Samsung leads global smartphone market in Q3 2024 as total shipments jump 5% to 310 million

Thursday, 31 October 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

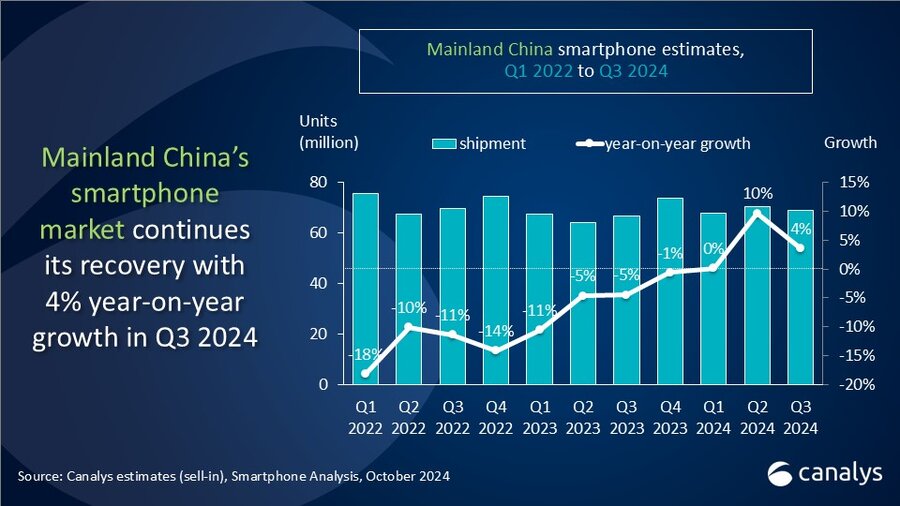

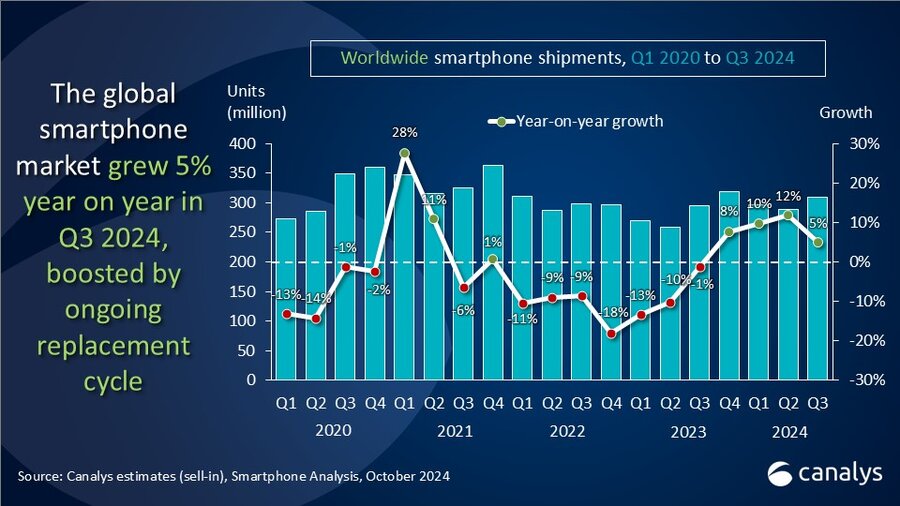

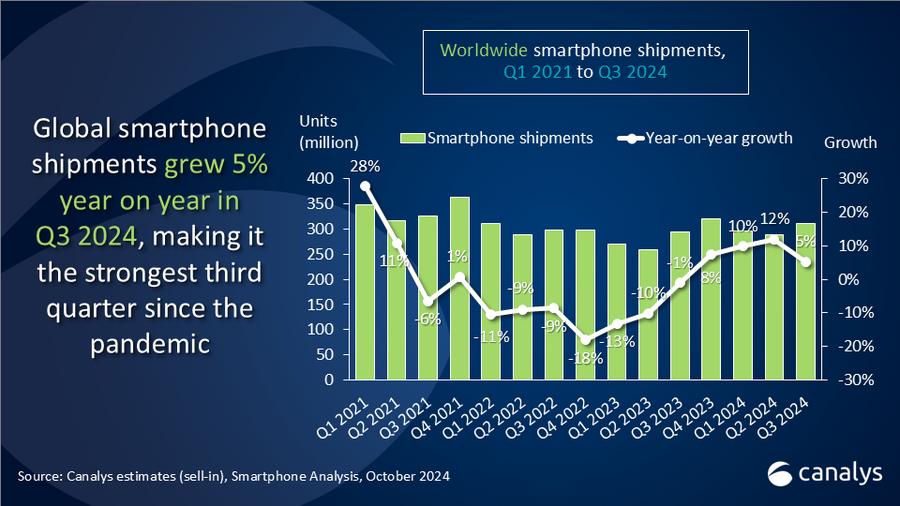

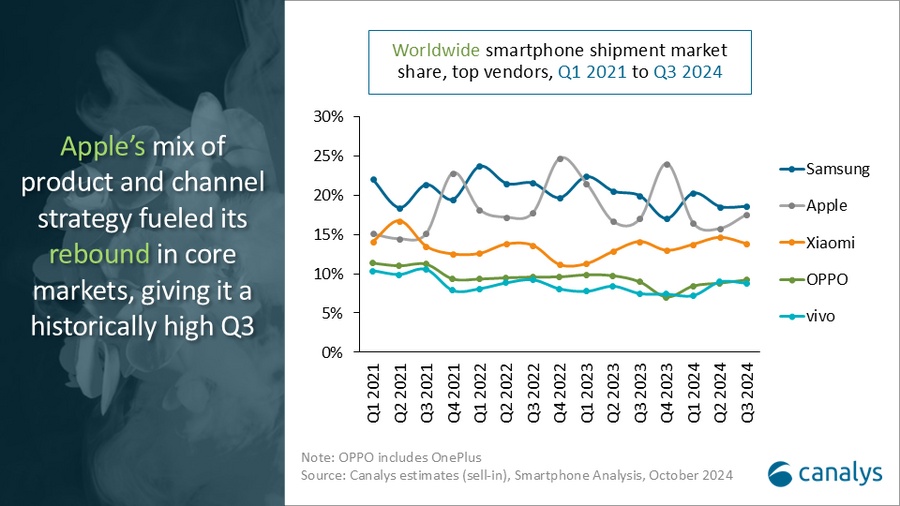

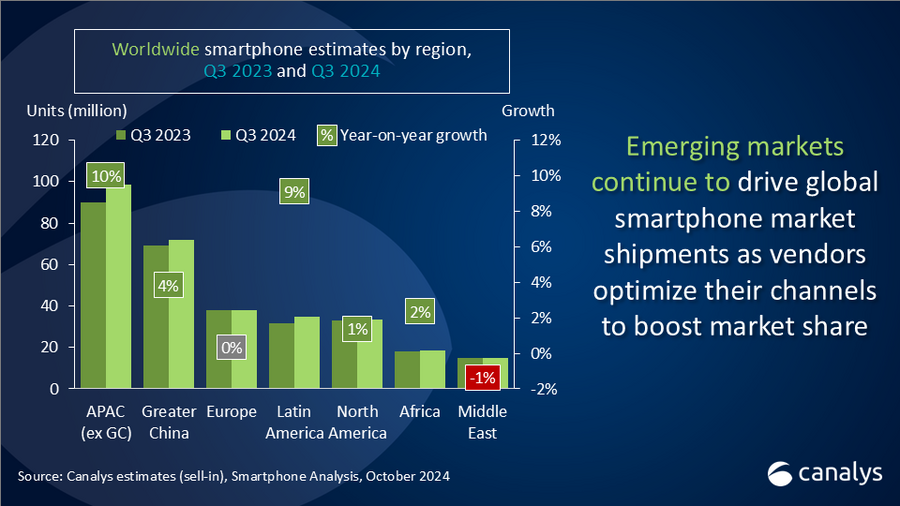

According to Canalys research, global smartphone shipments grew 5% year on year in Q3 2024, reaching 309.9 million units, the strongest Q3 performance since 2021. This surge was fueled by aggressive launches from smartphone brands offering refreshed portfolios with strong value propositions, encouraging upgrade numbers amid a favorable refresh cycle and robust consumer sentiment. Samsung led with 57.5 million shipments, bolstered by a streamlined entry-level lineup. Apple retained second place with a record 54.5 million units, driven by the iPhone 16 series’ strong debut in emerging markets from narrower hardware gaps between base and Pro models. Xiaomi held third with 42.8 million units and a 14% market share, benefiting from strategic inventory positioning for new launches in core markets. OPPO and vivo finished the top five, shipping 28.6 million and 27.2 million units, respectively, with healthy performances in the highly competitive Asia Pacific region.

“Apple achieved record Q3 shipments, driven by a strategic blend of channel and supply chain optimizations,” said Canalys Analyst Le Xuan Chiew. “Post-WWDC’s Apple Intelligence announcements, consumers are actively upgrading from older iPhone 12 and 13 models to embrace this