Latin America's smartphone market grew 20% in Q4 2023, driven by holiday season demand

Monday, 26 February 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

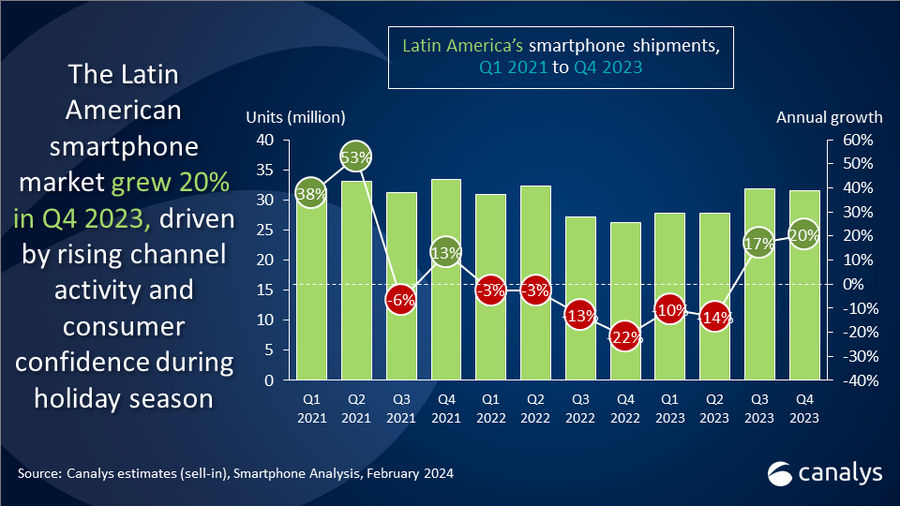

Canalys’ latest research reveals that the Latin American smartphone market grew by 20% in Q4 2023, as the strong consumer momentum from the previous quarter continued. The surge was primarily fueled by intensified brand and channel initiatives aimed at replenishing inventories. It was coupled with a restored socio-economic stability in key countries that bolstered consumer confidence and spurred consumption during the peak holiday sales season. For the full year 2023, the market experienced a 2% growth, reaching a total of 118.9 million units. The region witnessed signs of recovery in H2 2023 to offset the decline experienced in the first two quarters, primarily owing to a favorable device replacement cycle.

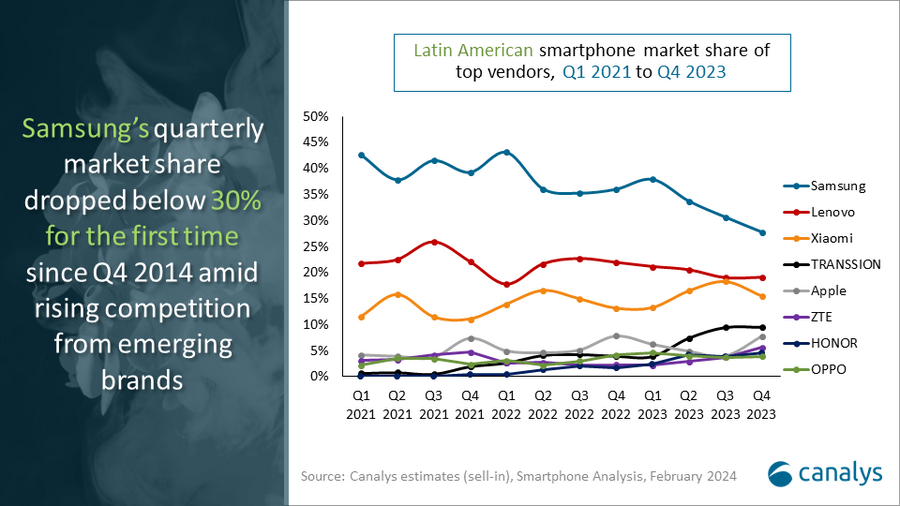

“In Q4 2023, Samsung led in Latin America, but its market share dropped below 30% for the first time since Q4 2014 as challenger brands like Xiaomi, TRANSSION and ZTE drove volumes in the entry-level,” said Miguel Pérez, Senior Consultant at Canalys. “Unlike some Chinese brands seizing market share in the region, Samsung and Motorola have pivoted their long-term strategies. They have transitioned from a volume-centric approach in entry and low-end segments to prioritizing profitability through business segmentation. Samsung now targets mid-to-high range and premium segments with its A series, Galaxy S and Galaxy Z, while Motorola is solidifying its second-place position by nurturing strong partnerships with major operators and retailers. Although major volumes for lower to mid-range markets are driven by the E and G series, it is also gaining ground in higher value segments with its Edge and foldable razr series.”

