Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

The evolution of digital cockpits in China’s automotive market

This blog explores how OEMs and Tier-1 are navigating the integration of software and hardware ecosystems to enhance the digital cockpit experience in China. The blog also describes how AI will accelerate the application of personalized digital cockpit features by 2025.

As the automotive industry continues to evolve, China is at the forefront of integrating advanced technologies into vehicle design. One of the most significant developments is the digital cockpit, transforming how drivers interact with their vehicles. This blog delves into the current state and future trajectory of digital cockpits in China, examining key trends and technological advancements.

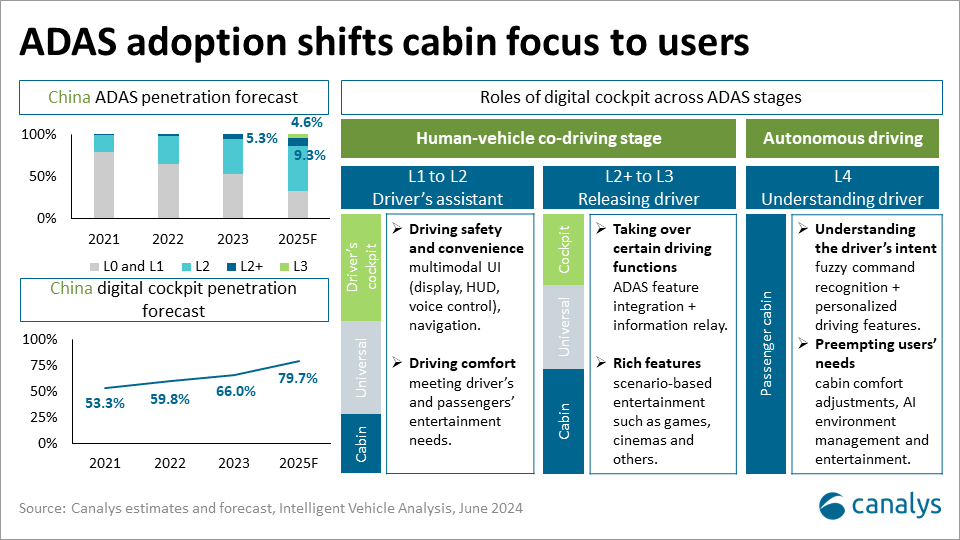

Rapid deployment of ADAS

The timeline for implementing ADAS is accelerating. Specifically, L2+ systems are rapidly being adopted due to extensive investments from new and traditional automakers, technology, and smart device vendors. Enhanced sensory solutions negate the need for costly HD maps, critical for the swift rollout of L2+ systems. Key factors driving further deployment of L2+ include the wide adoption of improved machine vision and object detection algorithms that enhance safety and driving experience and reduce hardware costs. By 2025-2026, urban Navigation on Autopilot (NOA) systems are expected to penetrate markets down to CNY150,000 (approximately US$21,000). Market share for L2+ products is projected to rise to 9.3% in 2025, marking a 75% growth.

As for L3 systems, based on current product capabilities, their adoption will quickly cover vehicles priced above CNY300,000 (US$41,000) and some above CNY250,000 (US$34,000) once regulations are established. By 2025, the market share for L3 is anticipated to reach 4.6%.

The interplay between digital cockpits and ADAS

Understanding the relationship between digital cockpits and ADAS is crucial. The automotive cockpit can be divided into three areas: the driver’s cockpit, general functions and passenger cabin. Each area demands different core capabilities. The transition toward reducing driving functions requires the driver’s cockpit to be ready to release the driver, while the passenger cabin focuses on understanding and meeting user preferences.

High-level ADAS deployment is driving digital cockpit development into its next phase. Automakers have already implemented the first two stages of digital cockpit functions, focusing on comfort and personalized user experiences. The third stage is about understanding user needs and preferences, providing tailored experiences, and transforming the concept of the “third space” from manufacturer-defined to user-defined.

Growth and penetration of digital cockpits

Since 2022, the penetration rate of digital cockpits has steadily increased, reaching 66% in 2023. By 2025, it is expected to reach 80%. However, recent innovations in human-machine interfaces (HMI) and “third space” designs have become homogenized, reducing their impact on consumer purchasing decisions. Future differentiation in digital cockpits will depend on meeting “generalized” consumer needs while enhancing fundamental functions. The “generalized” demand should be interpreted as consumers’ broad, diversified and personalized needs for automotive interior systems, particularly the cockpit and human-computer interaction interfaces. This balance between generalized needs and fundamental functions will be crucial as ADAS technology becomes standardized.

