How do vendors capture the 28 presale moments of the new customer journey? (hint: through-partner marketing)

29 December 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

This blog explores the competitive landscape and development drivers in the L2+ markets of Germany, the United States, and China. It provides insights into the growth of the ADAS market in China, the challenges faced by Germany and the US, and the key opportunities of Chinese supply chain companies expanding overseas.

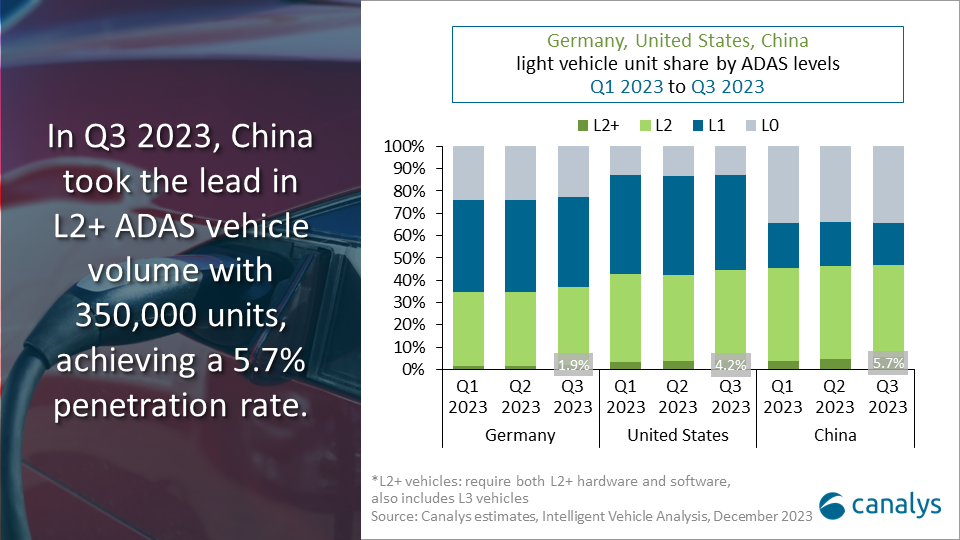

Global shipments of light vehicles equipped with L2+ advanced driving assistance (ADAS) features reached 630,000 units in Q3 2023, achieving a 3.1% penetration rate of the overall light vehicle market. The three largest markets, Germany (14,000 units), United States (170,000 units), and China (350,000 units) took 85% of the global market of L2+ equipped vehicles. China has maintained a leading position in L2+ penetration for three consecutive quarters, reaching 5.7% in Q3 2023. In overall 2023, global shipments of L2+ equipped light vehicles are expected to reach 2.0 million units. In 2024, that figure is set to double to 4.5 million, and the penetration rate will reach 5.5%, with China leading.

Here we look at the competitive landscape and core development drivers in the L2+ markets of Germany, the US, and China, and provide forecasts for the global L2+ market in 2023 and 2024.

Compared to Germany and the US, China has favorable factors supporting the growth of the L2+ ADAS market.

Transformer-based AI models effectively address a long-tailed problem in autonomous driving by enhancing a vehicle's precision in detecting and predicting its external environment and the behavior of obstacles and objects around it. Carmakers and tier-1 suppliers are benefiting from efficiency gains by utilizing automated object labeling and scene simulations by transformers. Emerging companies, benchmarking against Tesla and upgrading Occupancy Network algorithms, are hoping to attract consumer attention through improving urban autonomous driving experiences. Huawei's ADAS 2.0, Li Auto's AD Max 3.0, and the recently announced Xiaomi Pilot, are examples of Chinese players transitioning to the Occupancy Network. Moreover, major carmakers aim to leverage new AI models to improve urban autonomous driving without high-precision maps, preempting Tesla's Full Self Driving (FSD) market entrance in China once Tesla completes its domestic data centers.

The broadening of the L2+ application, especially for urban driving, which amounts to over 75% of driving time, increased the purchase rate of high-end ADAS-equipped vehicles in China. The swift rise in sales of Xpeng's G6 model, which comprised nearly 50% of the brand's Q3 sales, along with over 60% of new AITO M7 customers choosing the Smart Driving Edition, demonstrates the importance of ADAS features on consumer purchasing decisions.