“Vendors outside of the top players in the market were instrumental in driving the 20% year-over-year growth in Q4 2023,” added Pérez. “Brands such as Xiaomi maintained momentum through strengthened carrier ties in Mexico and Colombia and expansion in Brazil and Central America, resulting in a 42% annual growth. TRANSSION's Infinix and Tecno brands witnessed an impressive 188% growth in untapped markets like Central America, the Caribbean and Ecuador, targeting value-conscious young consumers in the open market. Notably, Apple experienced 20% annual growth, largely fueled by its success in Brazil and Mexico, which accounted for 85% of iPhone 15 series shipments. Out of the top five, ZTE and HONOR achieved triple-digit shipment growth. ZTE resumed significant shipments to its key market, Mexico, and expanded its presence in Central America, the Caribbean and Peru. Meanwhile, HONOR achieved consistent quarterly growth in 2023, showcasing strong inventory management and a focused channel strategy targeting operators and major retailers.”

“Despite persistent socio-economic challenges in Latin America, Canalys forecasts a 3% growth in the regional smartphone market in 2024,” added Pérez. “This modest growth is bolstered by continued interest rate adjustments across the region, aimed at curbing inflation and boosting consumer confidence, leading to increased consumption. Moreover, healthier inventories in the market will facilitate the introduction of new models. In the low to mid-range segment, emerging brands will continue emphasizing the importance of affordable value propositions and will look to drive volumes assisted by the replacement of devices acquired during the pandemic. The top players will look to strengthen their positioning through AI-driven strategies and enhanced channel partnerships to seize a greater share of the premium segment.”

|

LATAM smartphone shipments and annual growth |

|||||

|

Vendor |

Q4 2023 |

Q4 2023 |

Q4 2022 |

Q4 2022 |

Annual |

|

Samsung |

8.8 |

28% |

9.4 |

36% |

-7% |

|

Motorola |

6.0 |

19% |

5.7 |

22% |

5% |

|

Xiaomi |

4.9 |

16% |

3.4 |

13% |

42% |

|

TRANSSION |

3.0 |

10% |

1.0 |

4% |

188% |

|

Apple |

2.5 |

8% |

2.1 |

8% |

20% |

|

Others |

6.4 |

20% |

4.5 |

17% |

43% |

|

Total |

31.5 |

100% |

26.2 |

100% |

20% |

|

|

|

|

|||

|

Note: Xiaomi estimates includes sub-brands POCO and Redmi, and TRANSSION includes sub-brands Tecno and Infinix. |

|

||||

|

LATAM smartphone shipments and annual growth |

|||||

|

Vendor |

2023 |

2023 |

2022 |

2022 |

Annual |

|

Samsung |

38.4 |

32% |

44.0 |

38% |

-13% |

|

Motorola |

23.6 |

20% |

24.4 |

21% |

-3% |

|

Xiaomi |

19.0 |

16% |

17.2 |

15% |

11% |

|

TRANSSION |

9.2 |

8% |

4.4 |

4% |

110% |

|

Apple |

6.8 |

6% |

6.4 |

6% |

6% |

|

Others |

21.8 |

18% |

20.1 |

17% |

8% |

|

Total |

118.9 |

100% |

116.5 |

100% |

2% |

|

|

|

|

|||

|

Note: Xiaomi estimates includes sub-brands POCO and Redmi, and TRANSSION includes sub-brands Tecno and Infinix. |

|

||||

For more information, please contact:

Miguel Perez: miguel_perez@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.