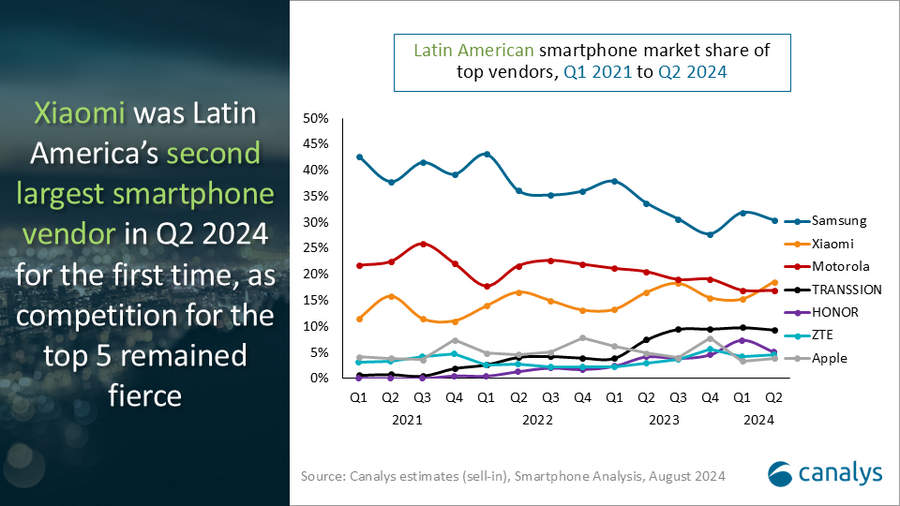

Latin America’s smartphone market up 20% in Q2 2024 as Xiaomi ranks second for first time

Friday, 9 August 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

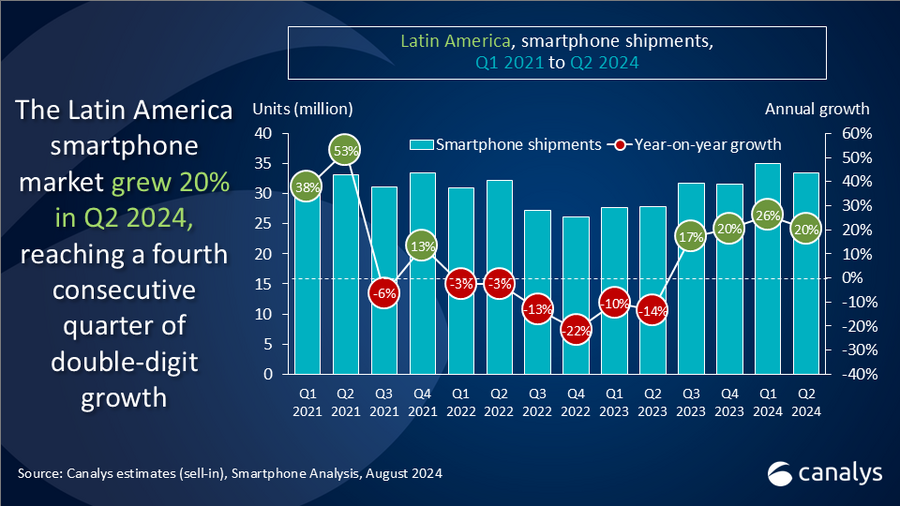

Canalys' latest research shows Latin America’s smartphone market reached a fourth consecutive quarter of double-digit annual growth in Q2 2024, as shipments rose 20% year-on-year to 33.5 million units. The continued growth has been fueled by the highest share of devices costing less than US$200 since Q2 2021. Samsung maintained its healthy lead in the market, growing 9% year-on-year to 10.2 million units, driven by the budget friendly A-series. Xiaomi was Latin America’s second largest smartphone vendor for the very first time, supported by 35% shipment growth to 6.2 million devices. Q2 also marked Xiaomi’s highest quarterly volume in the region to date, as it surpassed the 6 million units milestone for the first time. Motorola followed in third, shipping 5.7 million units. TRANSSION and HONOR rounded off the top 5, growing 52% and 47%, respectively, to 3.2 million and 1.7 million units.

“Smartphone demand continues to boom in Latin America thanks to an ongoing refresh cycle which has been accelerated by large investments from growth-ambitious vendors,” said Canalys Senior Analyst Miguel Pérez. “Vendors are incentivizing consumers to refresh their devices sooner using strong value-for-money positioning and aggressive pricing. These factors also define the current competitive dynamic between vendors, as most players are focused on launching compelling specs at low prices. This is reflected in the ASP (average-sales-price) declining 12% year-on-year to its lowest value since Q2 2021. Fierce competition among many vendors is making the consumer the current winner in the market. However, vendors must find a balance between short-term volume gains and long-term strength factors such as operational profitability and brand positioning.”

“The number of smartphones shipped in the first half of 2024 is the highest volume ever shipped across two quarters in Latin America,” added Pérez. “Most vendors are flying high with strong growth rates. However, there are growing concerns about market saturation combined with mounting uncertainty in the global economic environment and from the US presidential election, which might impact smartphone demand in the region. If not managed well, the slowdown can compromise both vendors’ and the sales channel’s long-term ambitions. For all industry players, it will be crucial to have effective inventory management, strict replenishment controls and plan resource allocation far in advance. Hard lessons were learned during the market’s slowdown in 2023, and vendors with long-term aspirations in region should already now look beyond their sales-in targets and prioritize strengthening channel partnerships, assuring healthy product margins, and delivering on their roadmaps and targets. Still, in a market slowdown, new vendors can challenge established players as both consumers and the sales channel remain open to new brands and product propositions in search of the best offer.”

|

LATAM smartphone shipments and annual growth |

|||||

|

Vendor |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

Samsung |

10.2 |

30% |

9.4 |

34% |

9% |

|

Xiaomi |

6.2 |

19% |

4.6 |

17% |

35% |

|

Motorola |

5.7 |

17% |

5.7 |

21% |

-1% |

|

TRANSSION |

3.2 |

9% |

2.1 |

7% |

52% |

|

HONOR |

1.7 |

5% |

1.2 |

4% |

47% |

|

Others |

6.5 |

20% |

4.9 |

18% |

34% |

|

Total |

33.5 |

100% |

27.9 |

100% |

20% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brands POCO and Redmi. |

|

||||

For more information, please contact:

Miguel Pérez: miguel_perez@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.