Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Redefining the future of mobile technology with AI-capable smartphones

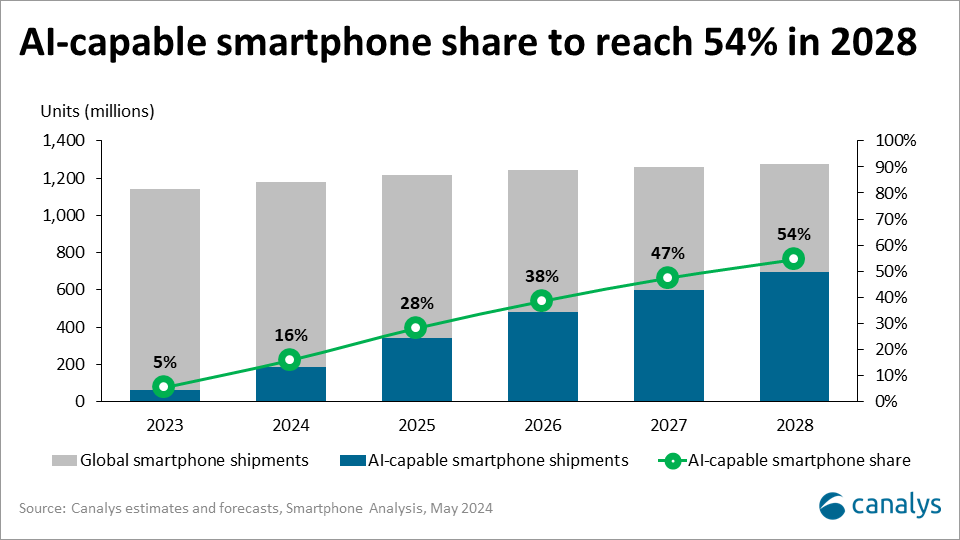

The Canalys "Now and Next in AI Smartphones" complimentary report presents an in-depth examination of AI’s emergence in mobile technology. This free report explores the transformative impact of AI on smartphones, offering expert insights from Canalys’ top analysts on the evolving AI smartphone landscape. A key focus of the report is Canalys' forecast that by the end of 2024, 16% of new smartphones shipped will be gen AI capable. This growth is driven by rapid advancements in chipset technology and increasing consumer demand. Major global players such as Apple, Google, and Samsung as well as leading Chinese players HONOR, OPPO, Xiaomi and vivo are at the forefront of integrating AI capabilities into their devices. Canalys projects an exponential increase in AI-capable smartphone market share, reaching 54% by 2028, a 63% CAGR from 2023 to 2028 driven by consumer demand for enhanced functionalities such as AI agents and on-device processing. The success of AI smartphones will hinge on technological advancements, privacy and security measures, and the ability to integrate AI seamlessly into everyday user experiences. Unlock the comprehensive "Now and Next for AI-Capable Smartphones" report to stay ahead in the evolving landscape of mobile technology. Gain expert insights, detailed forecasts, and strategic recommendations to navigate the future of AI in smartphones.

The report provides a companion piece to the Now and Next in AI-capable PC report published in January 2024 , and forms part of Canalys’ extensive portfolio of AI insights and analysis.

The report targets smartphone vendors, component manufacturers, carriers, service providers, channel partners, and the financial community.

- Defining AI-capable smartphones: Understand what makes a smartphone AI-capable and how this definition and user requirements are expected to evolve.

- Market projections: 28% of new smartphones will be generative AI-capable by 2025, driven by rapid advancements in chipset technologies and growing consumer demand.

- Key trends Identifying major trends driving AI adoption in smartphones, such as multimodal capabilities, personalization, and enhanced connectivity between devices.

- Opportunities and challenges: Examining the potential for product differentiation through unique AI features, robust privacy protections, and the imperative of developing a sustainable ecosystem for third-party AI applications.

- AI-capable smartphone use cases: Exploring early AI-powered features and their impact on user experiences.

