Middle Eastern smartphone market surges 20% in Q2 2024 amid economic diversifications

Thursday, 15 August 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

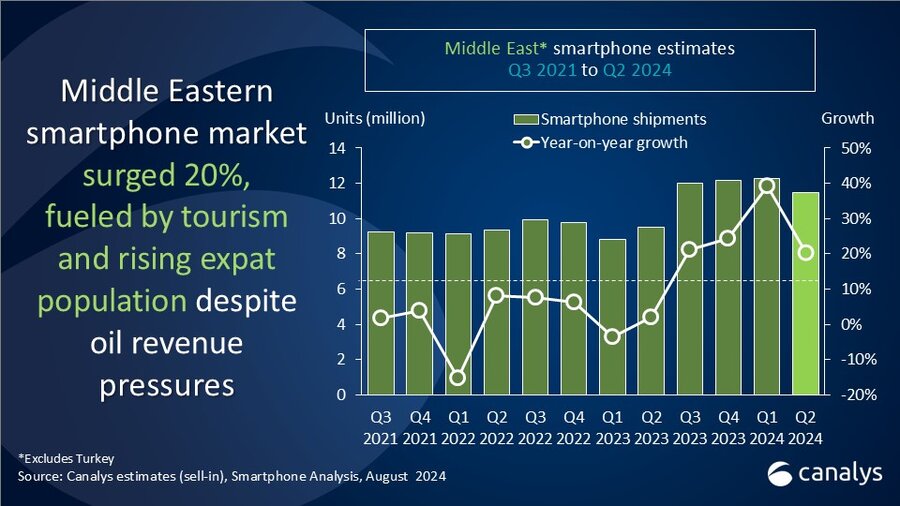

Canalys latest research shows smartphone shipments in the Middle East (excluding Turkey) reached 11.5 million units in Q2 2024, marking a 20% year-on-year increase. This robust growth was fueled by the region’s strong economic stability and supportive government policies that assisted consumer demand in the smartphone market. Strategic tech investments and economic diversification will keep driving momentum, pushing vendors to strengthen their market positions in the region.

Double-digit growth across all markets, as the region moves beyond oil reliance

Saudi Arabia's economic outlook remains robust, with significant growth in non-oil sectors despite lower oil revenues. In Q2 2024, the smartphone market in Saudi Arabia surged by 13%, fueled by strong retail and F&B growth, along with a boost in consumer markets from an influx of pilgrims during the Hajj season. The United Arab Emirates experienced a notable 19% growth driven by robust retail footfall, mainly from international visitors, supported by key initiatives like Abu Dhabi’s US$10 billion investment in tourism infrastructure. Notably, Iraq witnessed a 22% growth in terms of shipments, but vendor operations will be impacted amid economic challenges and Central Bank restrictions on US Dollars. Meanwhile, Qatar and Kuwait reported 14% and 17% gains, respectively, fueled by festive spending and easing inflation.

