European smartphone market to grow by 1% in 2024 as mass-market demand improves

Thursday, 6 June 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

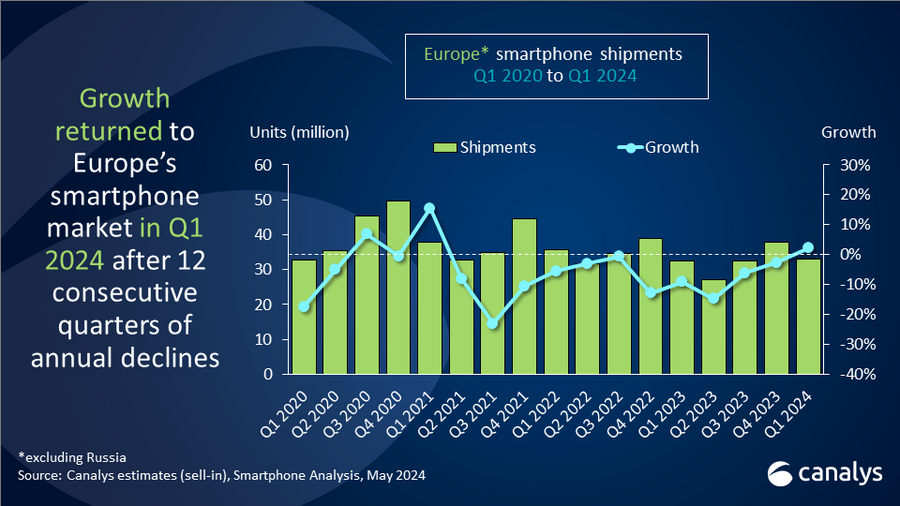

Canalys’ latest research shows that growth returned to Europe’s (excluding Russia) smartphone market in Q1 2024 as shipments grew 2% year on year to 33.1 million units. This was thanks to easing macroeconomic conditions and the start of an Android refresh cycle for devices bought during the pandemic. Samsung was the largest vendor in Q1 2024, with a 37% market share, driven by the strong Galaxy S24 series and a portfolio refresh of its low-end A series. Apple came second with a 22% market share. Xiaomi, Motorola and HONOR completed the top five, taking 16%, 6% and 3% market shares, respectively.

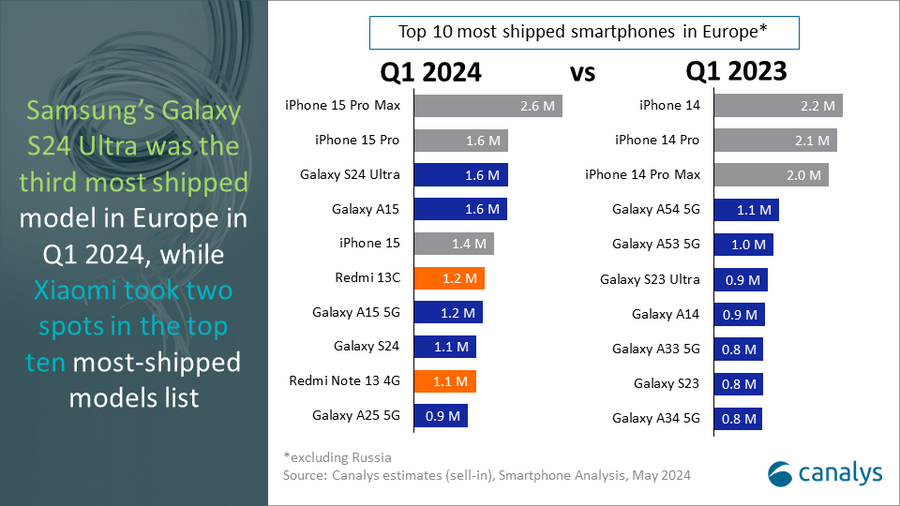

“The split between the price segments is increasing as the premium segment skews more toward the ultra-high end and the mass market skews more toward the low end,” said Canalys Analyst Runar Bjørhovde. “Q1 2024 had the highest premium share in Europe for a Q1 ever, as smartphones costing US$800 and above made up 32% of shipments. The premium market’s performance was driven by Samsung’s Galaxy S24 series, which was aided by a large marketing investment highlighting Galaxy AI alongside significant trade-in and bundling promotions. Galaxy S series shipments into Europe grew by 58% year on year to 4.3 million units in Q1 2024. Despite the high end’s strength, the ASP increased by only 2%, caused by a regional resurgence in demand for budget devices. This improved demand is reflected in the high presence of budget-friendly models in the top ten most-shipped devices list, such as the Samsung Galaxy A15 and Xiaomi’s Redmi 13C and Redmi Note 13 4G. Improved low-end demand will be vital for the market to return to growth in 2024.”