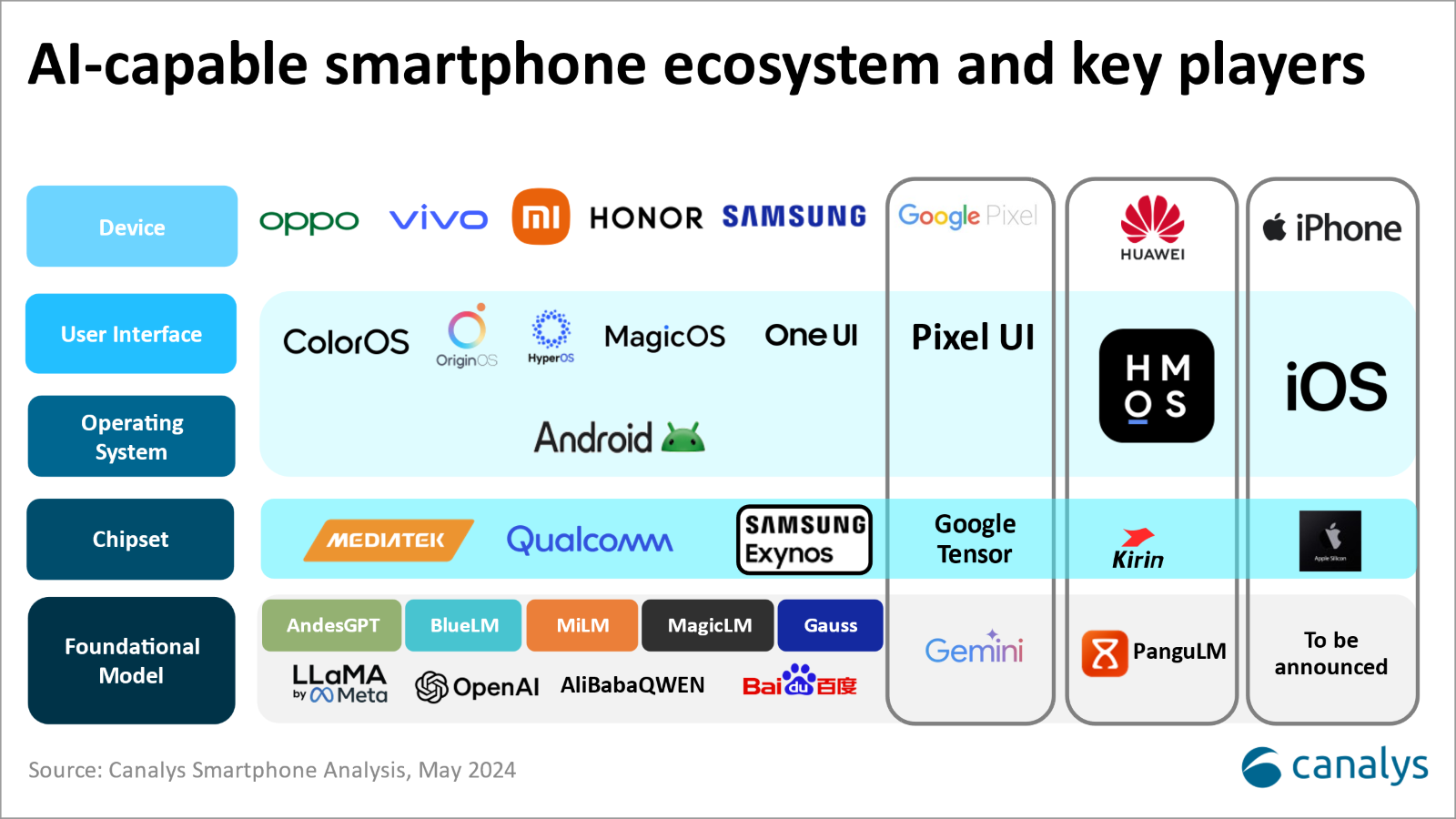

- Leading industry players' strategies: Analyzing the AI strategies of key ecosystem players such as Apple, Google, HONOR, Huawei, MediaTek, OPPO, Samsung, Qualcomm and vivo.