Emerging brands bolstered local operations and kept channels stocked in Q2

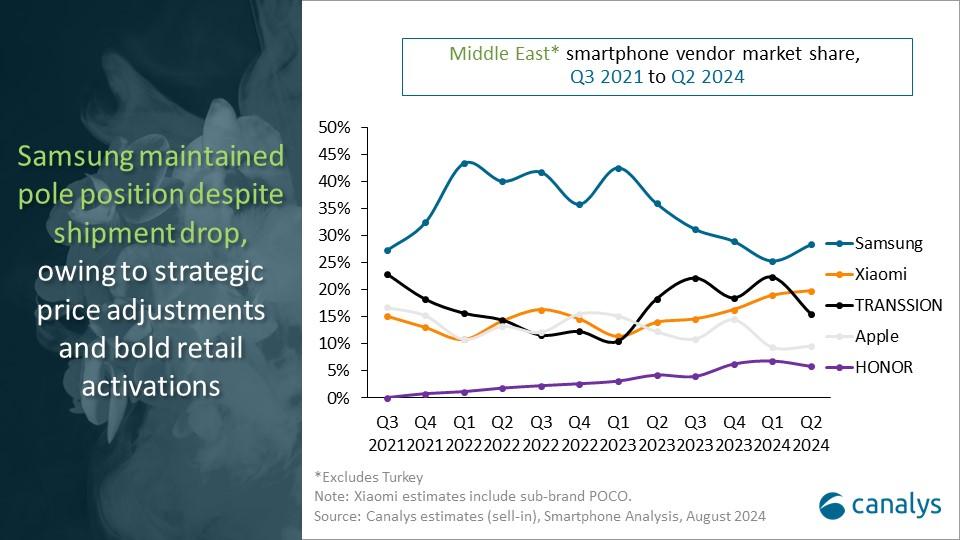

“Samsung and Apple saw shipment declines in Q2 2024 but are poised for growth in the second half,” said Canalys Senior Analyst Manish Pravinkumar. “In Q2, Samsung maintained pole position in the region with a 28% market share, despite a 5% drop in shipments, driven by the mid-tier Galaxy A series and the premium Galaxy S24. In the second half, Samsung's shipments are expected to be boosted by aggressive retail activations and strategic pricing in the mid-to-high segments. Even though the newly launched Z Fold series is yet to show the expected attention, demand for the S24 series remains high. Meanwhile, Apple held a 10% market share, with the iPhone 13 and 14 satisfying the region’s iOS demand in Q2. The second half is expected to see a demand increase for upcoming iPhones from the region’s affluent population.”

“In Q2, Xiaomi surged to second place with a 70% growth, thanks to competitively priced models such as its Redmi A3, 13C, and 13 4G. However, its ASP dropped by 14% due to a focus on the sub-US$200 segment. TRANSSION, which achieved 3% growth, claimed third place by capitalizing on aggressive pricing and mass-market appeal. Almost 49% of TRANSSION’s volume came from its Infinix brand, while TECNO’s regional sign-up with Lulu Hypermarkets is yet to drive shipments, but it will assist its growth in Saudi Arabia, which has a larger expat population. HONOR experienced substantial growth through increased retail presence in Saudi Arabia and Iraq. And Motorola expanded its distribution across key channels, which assisted its Edge series’ robust shipment growth.”

Agility and innovation drive sustainable growth amid shifting brand dynamics.

“Emerging brands are steadily closing the market share gap with leading players in the region, reshaping the competitive landscape,” Pravinkumar continues. “In the short-term, emerging brands must capitalize on the favorable economic climate by strengthening local foundations. This includes expanding retail presence, optimizing product portfolios, and prioritizing profitability while maintaining channel confidence. Established brands, on the other hand, should focus on innovating with GenAI, expanding their ecosystems, and embedding sustainability practices to enhance customer stickiness. In the long-term, smartphone brands must adapt to shifting consumer behaviors driven by the growing expat population influenced by the region’s strategic location, tax advantages, and economic diversification plans. To create sustainable business, brands must remain flexible in their product offerings and channel presence, and partnerships will be crucial for long-term success.”

|

Middle East* Smartphone shipments and annual growth |

||||||

|

Canalys Smartphone Market Pulse: Q2 2024 |

||||||

|

Vendor |

Q2 2024 shipments |

Q2 2024 market share |

Q2 2023 shipments (million) |

Q2 2023 market share |

Annual growth |

|

|

Samsung |

3.3 |

28% |

3.4 |

36% |

-5% |

|

|

Xiaomi |

2.3 |

20% |

1.3 |

14% |

70% |

|

|

TRANSSION |

1.8 |

16% |

1.7 |

18% |

3% |

|

|

Apple |

1.1 |

10% |

1.2 |

12% |

-6% |

|

|

HONOR |

0.7 |

6% |

0.4 |

4% |

67% |

|

|

Others |

2.4 |

21% |

1.4 |

15% |

65% |

|

|

Total |

11.5 |

100% |

9.5 |

100% |

20% |

|

|

Note: Xiaomi estimates include sub-brand POCO and Redmi. |

|

|||||

For more information, please contact:

Manish Pravinkumar: manish_pravinkumar@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other parameters. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.