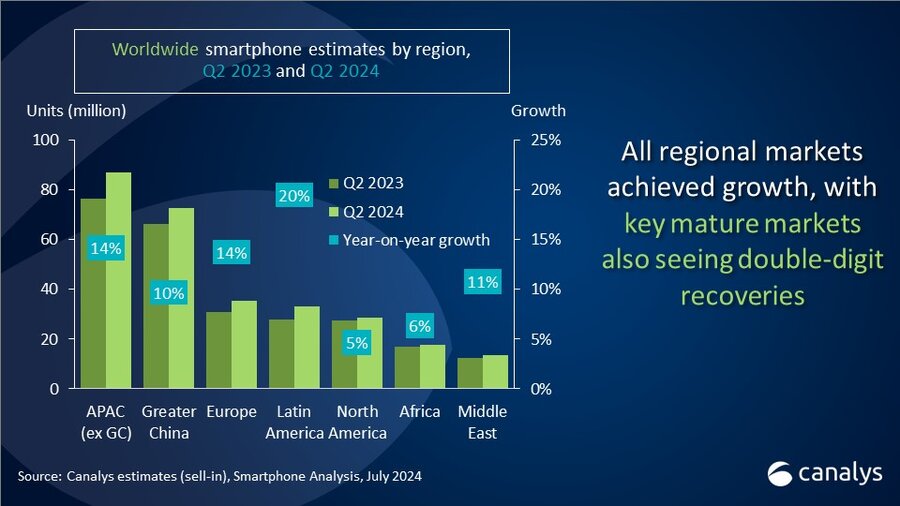

The global smartphone market surged 12% in Q2, with all regions rebounding strongly