- AI Smartphones go-to-market approach: Strategies for device OEMs to invest in and monetize AI features, develop new revenue models, and enhance user loyalty.

- The Canalys Consumer AI Inclination Index: Identifying different consumer segments and how vendors can effectively market and position AI smartphones to each group.

- Consumer segmentation for marketing strategies: What must be addressed by industry players before they bring AI-capable PCs and AI-powered solutions to market.

- Potential in enterprise: Exploring the potential of AI smartphones in the enterprise sector, enhancing productivity, security, and collaboration.

- Forecast assumptions: Projecting the market share of AI-capable smartphones through 2028 and the technological advancements driving this growth.

- Challenges and recommendations: Addressing transparency, responsibility, and regional differences in AI smartphone adoption and market expansion.

Receive the report straight to your inbox for detailed insights and forecasts, helping you understand the future of AI in smartphones.

Why read this complimentary report about AI smartphones from Canalys?

The "Now and Next for AI-Capable Smartphones" report by Canalys offers an invaluable resource for understanding the transformative impact of artificial intelligence on smartphones.

Areas of projections and forecasts mentioned in this Canalys report:

- Market share of AI-capable smartphones from 2024 to 2028

- Commercial vs consumer adoption rates

- Trends in processor technology and performance roadmap

- Adoption impact on various market segments (eg, gaming, business, consumer)

- Long-term market implications on the Total Addressable Market and evolving definition requirements of AI-capable smartphones

The report provides a detailed analysis of how AI is being integrated into smartphones, revolutionizing their capabilities and functionalities. Understanding this integration is essential for industry players to anticipate market trends, align their strategies, and stay competitive. The report delves into the hardware and software advancements that define AI-capable smartphones, offering a clear picture of the current and future landscape.

Canalys projects that by 2025, 58% of new smartphones will be generative AI-capable. This surge reflects advancements in chipset technologies and growing consumer demand for AI capabilities. The report suggests that vendors can leverage unique AI features to enhance user experiences and gain market share. It highlights early AI features like multimodal capabilities and personalized experiences, and their impact on entertainment, communication, and productivity. For investors and business leaders, these insights are crucial for making informed decisions and identifying growth opportunities.

The report provides insights into how major players like Apple, Google, HONOR, Huawei, MediaTek, OPPO, Samsung, Qualcomm, and vivo are shaping the AI smartphone market. These companies lead in integrating AI into devices, setting competitive standards, and driving innovation. Understanding their strategies offers valuable knowledge on best practices, emerging trends, and industry challenges.

