Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

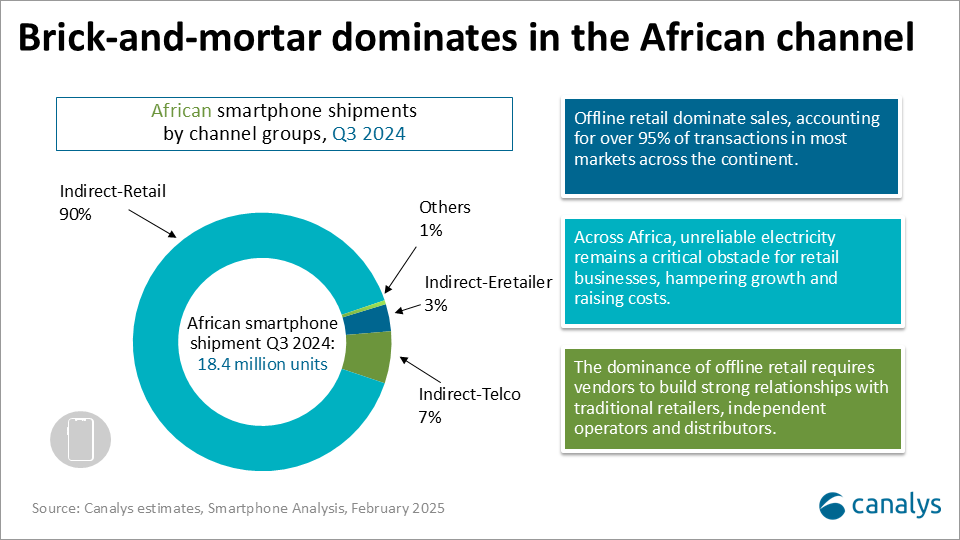

Offline dominance in smartphone retail: Africa’s resilient backbone

From Lagos to Nairobi, Cairo to Johannesburg, offline retail channels continue to dominate Africa’s smartphone market, contributing over 95% of sales in most regions.

From Lagos to Nairobi, Cairo to Johannesburg, offline retail channels continue to dominate Africa's smartphone market, contributing over 95% of sales in most regions. Despite the growing interest in ecommerce, challenges like low consumer trust, logistics inefficiencies and tight margins limit its growth. Structural barriers, including inadequate modern retail, currency instability and inconsistent electricity supply, reinforce the primacy of traditional retail.

Africa’s retail sector remains relatively underdeveloped at present, with most shopping being done at traditional shops. Much has been said about the prospect of consumer spending in Africa, driven by demographics and rapid economic growth. This has fueled massive interest from smartphone vendors in establishing a footprint on the continent.

Nigeria: a thriving ecosystem of independent retailers

As of December 2024, Nigeria boasts over 4,800 mobile phone stores, with 90% of sales driven by offline channels such as kiosks and street vendors. Independent retailers dominate the landscape, accounting for nearly all store operations. Lagos, Nigeria’s economic heart, handles 40% of smartphone transactions, with hotspots like Computer Village and GSM Village acting as retail magnets.

Egypt: urban dominance in smartphone sales

Egypt mirrors Nigeria’s offline retail strength, with 95% of sales occurring through brick-and-mortar channels. Unorganized retail leads the market at 75%, while organized outlets like malls and operator stores contribute 20%. Urban centers, led by Cairo and Alexandria, account for most sales, reflecting the country’s centralized retail structure.

South Africa: a modern retail exception

South Africa’s retail sales surged by a positive 6.3%, based on a year-on-year comparison for October 2024 compared to October 2023 as per Statistics South Africa. Retail giants like Pepkor, through brands like PEP and Ackermans, sold over 11.5 million mobile phones in its fiscal year of 2024. However, challenges such as load-shedding increase operational costs and disrupt business continuity, underscoring the need for resilient infrastructure. The operator channel continues to control 40% to 50% of the market between Vodacom, MTN and Cell C.

Morocco: a gradual shift toward organized retail

In Morocco, unorganized retailers still dominate 80% of the retail channel, but government initiatives aim to shift 35% of business to established channels in the coming years. Casablanca, the country's largest city, serves as the retail hub, handling a major part of handset sales. As per Canalys research, while offline channels remain dominant, Morocco’s ecommerce penetration is at 4% as of Q3 2024. Government initiatives in Morocco, such as the “Digital Morocco 2030” strategy, aim to promote digital inclusion and expand internet connectivity, which boosts smartphone adoption. Additionally, the government's focus on improving infrastructure and offering incentives for tech investments is likely to enhance smartphone distribution channels.

Navigating Africa’s retail evolution: challenges and opportunities in ecommerce growth

Africa’s retail landscape faces significant challenges, including unreliable electricity, rising operational costs and the shifting preferences of the growing middle class. The rise of ecommerce and modern retail is evident with the entry of American retail giant Amazon into South Africa where it aims to accelerate online shopping adoption. Amazon’s presence is expected to intensify competition, offering consumers lower prices.

Additionally, the merger between Kenyan startup Wasoko and Egyptian company MaxAB has created a dominant B2B ecommerce platform in Africa, which will reach 450,000 merchants across Egypt, Morocco, Kenya, Tanzania, and Rwanda, promising to reduce costs and enhance access to essential goods across the continent. Egyptian platforms like Halan and Talabat are diversifying into sectors such as digital finance and logistics, though traditional retail channels remain crucial, particularly in rural and underserved regions.

Smartphone retailers must embrace omnichannel strategies to cater to the blending of offline and online shopping experiences. Africa’s youthful demographic, with over 60% of the population under 25 years and rapid urbanization are driving ecommerce growth, as the continent’s population is projected to hit 2.5 billion by 2050 as per the World Economic Forum.

African smartphone outlook: regional market drivers

According to Canalys’ latest forecast, annual smartphone shipments in Africa are estimated to be 344.8 million units in 2024 and are expected to reach 433.8 million units by 2028, representing the highest CAGR of 6.5% among all global regions.

The growth prospects for the African market are optimistic. Vendors’ ability to adapt channel trends and deepen channel relationships is crucial for establishing a strong presence in the local market. To succeed in Africa's smartphone market, vendors must adopt agile and localized strategies:

- Ensuring presence in brick-and-mortar: vendors should focus on building strong relationships with traditional retailers, such as spaza shops and dukas, which account for a major share. Providing tailored support, including training and resources, can help these small retailers modernize and diversify their offerings, enhancing mutual growth. Embracing digital solutions is also crucial, for instance, offering mobile-based ordering systems can streamline procurement processes for shop owners.

- Adapting to evolving consumer preferences: African consumers are shifting toward formal retail outlets for better reliability and product variety. For example, Jumia and MTN stores in regions like Ghana and Uganda are becoming preferred channels due to their product authenticity guarantees and financing options. Vendors must align with this trend by partnering with formal retailers and ecommerce platforms to build trust and loyalty.

- Eying and seizing opportunities with retailers' expansion: the development of better roads, logistics and retail infrastructure is making it easier for vendors to access previously underserved areas. For example, the expansion of retail chains like Game and Shoprite in countries such as Zambia and Angola provides smartphone brands with formalized distribution channels, helping them penetrate rural and peri-urban regions.

Africa’s offline retail remains indispensable to the smartphone industry, with unorganized channels playing a central role. While modern retail and ecommerce are gaining ground, traditional networks continue to meet the needs of a diverse consumer base. For smartphone vendors, success lies in balancing innovation with a deep understanding of Africa's unique retail ecosystem, ensuring relevance and resilience in the years ahead.