Global smartphone market drops just 1% amid resurging regional demand

Friday, 27 October 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

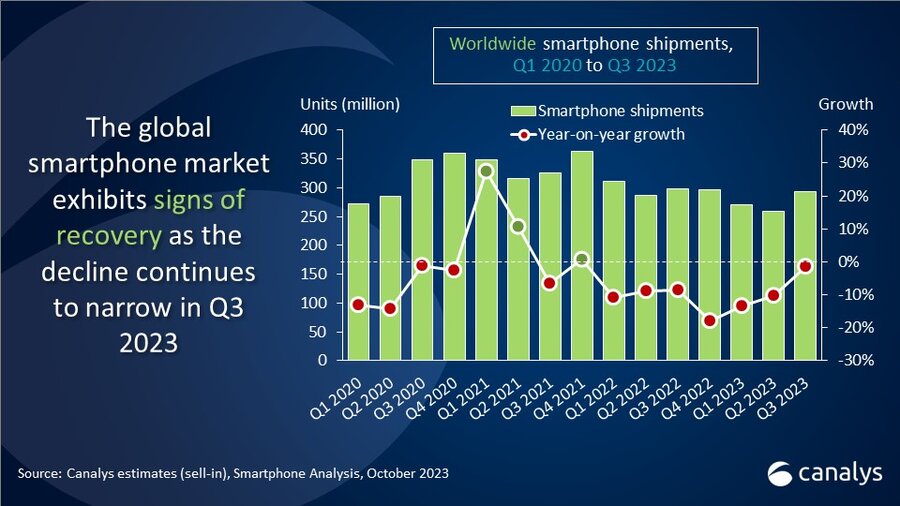

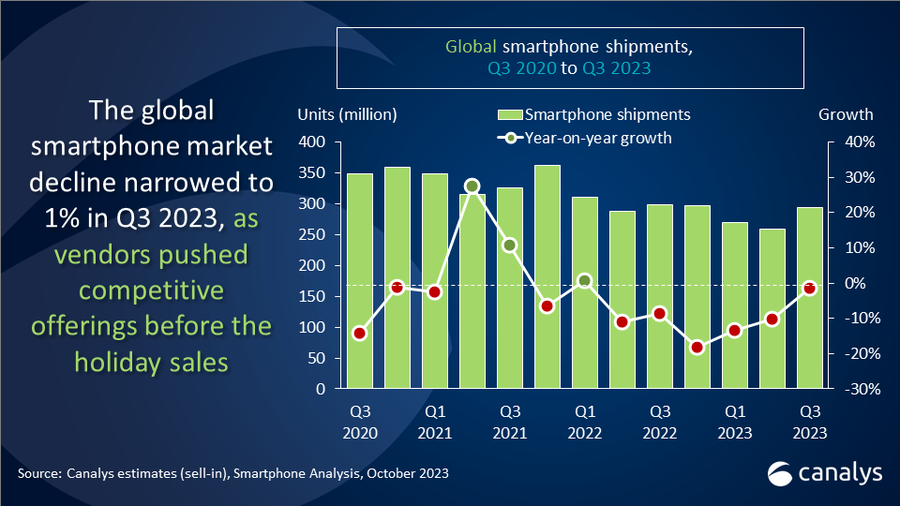

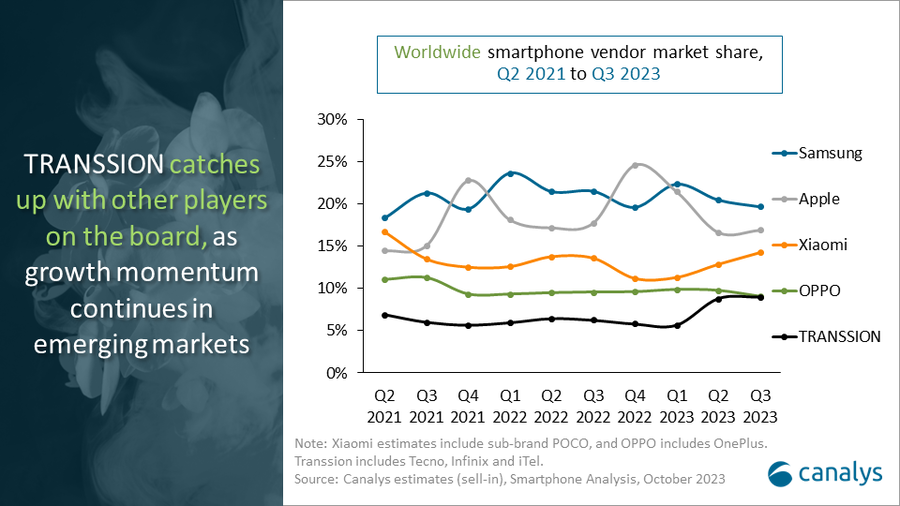

Canalys’ latest research reveals that the global smartphone market fell slightly by 1% to 293.4 million units in Q3 2023 with vendors pushing new models following a healthy inventory level in Q2. Samsung held the pole position and shipped 57.4 million units with a 20% market share, thanks to an early update of its foldable devices. Apple followed in second place, shipping 50.0 million units and gaining 17% market share, driven by strong initial demand for the iPhone 15 series with USB-C upgrade. Xiaomi took third place, shipping 41.5 million units, achieving an annual growth of 2%, owing to strong performance in emerging markets. OPPO (including OnePlus) secured the fourth position with 26.4 million units of shipment, capturing 9% market share. TRANSSION Group (includes Tecno, Infinix and iTel brands), maintained its fifth position as it continued its strong momentum from the previous quarter and defended its top five position, shipping 26.0 million units.

“Rising demand for fresh offerings in emerging markets is propelling brands and channels forward as the holiday season approaches,” said Sanyam Chaurasia, Senior Analyst at Canalys. “Xiaomi and the TRANSSION Group maintained their strong performance from the previous quarter and were the sole brands among the top five to experience growth. Xiaomi regained growth momentum in Q3 due to successful inventory normalization in H1 2023 and the launch of the budget-friendly Redmi Number series in emerging markets. Meanwhile, TRANSSION achieved an impressive 40% year-on-year growth, driven by increased shipments in the core African market. Despite currency fluctuation and import restrictions in these markets, new upgrade demand was intact along with consumers' adaptation to higher inflation. In the Middle East, a growing budget segment demand and a robust regional team in less-affluent markets spurred momentum. Aggressive channel investment expanded TRANSSION’s presence in Latin American markets alongside their new product portfolio.”

“Vendors are seeking opportunities to solidify their positioning in the premium market,” said Lucas Zhong, Research Analyst at Canalys. “Brands are enhancing their premium segment offerings to expand their utility through design and user interface improvements. The global competition for foldable smartphones is set to intensify. Samsung's Galaxy Z Flip and Fold 5 series were released two weeks earlier than usual to bolster Q3 2023 revenue and market performance. However, as foldable smartphone options continue to increase, this trend poses a challenge to Samsung's current dominance in the same market. OPPO strategically introduced the Find N3 and OnePlus Open models in different regions, demonstrating Android brands' ambition to capture the global foldable market. Learning from demand challenges due to the over-differentiation of the iPhone 14 series, Apple narrowed the gap through the addition of the USB-C and Dynamic Island support to the iPhone 15 and 15 Plus models, resulting in stronger-than-expected volume and supporting the brand’s footprint in the high-end.”