The sales increase further encouraged OEMs to accelerate launches of L2+ equipped vehicles. To capitalize on the favorable market environment and to compete with China's local players, global carmakers also prioritized testing and deploying ADAS features in China. Mercedes-Benz's new E-Class was first equipped with an L2+ ADAS feature in China, which the local Chinese R&D team developed. Honda also chose to debut its L2+ feature, Honda Sensing 360, in China. It is anticipated that China's high-end ADAS market will be under a competition-reshaping period in the next one to two years.

Compared to other markets, China's new L3 road testing policies are expected to provide ample preparation space for OEMs and industry participants to deploy higher-level advanced driving features. The well-organized approach to the L3 development and commercialization phase strongly incentivizes carmakers to participate, increasing China's chances of overtaking Germany and the US in L3 deployment.

Due to the limited product choices of EVs and inadequate charging infrastructure, Germany and the US are still in the early stages of electrification. The overall cost-effectiveness of EVs is low in these two markets, failing to stimulate users' demand for intelligent vehicle features. While the willingness among carmakers to invest in developing ADAS features is growing, the pace of development and deployment is still constricted by limited market demand and technological challenges in developing effective solutions.

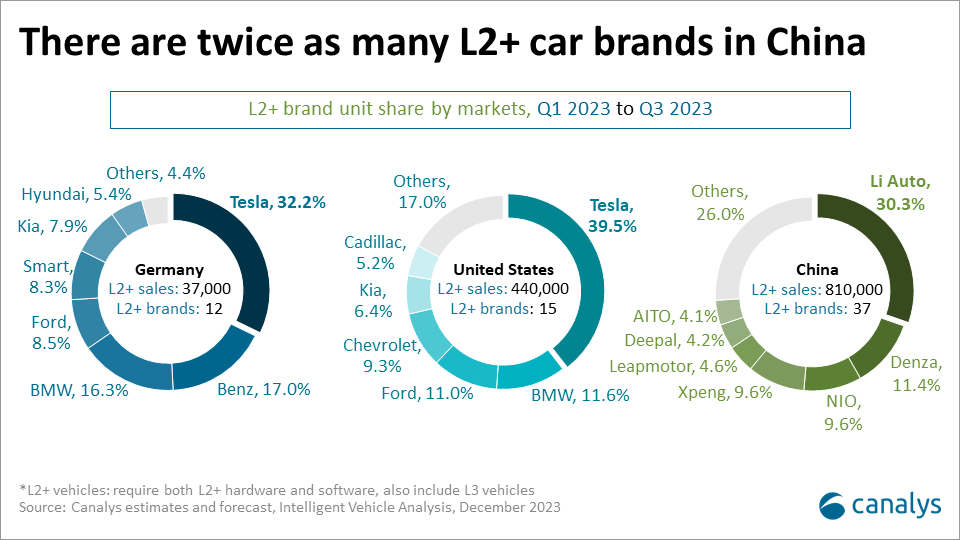

Based on Q1 2023 to Q3 2023's market performance, Tesla aside, major local brands in respective markets included Mercedes-Benz and BMW which collectively hold 33.3% L2+ market share in Germany, and Ford, Chevrolet, and Cadillac which hold 25.5% market share in the US.

Road conditions in these two markets are relatively simple and less prone to frequent change, which has led OEMs to favor tech solutions that heavily rely on high-precision maps. However, the high surveying costs of maps, the demand for high-cost components such as lidar, and the challenges in accessing road information are key barriers cautioning OEMs in higher-end ADAS. These are the main reasons why L2+ vehicles are generally provided by local premium brands.

In 2023, the rapid growth in L2+ demand in China caught the eyes of global OEMs, and this trend is expected to extend to the global market in 2024. The ADAS ecosystem in China is expected to flourish, benefiting major tier-1 suppliers and chipset makers. The experiences of working with carmakers, from new partnership models to new E/E architecture, will become crucial know-how for suppliers to address emerging global needs. With the rising focus on improving cost efficiency and time-to-market, there's an opportunity for Chinese chipmakers and solution providers to quickly address local needs, increasing the likelihood of addressing global opportunities when carmakers expand overseas.