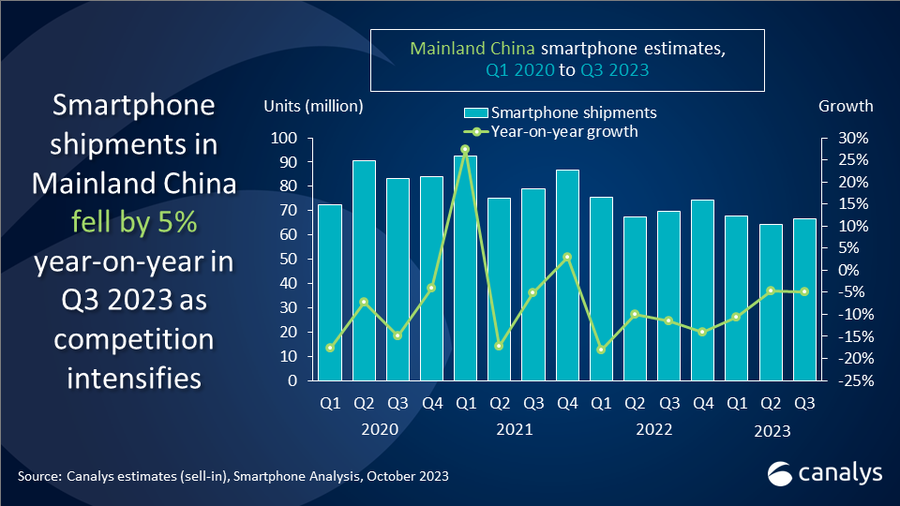

A close race ahead in Mainland China smartphone market after 5% shipment decline in Q3 2023

Thursday, 26 October 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

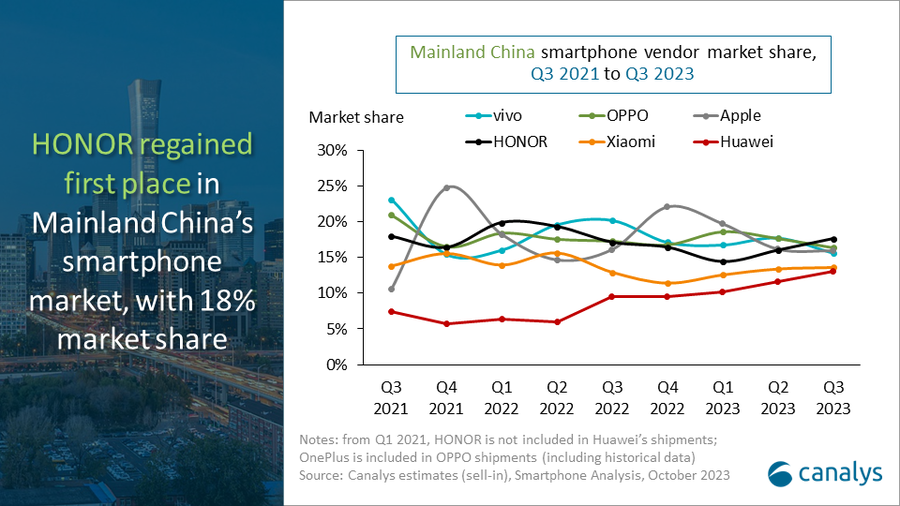

According to Canalys estimates, smartphone shipments in Mainland China saw a second consecutive quarter of modest decline, falling 5% to 66.7 million units. HONOR, driven by product and channel competitiveness, returned to the top position with an 18% market share and 11.8 million shipments. OPPO (including OnePlus) followed with 10.9 million shipments, securing second spot. Apple came in third with 10.6 million shipments, benefiting from its new launch. vivo, with a cautious shipment strategy, held fourth position with a 16% market share. Xiaomi's hot-selling series maintained its momentum, with a slight increase in market share to 14%, securing the fifth spot. Additionally, Huawei continued to gain market share and inch its way towards the top players through its high-profile Mate series launches.

“Product competitiveness is, again, key for growth,” said Canalys Research Analyst Lucas Zhong. “The Huawei Mate 60 series launch sparked the market. If Huawei expands the new Kirin chipset into its low-to-mid-range portfolio in the future, it has the potential to disrupt the competitive dynamic among leading vendors. Meanwhile, the HONOR X50 series focuses on durability improvement as a new unique selling point, adding momentum to shipments in the third quarter. Apple's new iPhone 15 series introduced bigger upgrades to meet consumers’ expectations. Android vendors, however, showed ambitions in the foldable category with a plethora of launches, including Xiaomi Mix Fold3, HONOR V Purse, Magic Vs2, OPPO Find N3 Flip, Find N3, and Huawei Mate X5, providing consumers with offerings in different form factors, specifications, and price ranges.”

“Vendors and channels are collaborating closer on all levels from macro-level strategy to day-to-day operations, especially since 2022, after experiencing a demand downturn and inventory risks together,” added Canalys Research Manager Amber Liu. “Vendors have been assisting channels in operational efficiency enhancement in various ways. For instance, HONOR and OPPO are helping distributors improve cash flow by providing digital financial tools, while Xiaomi started offering distributors the options to acquire Mi stores, optimizing resource allocation and allowing ambitious distributors to expand. Facing intense rivalry, vendors continuously experiment with new models of symbiotic relationship with channel partners.”

“The market has bottomed out in 2023 as vendors steadfastly invest and refine channel incentive policies, and there is an expected gradual demand recovery," commented Canalys Senior Analyst Toby Zhu. “The market shows that, despite prolonged replacement cycles, consumers are still willing to pay for products within their budget that offer attractive value propositions. In the second half of the year, Huawei will generate a 'Catfish Effect' on the competitive landscape. Vendors will proactively expand their product portfolios and accelerate upgrade frequency, especially in the high-end category, to stimulate consumer upgrades and brand switches.”

|

People’s Republic of China (Mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q3 2023 |

|||||

|

Vendor |

Q3 2023 |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual

|

|

HONOR |

11.8 |

18% |

12.0 |

17% |

-1% |

|

OPPO |

10.9 |

16% |

12.1 |

17% |

-10% |

|

Apple |

10.6 |

16% |

11.3 |

16% |

-6% |

|

vivo |

10.4 |

16% |

14.1 |

20% |

-26% |

|

Xiaomi |

9.1 |

14% |

9.0 |

13% |

0% |

|

Others |

13.9 |

21% |

11.4 |

16% |

21% |

|

Total |

66.7 |

100% |

69.8 |

100% |

-5% |

|

|

|

|

|||

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments. |

|

||||

For more information, please contact:

Lucas Zhong: lucas_zhong@canalys.com

Toby Zhu: toby_zhu@canalys.com

Amber Liu: amber_liu@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.