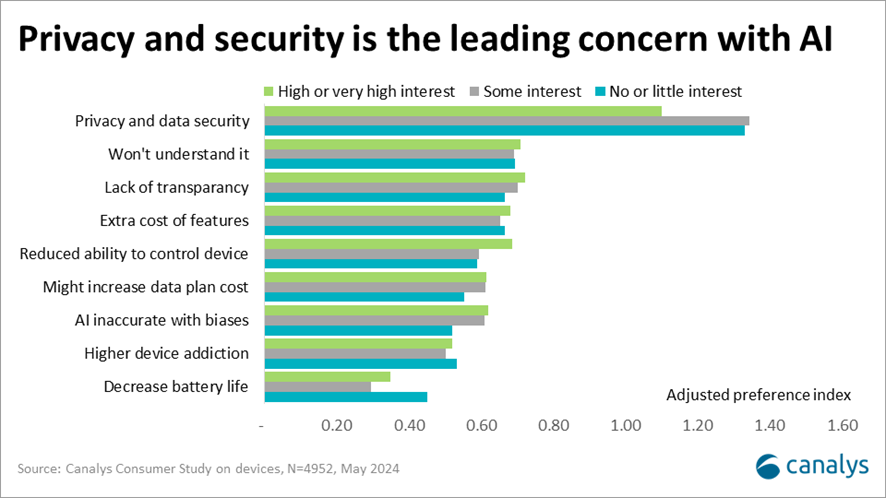

While the proliferation of AI-capable smartphones presents substantial opportunities, it also brings challenges such as the need for robust privacy protections, developing a sustainable ecosystem for third-party AI applications, and educating consumers about the benefits and limitations of on-device AI functionalities. The report addresses these challenges, providing actionable insights on how to navigate them effectively. This is particularly important for OEMs and developers who must balance innovation with ethical considerations and consumer trust. For original equipment manufacturers (OEMs), the report provides strategic recommendations on how to invest in and monetize AI features, develop new revenue models, and enhance user loyalty. It outlines potential business models such as AI-as-a-feature, AI-as-a-service, and AI-as-a-interface, offering a roadmap for leveraging AI to create competitive advantages. These recommendations are essential for OEMs to stay ahead in a highly competitive market.

Understanding consumer interest and adoption trends is key to developing successful AI-capable smartphones. The report includes insights from the Canalys Consumer AI Inclination Index, which measures consumer interest and attitudes towards AI capabilities on smartphones. By analyzing these trends, vendors can tailor marketing strategies and product development efforts to better meet consumer expectations and drive adoption.

Finally, the report offers a forward-looking perspective on the future of AI-capable smartphones, projecting market share growth and technological advancements through 2028. It addresses the long-term implications of AI integration, providing a strategic vision for industry players to navigate the evolving landscape of mobile technology.

The "Now and Next for AI-Capable Smartphones" report is an essential resource for anyone involved in the smartphone industry. It provides comprehensive analysis, market projections, strategic insights, and actionable recommendations that are crucial for staying competitive and driving innovation in the era of AI-capable smartphones.

Companies appearing in this report: Alibaba, Apple, Baichuan, Baidu, Google, HONOR, Huawei, IBM, MediaTek, OPPO, OpenAI, Qualcomm, Samsung, vivo, Xiaomi

Key findings

Major manufacturers such as Samsung and Apple are driving the integration of AI capabilities, setting competitive standards in the market. Canalys predicts that 16% of new smartphones will be generative AI-capable by the end of 2024, driven by advancements in chipset technologies and increasing consumer demand.

- Defined by Canalys as devices with dedicated AI hardware (eg, ASICs) capable of efficiently executing large generative AI models on-device.

- The Canalys Consumer AI Inclination Index shows varying regional interest in AI capabilities, highlighting the importance of localized marketing strategies.

- AI-capable smartphone market share is projected to reach 54% by 2028, driven by improvements in generative AI models and hardware advancements.

- Challenges include ensuring robust privacy protections, developing a sustainable ecosystem for third-party AI applications, and educating consumers about on-device AI functionalities.

Your next steps

To fully understand the transformative impact of AI-capable smartphones and stay ahead in this rapidly evolving market, take the following next steps:

Access the report

Gain comprehensive insights into the future of AI-capable smartphones by accessing the full "Now and Next for AI-Capable Smartphones" report. This detailed report will provide you with in-depth analysis, market projections, strategic recommendations, and much more.

Connect with Canalys analysts

For personalized insights and to discuss the implications of the report findings on your business, reach out to Canalys analysts. Our experts are available to provide tailored advice, answer your questions, and help you navigate the opportunities and challenges presented by AI-capable smartphones.

Stay updated

Ensure you stay informed about the latest trends and developments in AI and mobile technology by subscribing to Canalys updates. Receive notifications about new reports, industry insights, and exclusive events directly to your inbox.

By following these steps, you can leverage the insights from the report to make informed decisions, drive innovation, and maintain a competitive edge in the AI-capable smartphone market. Don't miss out on this opportunity to position your business at the forefront of technological advancements.