Latin American smartphone market up 10% in Q3 2024 amid risk of looming market saturation

Wednesday, 13 November 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

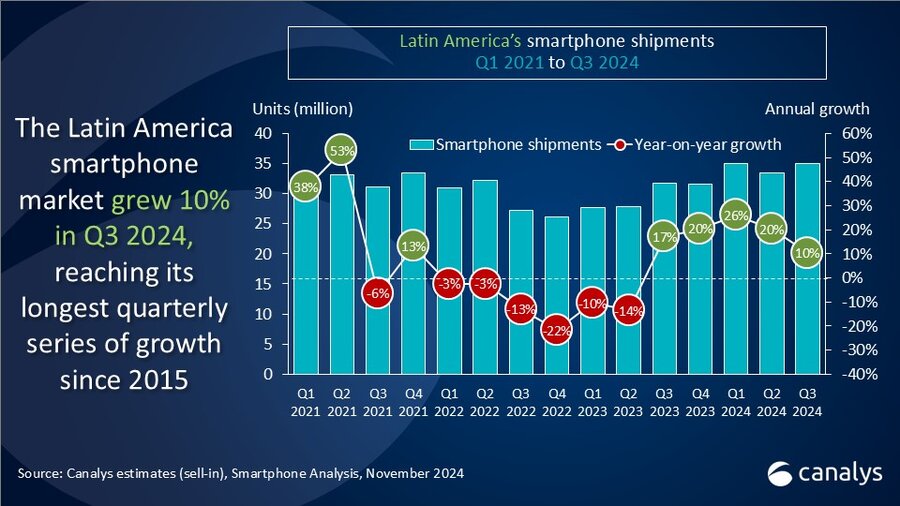

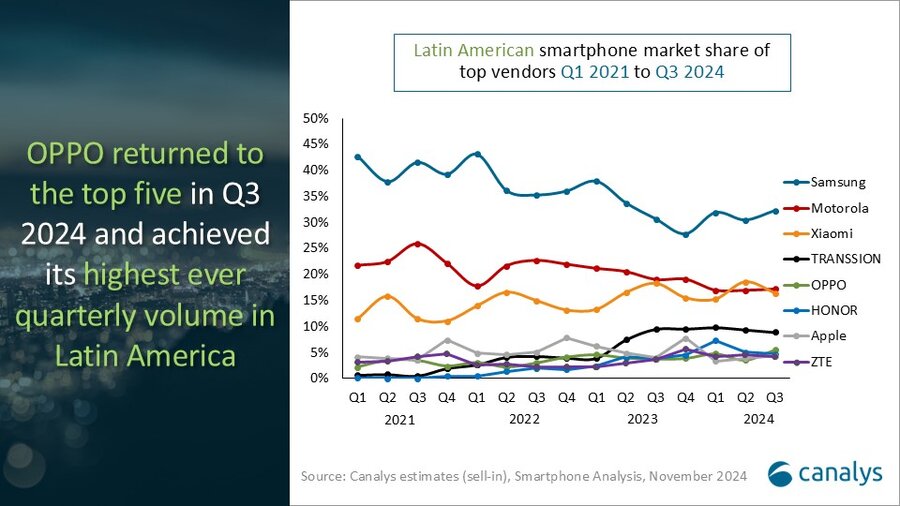

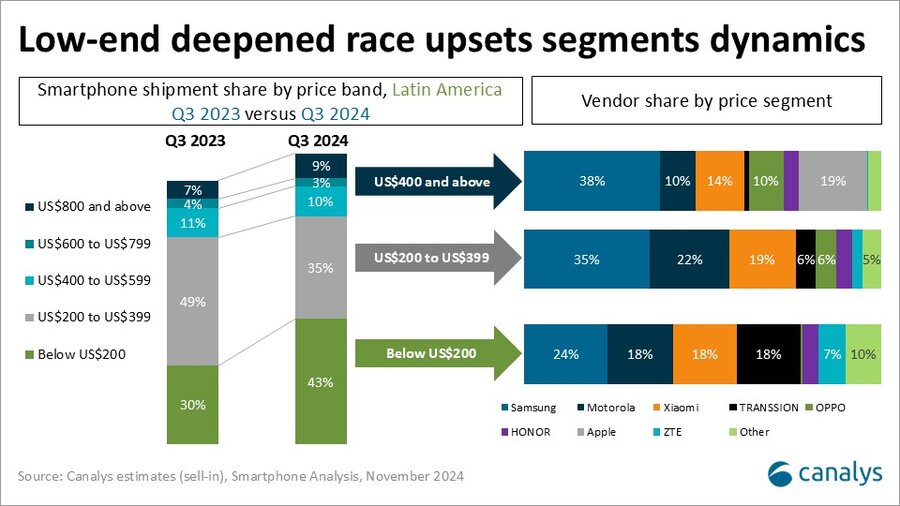

The latest Canalys research shows that the Latin American smartphone market grew 10% in Q3 2024 to 35.1 million units, the region’s second-highest quarterly volume ever. The growth was fueled by budget devices priced below US$200, making up 49% of the overall volume, the highest number since Q4 2021. Samsung led the market in Q3 and was the biggest contributor to the region’s overall shipment growth with 11.3 million units shipped and growing 16%. Motorola reclaimed the second spot on the ranking table despite a flat growth, shipping 6.0 million units. Xiaomi and TRANSSION trailed closely behind as their growth rates started to slow down and volumes began to stabilize. Xiaomi decreased by 1% and TRANSSION grew by 3% to 5.8 million and 3.1 million units, respectively. OPPO returned to the top five for the first time in six quarters and achieved its highest quarterly volume in Latin America to date, backed by rapid growth in Mexico and Colombia. OPPO’s shipments grew by 62% to 1.9 million units.

“Samsung was the big winner in Latin America in Q3 2024 as it reached its first quarter of double-digit growth since Q4 2021,” said Miguel Perez, Senior Analyst at Canalys. “Q3 marks a turn-around for Samsung, reflected by an increased focus on regaining competitiveness across the price segments and a growing desire to challenge the growth of ambitious vendors who have excelled the previous year. Most of Samsung’s growth was driven by the low-end A-series. In fact, Samsung’s shipments in the below US$200 segment grew 42% compared to Q3 2023 and made up 40% of the vendor’s shipments. Simultaneously, Samsung maintained a resilient high-end performance, predominantly fueled by the Galaxy S24 models. Smartphones priced at US$800 and above made up only 15% of Samsung’s volume, but contributed 36% of its value, reflecting its importance for operational sturdiness as well as brand positioning.”

