Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Google leverages Chromebook strengths to deliver AI experiences

With Chromebook Plus products, Google and its OEM partners are delivering AI experiences to customers while maintaining the core value propositions of security, stability and speed, all at competitive price points. Our exclusive video interview and blog give insights into the opportunities and challenges ahead.

In October 2023, Google announced the launch of Chromebook Plus, a new category of Chromebooks focused on delivering better performance and new AI experiences. Almost a year into this effort and with several models from OEM partners released to the market, Canalys Principal Analyst Ishan Dutt interviewed John Solomon, Vice President of ChromeOS and Education at Google, to learn more about how Chrome-based devices are being positioned in the era of AI computing, and what upcoming benefits OEMs and users can look forward to.

Chromebook Plus brings cloud-based AI experiences at competitive prices

Chromebook Plus devices entered the market at a critical time, as the roadmap of Windows-based AI-capable PCs has ramped up and Apple has outlined the feature improvements that Apple Intelligence will bring to its Mac products. The introduction of on-device AI capability in these ecosystems has so far been focused on products with relatively high price points. Chromebook Plus devices are currently hitting the market in the US$300 to US$600 range, a higher range than standard Chromebooks but significantly lower than Windows PCs and Macs. Not all Chromebook Plus devices have an NPU, which is currently the key characteristic of an AI-capable PC according to Canalys’ definition of the category. Google remains focused on providing cloud-based experiences through competitively priced hardware and this has extended into the era of AI features.

According to Solomon, Google is already witnessing about double the growth rate in Chromebook Plus shipments compared to standard Chromebooks, albeit from a smaller base. Solomon also insists that Google does not plan on “doing AI for AI’s sake,” instead focusing on seamlessly integrated features that help make the user more productive. An example of this is context-relevant insertion, in which Google’s software works in conjunction with the user to provide AI assistance within the active application.

Security, stability and speed are the core of the ChromeOS value proposition

While the introduction of AI capabilities to Chromebooks may steal the show with the latest Chromebook Plus models, Solomon stresses that the “core value proposition of security, stability and speed” is unchanged. A key strength underpinning this trifecta for ChromeOS is its operation of updates on a monthly cadence so that feature enhancements, security features and device efficiencies are offered to users soon after development. With Google handling all the software updates automatically, IT requests and efforts around the management of ChromeOS devices are minimized.

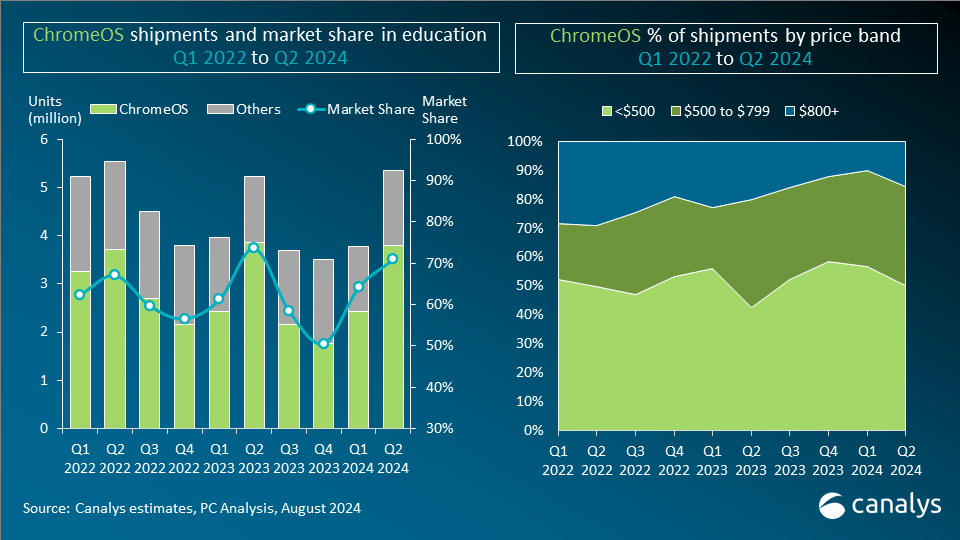

This core value offering of ChromeOS has been part of what has made the devices so popular in the education market. In addition to its pricing, ease of management was a critical benefit that helped establish Chromebooks in education, where IT resources are often constrained. However, Google is now seeing new factors drive adoption beyond just students. Solomon notes an “expansion of the addressable market” as the Chrome ecosystem is “pulling a lot of teachers into the market.” He highlights some features, such as Screencast and Cast Moderator. These allow teachers to highlight individual students and cast their screens to the classroom without worrying about undesirable content being shared with the whole classroom.