new technology. Moreover, Apple’s diversified iPhone production, notably in India, has significantly reduced lead times, streamlining pre-order fulfillment and stimulating local demand through competitive pricing. Supplementary production of previous-generation iPhones, such as the iPhone 13 and 15, in India has further bolstered Apple’s operator channel shipments into the US and Europe, enabling it to reclaim market share in the mid-range segment and capitalize on replacement demand. Nevertheless, it is vital to note the geopolitical obstacles, and the delayed deployment of Apple Intelligence may substantially hinder Apple’s performance both in the festive fourth quarter and in 2025.”

“Intense competition in the low-end market has persisted, despite a strong first half of 2024 buoyed by robust consumer demand and favorable economic conditions,” said Canalys Senior Analyst Toby Zhu. “OPPO’s successful launch of the rebranded A3 series in the US$100-to-US$200 price segment, particularly in Southeast Asia, is a prime example of this strategy. By streamlining its portfolio, OPPO has seen 30% year-on-year growth in the region and is poised to further increase its market share. But rising component costs and channel saturation pose challenges to long-term profitability and the sustainability of mass-market strategies. To address these challenges, brands are expanding their focus to mid-tier growth in emerging markets. In the second half of 2024, Xiaomi is leveraging its strong open market presence and brand stores to elevate its mid-to-high-end sales and redirect consumer demand toward its Pro series. Meanwhile, vivo expanded its V40 series to cover a wider range of variants to boost its mid-range offerings.”