“The budget-friendly price segment has become a target for almost all vendors, resulting in incredibly fierce competition,” added Perez. “Samsung and Motorola are using devices priced below US$200 to regain market share, defend their regional scale and put pressure on the competition. Xiaomi and TRANSSION achieved tremendous growth in the last quarters through the below US$200 segment and must continue to deliver strong value-for-money propositions to defend their recent market share gains. Growth-ambitious vendors such as OPPO, ZTE, HONOR and realme are using the below US$200 segment as their entry point to growth in Latin America. Although budget devices help to fuel many vendors’ short-term goals, the importance of the wider portfolio performance for long-term success, brand awareness and stronger profit margins cannot be understated. Relying solely upon budget devices requires a scale difficult to achieve consistently.”

“Q3 was characterized by vendors building up for the holiday sales peak season, setting up products through channel partners and marketing efforts for a successful Q4,” commented Perez. “Vendors are optimistic for a strong finish to 2024, a year poised to reach record-breaking annual sales volumes in the Latin American smartphone market. However, the looming risk of market saturation combined with growing uncertainty about the ramifications of the US Presidential transition increases the risk of a slowdown in the market and inventory piling up. Smartphone shipments into Latin America have grown annually by double digits consecutively for five quarters and the over-inventory risk increases for each quarter of sustained high growth. The market’s sell-out performance in Q4 will be critical to whether it will head into 2025 in a healthy state or with an inventory hangover.”

|

LATAM smartphone shipments and annual growth |

|||||

|

Vendor |

Q3 2024 |

Q3 2024 |

Q3 2023 |

Q3 2023 |

Annual |

|

Samsung |

11.3 |

32% |

9.7 |

31% |

16% |

|

Motorola |

6.0 |

17% |

6.0 |

19% |

0% |

|

Xiaomi |

5.8 |

16% |

5.8 |

18% |

-1% |

|

TRANSSION |

3.1 |

9% |

3.0 |

10% |

3% |

|

OPPO |

1.9 |

6% |

1.2 |

4% |

62% |

|

Others |

6.9 |

20% |

6.0 |

19% |

15% |

|

Total |

35.1 |

100% |

31.8 |

100% |

10% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brands POCO and Redmi. TRANSSION includes sub-brands TECNO and Infinix. |

|

||||

For more information, please contact:

Miguel Pérez: miguel_perez@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.