GITEX 2023 recap: from identifying mobility trends to networking

14 November 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

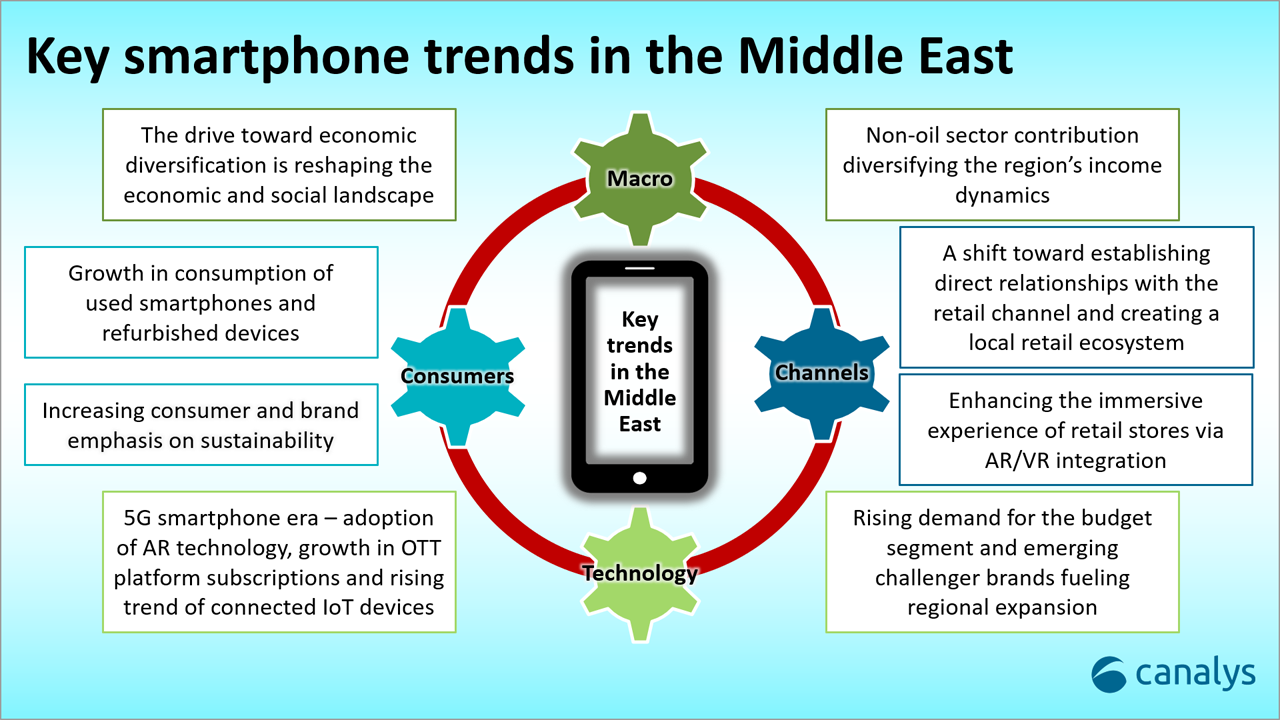

Canalys attended GITEX 2023 (Gulf Information Technology Expo) in Dubai, UAE, which consistently stands out as a beacon of innovation and a platform for cultivating relationships with the potential to redefine the future. Canalys also analyzed the impact of upcoming trends seen at GITEX 2023 on the smartphone market in the Middle East.

GITEX is a tech hub covering everything from AI and cybersecurity to AR/VR, EVs, 5G, and IoT. We had a comprehensive opportunity to look at diverse technological advancements, making it a one-stop platform for exploration and learning. Here are our key takeaways from GITEX 2023:

1. Sustainability is omnipresent as the Middle East approaches COP28, and other ESG strategies move to the forefront

Leveraging the anticipation for the upcoming COP28 event in the UAE, GITEX GLOBAL introduced GITEX Impact, the region’s most significant platform for climate technology. Its primary focus is to uncover sustainable energy solutions to combat climate change. In addition to vendors, major governments are increasing their commitment to sustainable development initiatives and presenting comprehensive plans for the implementation of smart cities.

Consumers are increasingly conscious of the environmental consequences of their buying choices. In the retail electronics sector, sustainability is gaining traction in the region, with eco-friendly packaging, carbon offset programs and ethical brands. UAE retailers such as Sharaf DG encourage customers to surrender used devices, yielding 25 kilotons of e-waste and aligning with global responsible consumption trends. E-city’s partnership with Cartlow introduced a device subscription program across 16 UAE stores, making it easier for customers to access the latest technology without selling or trading in their current devices. As GCC nations commit to achieving net-zero emissions, the regional focus is expected to drive further major reforms. Akis Evangelidis, a Co-Founder of Nothing, also highlighted the transformation of smartphones from tools of empowerment to sources of distraction.

Image courtesy of Cartlow

2. The realm of artificial intelligence (AI)

Of all the major themes highlighted at GITEX 2023, AI took center stage. In the coming years, Canalys expects a shift toward on-device AI applications, offering personalized experiences while safeguarding user privacy. This trend will likely gain traction in regions with youthful demographics, increased social media engagement and a growing female workforce.

In the consumer segment, AI will enhance shopping, gaming and entertainment experiences, significantly improving quality of life. While at the enterprise level, AI will affect tech enthusiasts and those engaged in scientific research and development. Leading the way will be vendors concentrating on collaboration with regional government entities in GCC, such as the RTA (Roads and Transport Authority), and partnering with B2B enterprises, with initiatives such as Lenovo’s introduction of the “Thinkphone”.