“Canalys remains cautiously optimistic for the rest of the year, with vendors sharpening inventory positioning and brand building to fuel growth into 2025,” said Chiew. “Emerging markets, such as Southeast Asia and Latin America, have outperformed the overall market, driven by increased price competition and channel incentives in the entry-level segment. While this segment remains vital for volume and market share, inflationary pressures limit the profitability of ultra-low-end devices, making sustained price wars challenging. In mature markets, such as the US, China and Western Europe, premium segment growth will be driven by AI-powered differentiation. Vendors such as vivo and HONOR are expanding their mid-range portfolios through innovative channel strategies, including pop-up stores and operator partnerships, to capture upgraders from the US$100-to-US$200 price band.”

|

Global smartphone shipments and annual growth |

|||||

|

Vendor |

Q3 2024 |

Q3 2024 |

Q3 2023 |

Q3 2023 |

Annual |

|

Samsung |

57.5 |

19% |

58.6 |

20% |

-2% |

|

Apple |

54.5 |

18% |

50.0 |

17% |

9% |

|

Xiaomi |

42.8 |

14% |

41.5 |

14% |

3% |

|

OPPO |

28.6 |

9% |

26.4 |

9% |

8% |

|

vivo |

27.2 |

9% |

22.0 |

7% |

24% |

|

Others |

99.4 |

32% |

95.9 |

33% |

4% |

|

Total |

309.9 |

100% |

294.6 |

100% |

5% |

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Le Xuan Chiew: lexuan_chiew@canalys.com

Toby Zhu: toby_zhu@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.