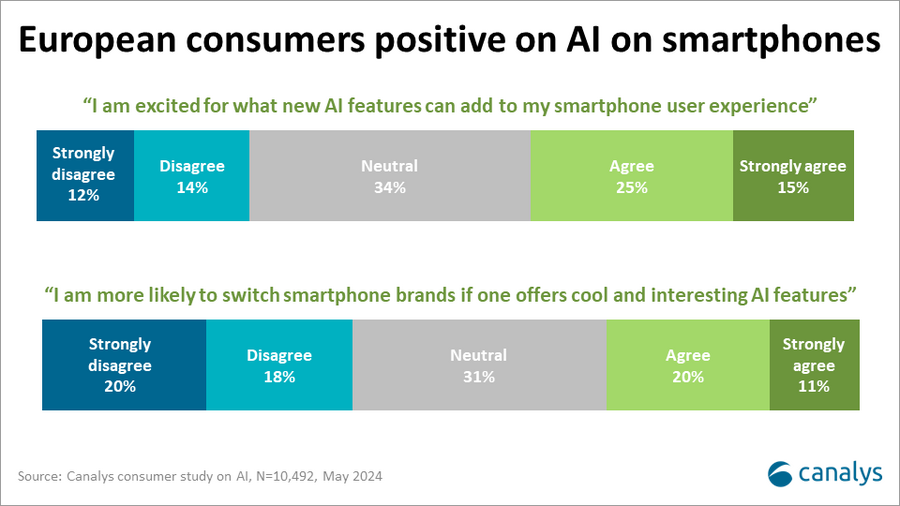

“AI capabilities will front vendors’ communication to consumers in Europe for the rest of the year, particularly for those vendors seeking to strengthen their premium segment presence,” said Bjørhovde. “In a recent consumer study conducted by Canalys focused on the European perception of AI capabilities on smartphones, 40% of respondents claimed to be positive about what AI features can add to their smartphone experience. But the gap between interest and buying intent is likely to be large. Consequently, AI capabilities should be used holistically and balanced as a part of wider product and brand marketing, as the average European consumer is cautiously optimistic about AI capabilities on smartphones. Jumping on the marketing hype and overusing AI will increase the risk of unmet consumer expectations, brand dilution and reduced consumer trust in the region.”

For deeper insights into consumers’ opinions of AI capabilities on smartphones, check out Canalys’ latest complimentary report, “Now and next for AI capable smartphones report 2024”, which explores market development, forecasts, market drivers, vendor strategies, marketing potential and consumer inclination.

Canalys forecasts the European smartphone market (excluding Russia) will grow by 1% in 2024 as demand remains modest amid longer device lifecycles. “AI capabilities will predominantly remain a mid-to-long-term aspiration for both consumers and vendors and are unlikely to drive significant demand this year,” said Bjørhovde. “Over the next year, vendors must prioritize adjusting their device designs to comply with the EU’s eco-design directive, which will ramp up the requirements for software updates, durability and repairability on smartphones. Finding a balance between sustainability, compliance, AI, brand strengthening and hardware innovations will be vital for vendors to succeed in Europe in the years leading up to 2030.”

|

European (excluding Russia) smartphone shipments and annual growth |

|||||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

||

|

Samsung |

12.1 |

37% |

11.9 |

37% |

+2% |

||

|

Apple |

7.3 |

22% |

8.8 |

27% |

-17% |

||

|

Xiaomi |

5.4 |

16% |

5.3 |

16% |

+2% |

||

|

Motorola |

2.1 |

6% |

1.2 |

4% |

+73% |

||

|

HONOR |

1.0 |

3% |

0.5 |

2% |

+103% |

||

|

Others |

5.3 |

16% |

4.7 |

14% |

+11% |

||

|

Total |

33.1 |

100% |

32.4 |

100% |

+2% |

||

|

|

|

|

|||||

|

Note: Xiaomi includes POCO. Percentages may not add up to 100% due to rounding. |

|

||||||

For more information, please contact:

Runar Bjørhovde: runar_bjorhovde@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.