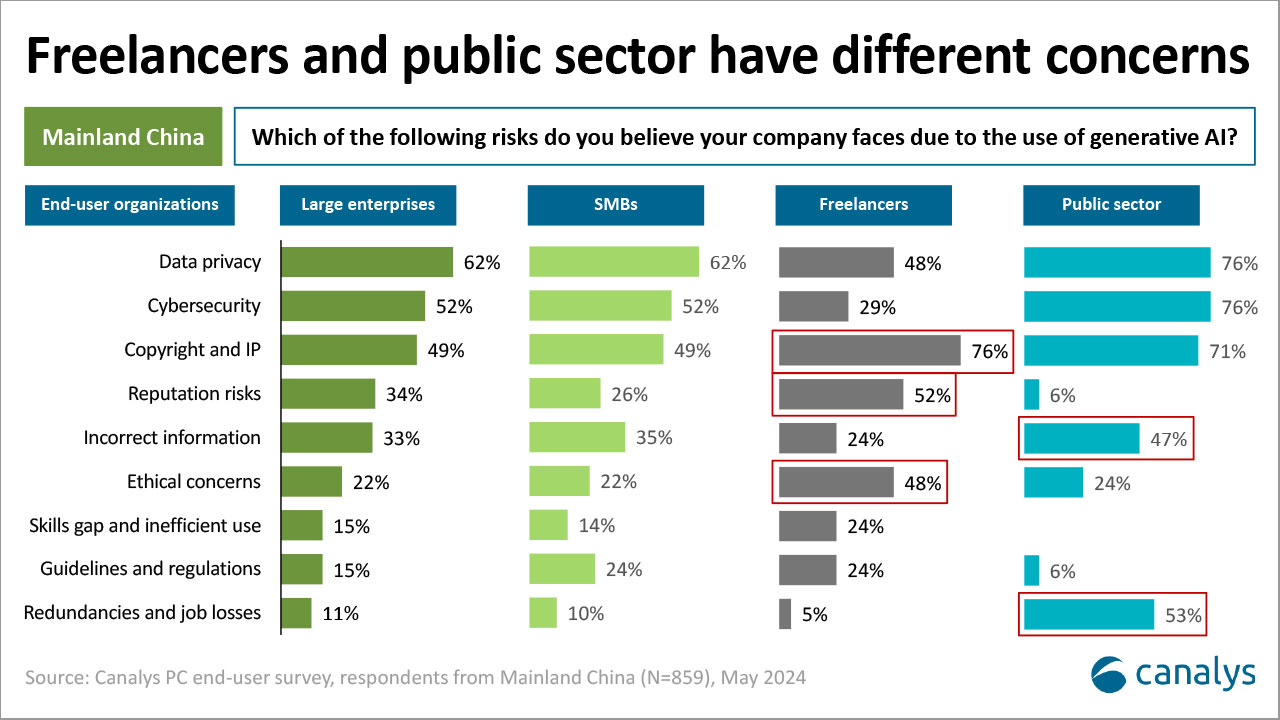

Consumers and SMBs are positive about AI-enhanced applications. Due to limited resources, SMBs are eager to integrate AI into their operations with flexible plug-and-play solutions.

Canalys’ latest PC end-user survey indicates that in Mainland China, many large companies have set clear guidelines for integrating GenAI into their workflows, surpassing the engagement rates seen in Western countries, such as the UK, the US and Germany. Large enterprises, such as tech companies involved in Internet services and IT infrastructure, are quick to adopt AI due to their advanced digital capabilities. But traditional industries, such as manufacturing, are still building their digital foundations and aren’t fully ready for AI yet.

For state-owned enterprises and government departments, local regulations and underdeveloped domestic chips hinder the use of on-device AI. Concurrently, Mainland China’s telecom companies are investing heavily in cloud infrastructure and focusing on developing on-cloud AI models. This shift promotes cloud-based computing and reduces dependency on hardware, such as PCs.

Two distinct options for AI PC go-to-market strategies in Mainland China

PC vendors are employing two main strategies to enter the AI PC market in Mainland China.

The vanilla approach: This strategy involves offering AI-capable PCs with standard Windows features and high-performance hardware, such as Intel’s Core Ultra or Qualcomm’s Snapdragon X Elite. These PCs do not include advanced AI features but rely on the Windows 11 upgrade to drive sales. This approach risks placing vendors in a defensive position due to a lack of product-level differentiation. Moreover, uncertainties surrounding the implementation of Copilot in Mainland China and the underdevelopment of AI software might make vanilla AI PCs less appealing due to their limited usability and high reliance on cloud-based AI.

AI integration with in-house and third-party features: The second strategy focuses on developing proprietary AI features and building an ecosystem of AI applications. Vendors such as Lenovo and Asus are taking this approach with their own AI agents and applications, such as Lenovo’s Xiaotian assistant, an AI agent, or Asus’ StoryCube, an AI application for creators. This strategy involves significant investment in developing and maintaining AI applications and collaborating with local developers to create a robust AI ecosystem. Moreover, some smartphone vendors are trying to leverage their platform-level development expertise from smartphones to PCs, providing innovative AI features with enhanced interoperability across their device ecosystems.

What’s next?

Vendors must take a flexible, open approach to capitalize on the AI PC boom in Mainland China. Building strong partnerships with local software providers and adapting to the regional market dynamics will be key to capturing growth opportunities. As the AI PC market evolves, strategic innovation and local adaptation will determine success in this promising landscape.

To flourish in Mainland China, vendors must address the unique needs of different segments, covering consumers, SMBs and government and state-owned enterprises.

Please log on to the Canalys client website for the full report.