“Android brands are striving to improve their ecosystem integration to compete with iOS. Consumers are willing to switch brands for better integration, leading brands to develop their own in-house operating systems to demonstrate R&D capabilities and bolster brand image. For example, Huawei's Mate 60 series boasts its in-house Kirin SoC and HarmonyOS to enhance integration. Xiaomi's HyperOS also stands out for improving connectivity across multiple devices. These in-house OSs are expected to open new revenue opportunities beyond smartphones, such as through IoT and electric vehicles. However, the key to the success of in-house OS lies in providing unique and compelling experiences to consumers. To maintain user loyalty and profits in the evolving market, vendors must invest in collaborative R&D for both software and hardware and focus on interconnecting features that give them a competitive edge,” added Zhong.

“Canalys anticipates that the global smartphone market will witness modest growth in a cautious-looking 2024,” said Zhong. “Vendors will close 2023 with a relatively healthier inventory level, providing space to rebuild their stock in preparation for a potential demand resurgence. However, regional performance is expected to diverge due to regional conflicts and geopolitical tensions. Hence, vendors should remain flexible and adaptable in their strategies to seize growth opportunities in specific regions. Additionally, close monitoring of end demand in different regions is needed to strategically optimize resource allocation and avoid disruptions. Long-term market growth remains constrained by the extended replacement cycles in major markets. In the saturated market competition, vendors must continuously enhance their capabilities and focus on profit and product portfolio optimization.”

|

Global smartphone shipments and annual growth |

|||||

|

Vendor |

Q3 2023 |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual |

|

Samsung |

57.4 |

20% |

64.1 |

22% |

-10% |

|

Apple |

50.0 |

17% |

53.0 |

18% |

-6% |

|

Xiaomi |

41.5 |

14% |

40.5 |

14% |

2% |

|

OPPO |

26.4 |

9% |

28.5 |

10% |

-8% |

|

TRANSSION |

26.0 |

9% |

18.6 |

6% |

40% |

|

Others |

92.1 |

31% |

93.1 |

31% |

-1% |

|

Total |

293.4 |

100% |

297.8 |

100% |

-1% |

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. Transsion includes Tecno, Infinix and iTel. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

Lucas Zhong: lucas_zhong@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.