African smartphone market expands modestly by 6% amid economic headwinds

Tuesday, 20 August 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

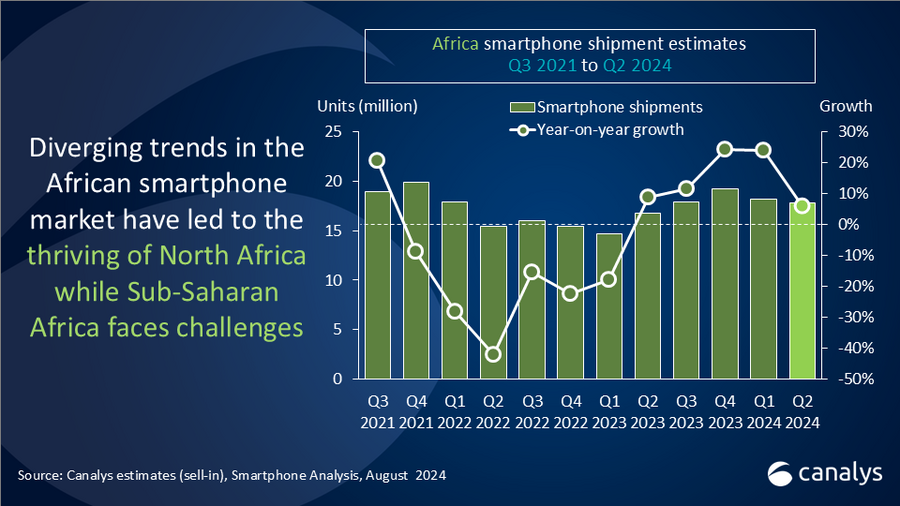

Canalys’ latest research reveals that the African smartphone market surged modestly in Q2 2024, by 6% year-on-year to reach 17.8 million units. The robust double-digit recovery seen over the previous three consecutive quarters has been slowed down by macroeconomic volatility, including heightened inflation risks, renewed currency pressures, due to lingering geopolitical tensions and political stability concerns related to elections.

The North African markets led the continent in double-digit growth, with Algeria surging by 52%, despite import challenges. Egypt also saw a notable 27% rise in shipments, driven by local currency stability and the government’s push for local manufacturing, attracting giants like Xiaomi, vivo, Samsung, and recently HMD in talks, with all eyes now on Apple. In contrast, Morocco faced a steep 24% decline as vendors struggled with import issues following increased customs duties earlier this year.

Sub-Saharan Africa faced its own challenges, with only South Africa achieving a 13% growth rate, influenced by the post-election environment that has reshaped its political landscape, offering both uncertainty and potential for reform. Meanwhile, Nigeria, which remains the leader in shipment volumes, recorded a modest 5% increase, hindered by persistent inflationary pressures, currency risks, sluggish GDP growth and shrinking disposable income. Kenya, East Africa’s trade hub, witnessed a 22% decline, driven by ongoing political tensions within the country.

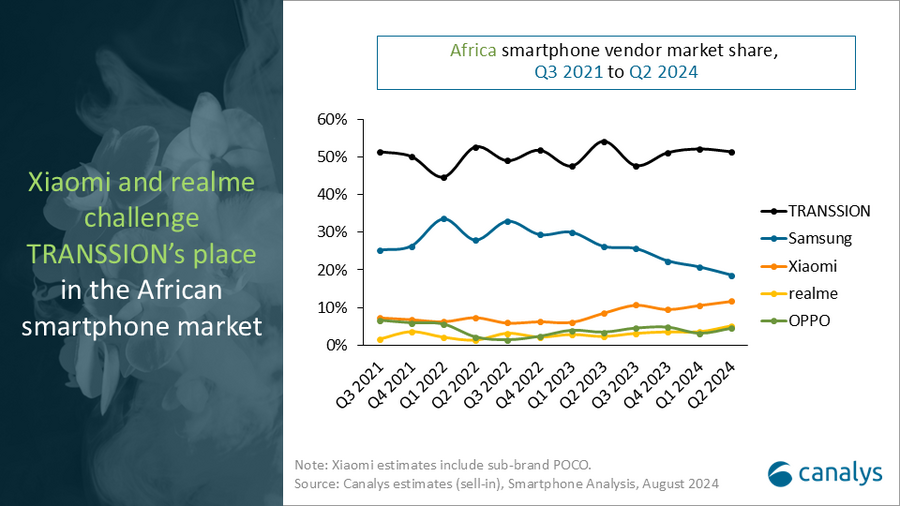

“Vendors leveraged the cost advantages carried over into the first half of the year to drive volume, resulting in an impressive 42% growth for sub-US$100 and 33% of the shipment was attributed to the price band,” said Canalys Senior Analyst Manish Pravinkumar. “With the rising cost of living, consumers are gravitating toward budget-friendly options. Q2 2024 saw one of the lowest ASPs in the last eleven quarters. TRANSSION continued its dominance with a 51% market share but even the leading vendor felt the pressure of a slowing market, with growth dipping to just 1%. Samsung, despite holding a 19% market share, saw shipments plummet by 25% as its focus on its entry-level models waned. Xiaomi bucked the trend with a 45% surge, reaching its record-high 12% regional market share in Q2. The Chinese tech giant's focus on Nigeria and Egypt, coupled with aggressive sales tactics and on-the-ground investments, paid off. Meanwhile, realme, though a smaller player with a 5% market share, exploded onto the scene with a staggering 137% growth. OPPO's resurgence with a 39% growth was equally impressive, driven by a stronger performance in North Africa. The company is committed to long-term investment and development in the region. The expansion of its product range with the Reno series and dedication to innovation are clearly resonating with consumers.”

|

Africa smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q2 2024 |

|||||

|

Vendor |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

TRANSSION |

9.2 |

51% |

9.1 |

54% |

1% |

|

Samsung |

3.3 |

19% |

4.4 |

26% |

-25% |

|

Xiaomi |

2.1 |

12% |

1.4 |

9% |

45% |

|

realme |

0.9 |

5% |

0.4 |

2% |

137% |

|

OPPO |

0.8 |

4% |

0.6 |

3% |

39% |

|

Others |

1.6 |

9% |

0.9 |

5% |

76% |

|

Total |

17.8 |

100.0% |

16.8 |

100.0% |

6% |

|

Note: Xiaomi estimates include sub-brand POCO and Redmi. |

|

||||

“Despite the rapid growth of the smartphone market in Africa, feature phones still hold a substantial 52% share and there are still many opportunities for expansion for smartphones,” stated Pravinkumar. “In sub-Saharan Africa, device financing is emerging as a critical driver, making smartphones more accessible to the average consumer. In the near term, scaling innovative financing models like Kenya’s M-Kopa with support from smartphone vendors like HMD, telecom operators and governments will be crucial to accelerating this transition. Over the long term, local manufacturing will be key to reducing costs. While countries like Egypt are taking the lead, other regions are expected to follow suit. Addressing broader challenges such as consumers’ willingness to pay, digital literacy, high taxation on devices and currency fluctuations will be essential for unlocking the full potential of smartphone adoption across Africa.”

For more information, please contact:

Manish Pravinkumar: manish_pravinkumar@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other parameters. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.