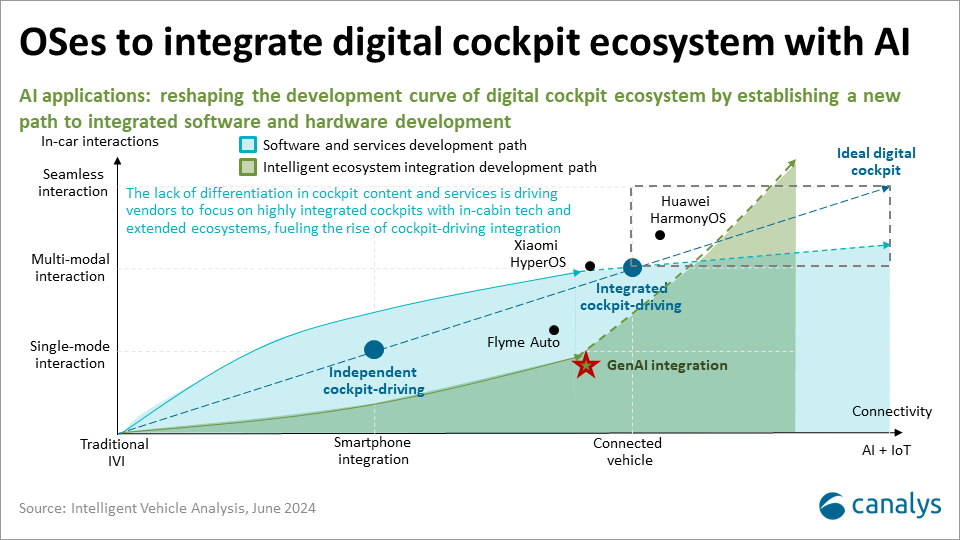

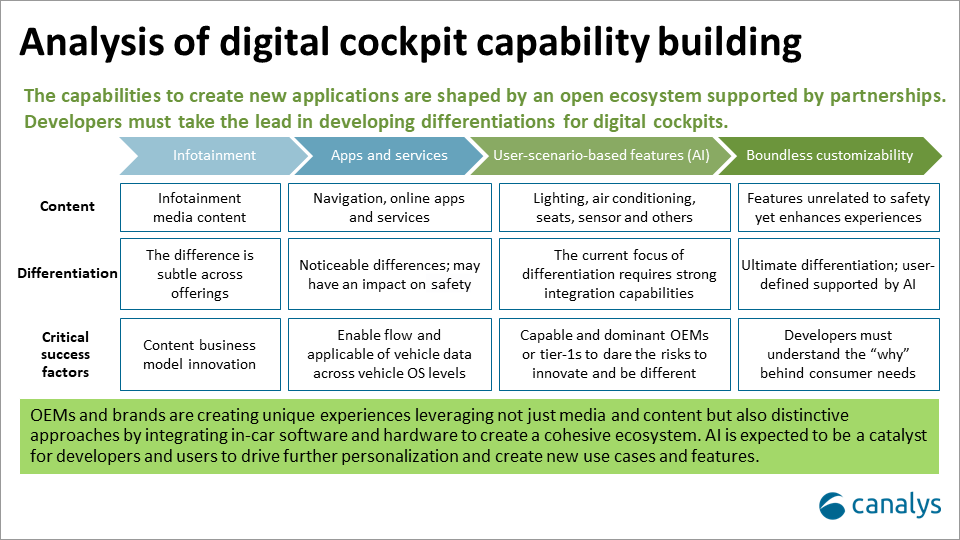

Software and hardware ecosystems in digital cockpit development

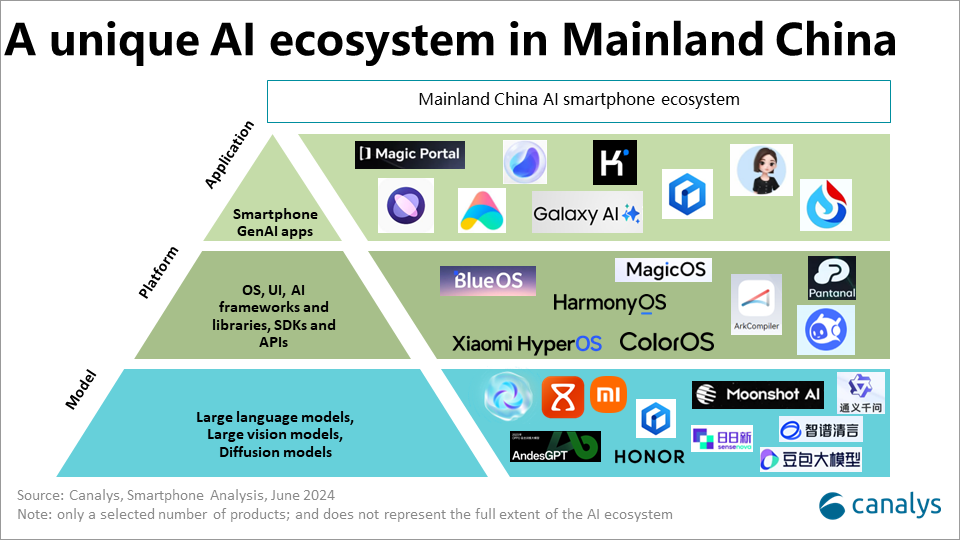

We identify two digital cockpit developmental paths in China: focusing on software ecosystems and focusing on intelligent hardware integration and ecosystem. The software ecosystem path aims to make the cockpit experience more like using a smartphone, emphasizing content, software applications and services. Early adopters like Tencent Auto Intelligence have found success by quickly meeting user needs with software and services.

The hardware ecosystem path emphasizes leveraging seamlessly connected in-car hardware to provide contextualized and user-scenario-driven experiences. This path faces challenges with limited personalization and scenario constraints. However, integrating driver monitoring systems (DMS), AI applications and real-time vehicle data can overcome these limitations, enhancing cockpit functionality and consumer satisfaction. Ecosystems comprising in-car features, supported by IoT integration and external services, are forming the foundation for OEMs and industry players to explore further.

Shift toward personalized experiences

AI will play a critical role in cockpit development. Current applications focus on driver monitoring and environmental feedback. In the short term, AI should complement the driver’s decision-making process through understanding, suggesting and executing actions, rather than fully automating tasks.

Key development resources will shift from connectivity to hardware utilization while offering greater access and control over developers. Consumer-defined scenarios will lead the market in the next generation of digital cockpits. Automakers and Tier-1 suppliers must provide avenues to developers not just to understand consumer needs, but also to understand the “why” behind them.

The future of digital cockpits lies in providing personalized experiences and products. The industry is moving from a software-led phase to a hardware-integrated phase, where the fusion of software and hardware will create unique and highly personalized user experiences. By 2025, automakers and tech vendors must anticipate a significant shift in the automotive landscape, driven by these advancements.