Wearable band market shipments to expand 5% in 2024

Monday, 24 June 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

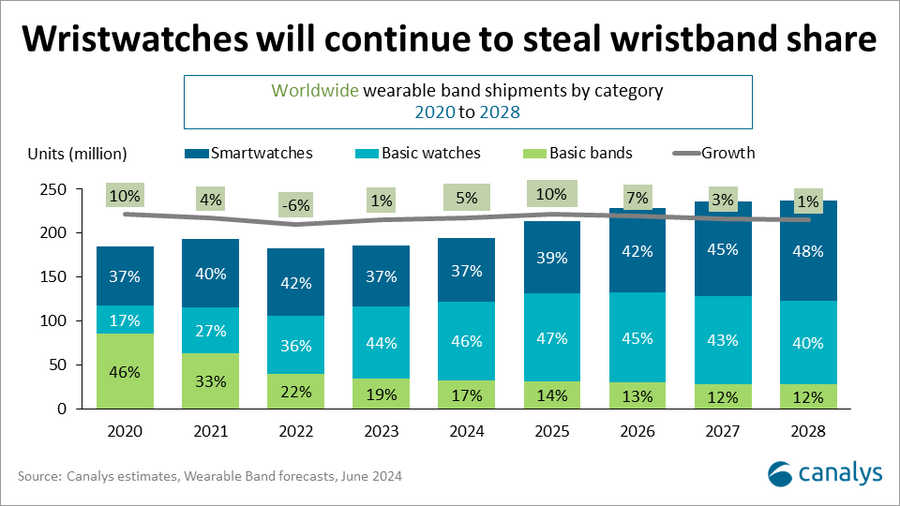

The global wearable band market is set to see a 5% increase in shipments for 2024, reaching a total of 194 million units, according to the latest Canalys analysis. Despite a slight 0.2% decline in Q1 2024, the market is expected to rebound significantly later in the year, bolstered by a resurgence in smartwatch growth at 4% and the continued rise in the basic watch segment, up 10%. Basic band however, continues to shrink by 6% in 2024.

“Basic watches continue to grow in popularity globally, reaching their highest-ever share of 48% of the wearable band market in Q1, with a forecasted 46% shipment share for the full year,” said Canalys Research Analyst Jack Leathem.

Xiaomi and Huawei recorded another quarter of shipment growth after releasing increasingly capable basic watches to drive shipments for price-conscious consumers, achieving 37% and 46% growth respectively in Q1 2024. “As user experience, tracking, and smart features of basic watches progress, more consumers are opting for these affordable models to meet most of their needs. The longer battery life of basic watches is a significant draw for many users. However, this basic watch growth is expected to be overshadowed by smartwatch expansion in the long-term, which will address more sophisticated use-cases as battery life and cost competitiveness improve in the smartwatch segment,” added Leathem.

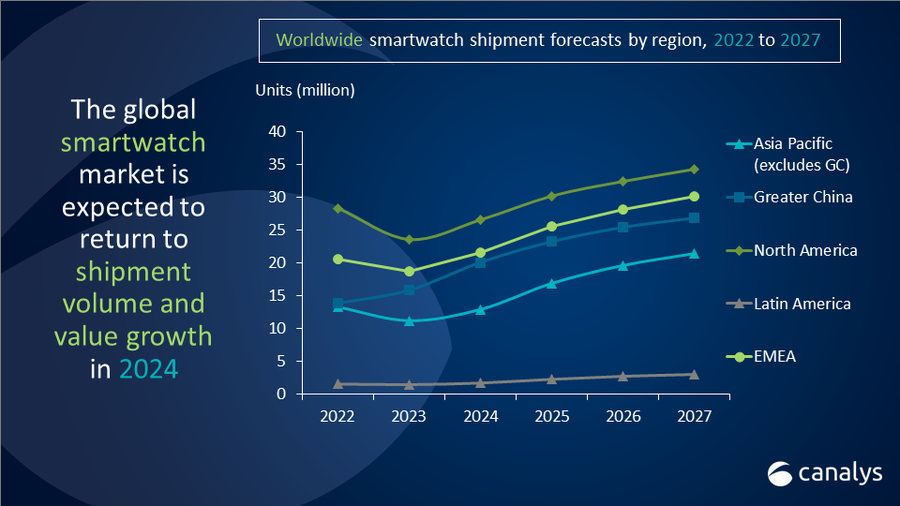

Smartwatch shipments experienced a 9% decline in Q1 2024 but are expected to rebound with a projected 4% growth for the year, driven by anticipated releases of upgraded devices in the latter half. “This growth trend reflects evolving consumer expectations beyond basic data tracking, with a growing demand for detailed, personalized healthcare solutions. Companies including Huawei, Zepp Health, and Samsung are pivoting towards software services, integrating advanced sensors, algorithms, and AI to offer comprehensive health insights. These innovations aim to enhance user experience and cement wearables as essential tools for future health management, contributing significantly to expected increases in smartwatch shipments throughout the year,” said Canalys Research Manager, Cynthia Chen.

Vendors in the wearable market must acknowledge the growing importance of bundling and trade-in deals. Consumer price sensitivity has driven the popularity of basic watches in recent years and offering aggressive trade-in discounts on new generation devices can make expensive flagship models more affordable and accessible, encouraging consumers to upgrade. This strategy, similar to bundling basic watches, not only boosts shipments but also fosters ecosystem loyalty and consumer retention.

Meanwhile vendors should continue to look for innovative use-cases by expanding their model portfolios to include ultra-premium smartwatches and smart rings. Developing ultra-premium smartwatches can enhance a brand's image, create higher-margin products, and provide a platform for introducing premium features that can later be integrated into other flagship devices. Smart rings present an opportunity to differentiate products in an increasingly homogenous market. By offering a premium extension to smartwatches, smart rings can further elevate the consumer experience.

|

Worldwide wearable band shipment (forecast and annual growth) |

|||||

|

Category |

2023 |

2024 |

2025 |

Annual |

Annual |

|

Basic band |

34.5 |

32.3 |

30.8 |

-6% |

-5% |

|

Basic watch |

81.8 |

89.9 |

100.4 |

+10% |

+12% |

|

Smartwatch |

69.2 |

72.0 |

82.9 |

+4% |

+15% |

|

Total |

185.4 |

194.3 |

214.1 |

+4.8% |

+10.2% |

|

|

|

|

|||

|

Note: percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Cynthia Chen: cynthia_chen@canalys.com

Jack Leathem: jack_leathem@canalys.com

Canalys’ Wearable Band Analysis service provides qualitative and quantitative insights into the wearable band market and addresses the areas where vendors can improve. Our best-in-class service guides vendors and partners to make the right decisions on value propositions, choose the right channel partners and enhance go-to-market strategies to engage in different markets worldwide. The data has detailed splits, tracking a list of 50+ features around connectivity, components, sensors, chipsets and many other different categories. Model-level information is available for 30+ key markets.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.