Looking forward to 2024, these trends will drive advancements in mobility. But it’s vital to recognize that AI can either create or diminish value. To ensure continued adoption, vendors and channels must educate consumers about the genuine potential of AI-powered devices. To facilitate understanding, implementing AI training courses and add-on applications in the device to guide users in the region is recommended. These courses should focus on practical applications for both PCs and smartphones, preventing potential dissatisfaction by aligning consumer expectations with the actual capabilities of the devices.

3. The Influence of digital transformation

GITEX 2023 highlighted the key need for the widespread adoption of digital transformation in the region. GCC countries are increasingly investing in technology to align with the demands of the digital era, placing a significant focus on 5G technology. Saudi Arabia, the UAE, Bahrain and Qatar are channeling substantial investment into startups in sectors such as EdTech, FinTech, gaming, and IT and web development. The Middle East, home to a sizable expatriate population, particularly in countries such as the UAE, where over 80% of the population are expats, is seeing substantial demand for educational services in various languages. The FinTech revolution is propelling the surge in digital payments and financing options, prompting vendors to seek collaborations with local providers to expand their reach and attract consumers.

In conversation with Canalys at GITEX 2023, Dubai

GITEX 2023 united global professionals, investors and enthusiasts, and offered an opportunity to build partnerships, exchange ideas and cultivate a worldwide network. That’s why Canalys organized a “mobility exclusive event”, a pioneering initiative within the industry. It featured prominent vendors and channel partners who were given the privilege of being among the first to witness cutting-edge research and emerging trends in smartphones, PCs and IoT.

As major announcements were made at the event, Canalys analyzed the impact of these trends on the smartphone market in the region.

Identifying trends and emerging market opportunities

A shorter upgrade cycle for smartphones is driving demand for refurbished and used devices: with inflationary pressures and rising costs, consumers are looking for alternatives for communicating, which is boosting demand for refurbished phones, especially in the mid-to-premium segment. Aspiration is also driving consumers to own an Apple or Samsung device, which comes with a one-year warranty on the open market. Growing consumer interest in advanced mobile phones at lower prices is forecast to fuel growth in the coming months. Online retailers such as Amazon are also pushing refurbished devices aggressively, while startups including North Ladder, Revibe and Revent are driving sales of used smartphones in the region.

E-commerce is growing, but retail still dominates: E-commerce is on the rise in the Middle East, particularly with the growing trend of mobile commerce (m-commerce), due to widespread smartphone use. But physical stores will continue to dominate, with online retail and B2B marketplaces gaining a share of the pie. Canalys data suggests offline channels in the Middle East (excluding Turkey) have increased to 96% in Q3 2023 from 92% in the same period last year. Retailers, though, are optimizing websites and apps for mobile phones and introducing mobile payment solutions. In the next five years, the UAE and Saudi Arabia will lead GCC retail sector growth. While some markets, such as Iraq, still rely heavily on traditional retail and cash transactions, Saudi Arabia has transitioned from mass-market to online and organized retail. The direct-to-retail model has evolved, but distribution houses remain vital in core markets of the Middle East.

Smartphone-centric enterprises are driving growth in the Middle East’s smartphone sector: Businesses including ride-hailing, food delivery and e-commerce apps are boosting demand for smartphones. This surge creates opportunities for manufacturers to design smartphones tailored to these enterprises and for app developers to create efficient tools. The influx of these enterprises attracts more investment, fostering innovation in the smartphone sector. Examples include Careem in Saudi Arabia, Noon in the UAE and Talabat in Qatar, each contributing to increased smartphone demand, accessibility and affordability, positively affecting the region’s economy and technological landscape.

5G smartphones’ contribution in the Middle East (excluding Turkey) is set to reach 82% by 2027, with leading operators including Etisalat in the UAE and Ooredoo in Qatar and Kuwait spearheading implementation. Key drivers for further growth include:

Gen Z is driving growth in budget-friendly segments: The consumer landscape in the region is undergoing a significant shift, led by the influence of Gen Z, as highlighted in the major themes of GITEX 2023. Emerging markets, particularly in Saudi Arabia and Iraq, are gaining prominence in the budget segment, attracting both local and global firms. Canalys data reveals a noteworthy 61% growth in the sub-US$200 segment during Q3 2023 in the Middle East (excluding Turkey), driven by TRANSSION brands (Tecno, Infinix and iTel), Xiaomi and realme. This underscores the increasing importance of these markets and the role played by specific brands in shaping consumer behavior.

The region’s consumers now prioritize more than just a brand’s market reputation when choosing smartphones. Brands need to intimately understand consumer preferences and build direct connections. A universal approach won’t suffice, given diverse cultures. In Saudi Arabia, for example, retailers may accept lower margins with extended credit, while in Iraq, longer credit periods are sought.

While the business environment in the region’s established economies is seeing slower improvement amid global geopolitical tensions, governments are looking to adapt and are actively pursuing reforms to boost non-oil revenue, attract investment and draw in talent to stimulate startup growth. Golden visa initiatives are enhancing resident confidence in investments. Amid the Russian war, many high-net-worth individuals are diversifying into properties and businesses, driving up demand and property prices. On the other hand, vendors and channels sense long-term opportunity in the region. They are looking for further strengthening of their local networks via hiring locally experienced staff, setting up offices in the new emerging markets instead of regional centralized operations and staying aligned with governments’ visions.

Canalys has published a special free report that deep-dives into the key mega-trends and drivers shaping the smartphone market in the Middle East (excluding Turkey), focusing on the GCC countries for 2023-2024. Download your copy now: Key mega-trends in the Middle East smartphone market 2023-2024.