Google’s strength in AI: what does it mean for PC OEMs?

Google has long been a pioneer in the development of machine learning and AI, from its release of the search engine spell-checking in the early 2000s to the introduction of TensorFlow roughly a decade ago and Gemini in early 2023. Through the Chromebook Plus platform, PC OEMs are easily able to leverage Google’s significant R&D investment and expertise in this area to bring new features and experiences to their customers. Solomon sums up this advantage to OEMs as “standing on the shoulders of giants.” This is especially true for OEMs lacking the resources to develop their own in-house AI capabilities.

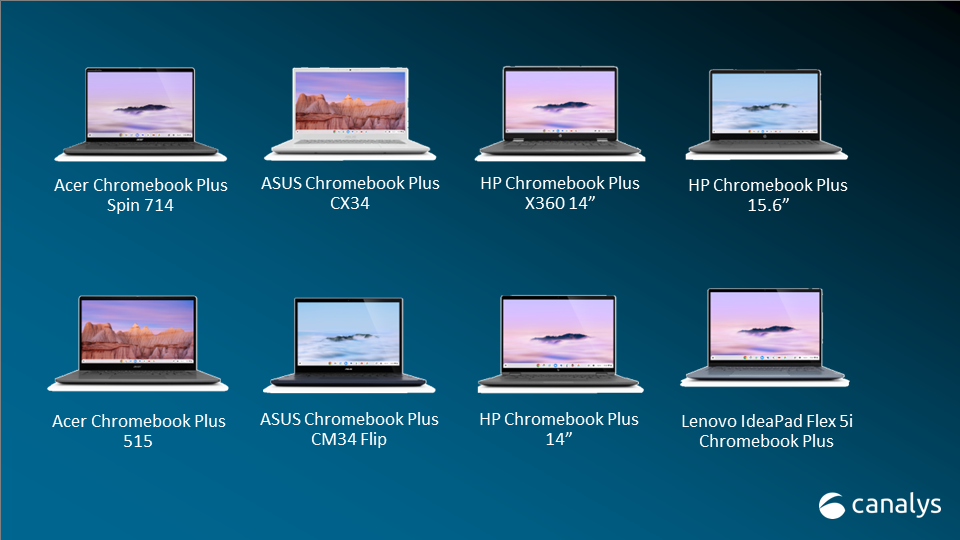

While vendors like Acer, Asus, HP and Lenovo have released native Chromebook Plus models, there are also around two dozen Chromebook models on the market that need only an OS update to become Chromebook Plus capable as they meet the hardware requirements for the platform - an Intel Core i3 12th Gen or AMD Ryzen 3 5000 Series CPU or above, 8 GB of RAM, 128 GB of storage, 1080p webcam with Temporal Noise Reduction, and a Full HD IPS display. These requirements ensure a minimum level of performance to provide a better experience across a variety of use cases.

Each Chromebook Plus also comes with one year of access to Gemini Advanced so that all users will get to experience, even if only temporarily, the most premium AI features from Google. Compared to the US$30 per month fee to access the Copilot for Microsoft 365 suite of features, this is an appealing offer for customers who are more sensitive to operating costs.

Canalys expects a minor shipment decline of under 2% in 2025, after a strong refresh this year, for a total of 17.6 million units. By 2028, we expect this figure to grow to 18.4 million units. NPU integration in Chromebooks to enhance performance and AI experiences is also expected to ramp up from 7% of total shipments in 2025 to over 40% by 2028. Despite this healthy outlook, the platform will face challenges in its bid for expansion through AI-powered offerings. As the roadmaps for Windows and Apple on-device AI-capability become more cemented, Chromebooks will face increased barriers to gaining a share outside of its stronghold in education. In the commercial space especially, the Windows ecosystem will begin to bring NPU integration down to mid- and entry-range products while also benefitting from the significant investment in ISV engagement by processor vendors and OEMs to strengthen its moat.