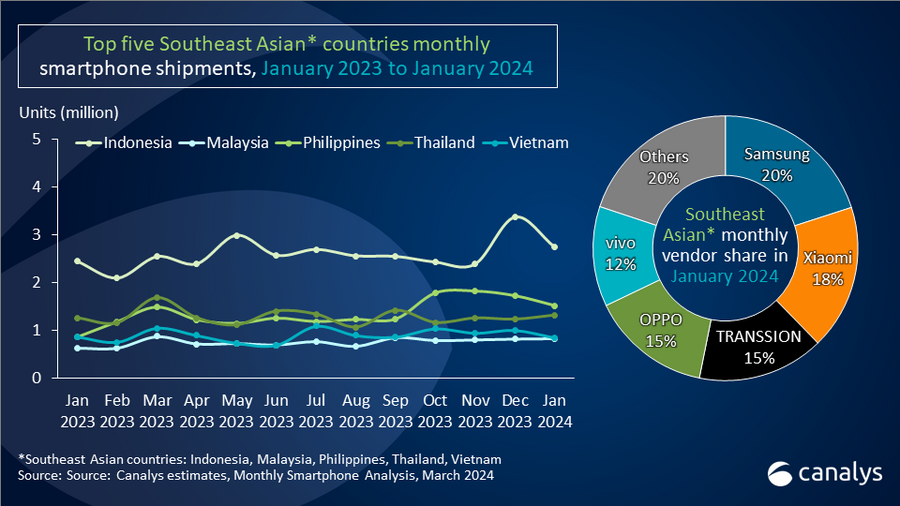

Southeast Asian smartphone shipments soar with 20% annual surge to kickstart 2024

Wednesday, 6 March 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Indonesia

Indonesia remains a strategic Southeast Asian market, representing 38% of shipments in the region at 2.7 million units in January. Year-on-year growth of 12% was propelled by increased vendor engagement, notably fueled by the introduction of new products. OPPO reclaimed the leading position, primarily by scaling up shipments of its Ax8 series, which accounted for over 90% of its total shipments. Xiaomi grew shipments by 30% year on year, driven by the launch of new POCO models that gained traction in the online channel. The strategic shift of its POCO series distribution to online platforms, in line with its global POCO strategy, has proven effective in optimizing channel sales and preventing cannibalization of its Redmi series.

Philippines

The smartphone market in the Philippines remained the second largest in Southeast Asia, with a 21% shipment share and 1.5 million shipments. It showed the most robust recovery, with remarkable year-on-year growth of 77%. Competition at the low end intensified as realme, Xiaomi and TRANSSION launched more budget-friendly devices with impressive core specifications, such as RAM and ROM. TRANSSION strengthened its market presence by securing a 37% market share in January, employing aggressive channel incentives and sponsoring gaming teams to appeal to youthful and budget-conscious buyers. In response to TRANSSION’s dominance, realme introduced its Note 50 series, priced below US$100, offering compelling value to compete in the market.

Thailand

In Thailand, smartphone shipments grew annually by 5% to reach 1.3 million units due to persistent challenges from adverse economic conditions and a weakened local currency, leading to higher import expenses. To address market dynamics, many vendors expanded their product offerings to include budget-friendly 5G devices, anticipating the growing adoption of 5G technology in the country, mainly driven by accessible 5G postpaid and prepaid packages. Samsung’s and Apple’s longstanding partnerships with local operators give them an advantage in the market.

Vietnam

Vietnam was the only market in the region to decline, by 2% to 848,000 units in January. The Vietnamese smartphone market recovery has been slower than anticipated, with major distributors such as Mobile World and FPT shifting their investments to new ventures, such as AI. Xiaomi is working to reinvigorate its presence in the Vietnamese market and increased its market share from 5% in January 2023 to 19% in 2024 thanks to a 288% growth in smartphone shipments. This growth was fueled by the introduction of its Note 13 series, which offers an appealing value proposition tailored to Vietnam’s expanding middle class.

Malaysia

Malaysia, known for its resilience in the smartphone market within the region, grew smartphone shipments by an impressive 33% sequentially in January, reaching 831,000 units. This resilience is attributed to government initiatives promoting the widespread adoption of 5G technology. According to Canalys’ monthly tracker, the operator share increased from 17% in Q1 2023 to 21% in Q4, peaking at 22% in September, coinciding with the start of the Rahmah program. Samsung’s and HONOR’s sustained efforts throughout 2023 to collaborate with operators and drive 5G programs in Malaysia have yielded success. Samsung emerged as the market leader in January with a 20% market share, while HONOR doubled its shipments compared with the previous year.

Canalys Analyst Le Xuan Chiew said, “The top five Southeast Asian markets performed strongly in January. Inflationary pressures are now stabilizing, buoyed by government support, leading to a resurgence in consumer sentiment and expenditure. To capitalize on this market resurgence, smartphone manufacturers, which adopted conservative strategies in the last six months, are now deploying aggressive tactics to gain market dominance. Balancing device affordability with prudent inventory management poses the primary challenge for smartphone vendors, particularly as channel partners exercise caution following a challenging start to the year. Looking ahead, it is imperative for smartphone vendors to seek out new avenues for growth, with emerging trends such as affordable 5G, AI integration, ecosystem development and channel optimization emerging as the primary drivers of industry evolution in the region.

|

Southeast Asian* smartphone shipments and annual growth |

|||||

|

Vendor |

January 2024 |

January 2024 |

January 2023 |

January 2023 |

Annual |

|

Samsung |

1.5 |

20% |

1.6 |

27% |

-11% |

|

Xiaomi |

1.3 |

18% |

0.6 |

9% |

128% |

|

TRANSSION |

1.1 |

15% |

0.4 |

6% |

190% |

|

OPPO |

1.1 |

15% |

1.1 |

19% |

-6% |

|

vivo |

0.9 |

12% |

0.7 |

12% |

25% |

|

Others |

1.4 |

20% |

1.6 |

27% |

-11% |

|

Total |

7.3 |

100% |

6.1 |

100% |

20% |

|

Note: Xiaomi estimates include sub-brand POCO; OPPO includes OnePlus. |

|

||||

This press release uses Canalys’ Southeast Asian monthly smartphone estimates. To get more data points and insights, contact us.

For more information, please contact:

Le Xuan Chiew: lexuan_chiew@canalys.com

Sheng Win Chow: shengwin_chow@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.