Wednesday, 31 July 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

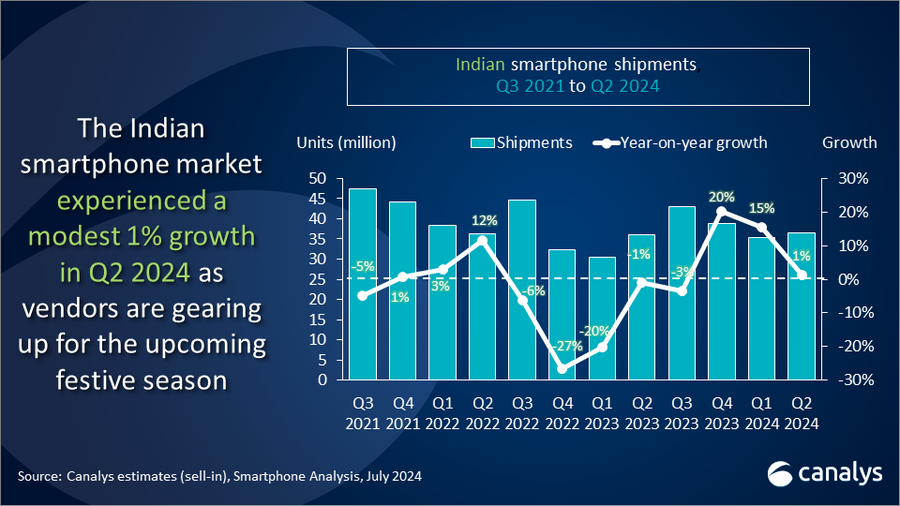

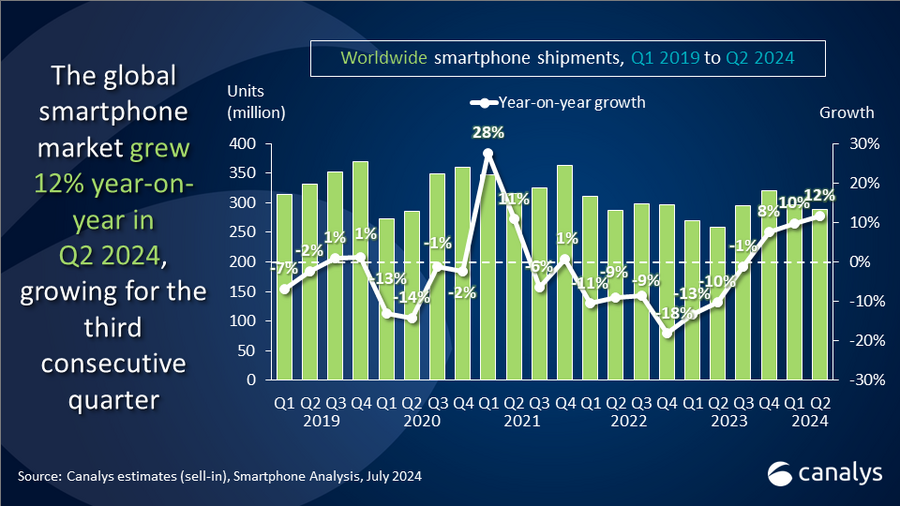

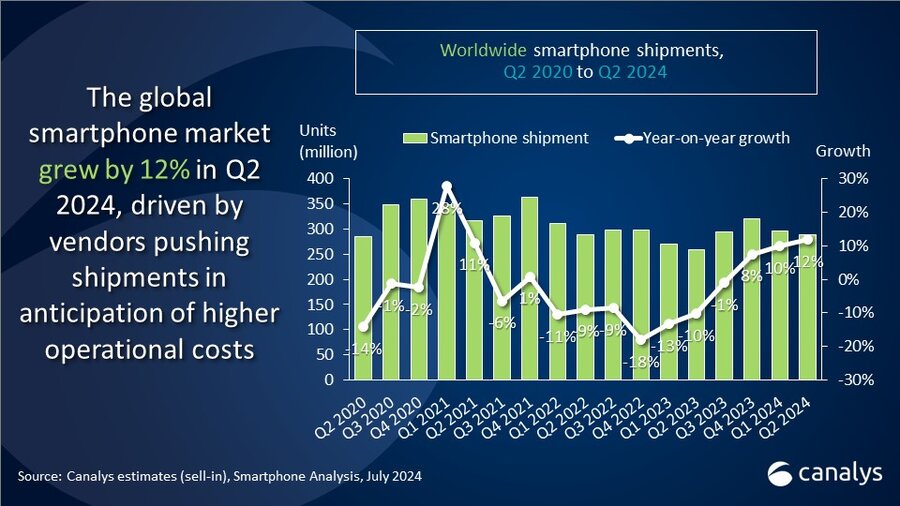

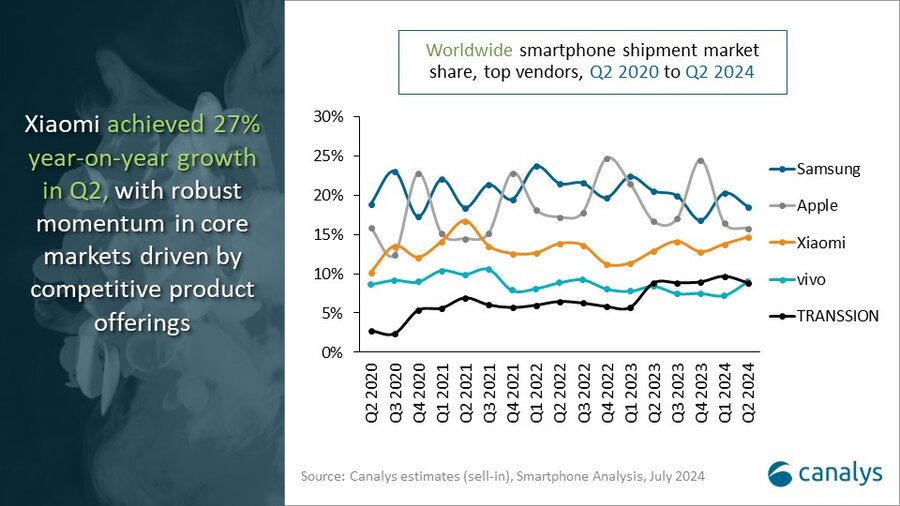

The latest Canalys research reveals that the worldwide smartphone market continued to grow strongly in Q2 2024, with shipments reaching 288.9 million units. The market has grown for three consecutive quarters, driven by product innovation initiatives and improvements in business conditions. Despite a modest 1% shipment increase, Samsung held onto pole position with 53.5 million units shipped. Its high-end product lines continued to boost value growth, while the revamped 5G A series maintained overall numbers. Apple held second place with 45.6 million units, bolstered by strong momentum in North America and APAC’s emerging markets. Xiaomi, with its competitive product offerings, closely followed with shipments of 42.3 million units to achieve a market share of 15%. Making a return to fourth place, vivo shipped 25.9 million units for a market share of 9%. TRANSSION came fifth, shipping 25.5 million units and taking a market share of 9%.

“In the second half of 2024, Apple and Samsung will focus on solidifying their long-term strategies in mature markets, while other brands will hope to boost sales in emerging markets, having stocked channels in anticipation of higher operating costs,” said Canalys Senior Analyst Sanyam Chaurasia. “In Q2, Europe and North America saw significant volume increases as vendors proactively stockpiled inventory for upcoming holiday sales seasons. Samsung will inevitably focus on integrating its Galaxy ecosystem to create strong value propositions for consumers via its flagship offerings with exclusive GenAI features. Apple will look to accelerate replacement demand in these markets via its AI strategy, with hybrid models, enhanced privacy and personalized Siri features. Meanwhile, Greater China’s growth trajectory now mirrors global markets, driven by improved macroeconomic conditions and renewed business confidence among channel and smartphone brands. In the domestic market, local Chinese brands will use GenAI features to stand out in the premium segment, aiming to capture rising high-end spending and apply successful strategies worldwide.

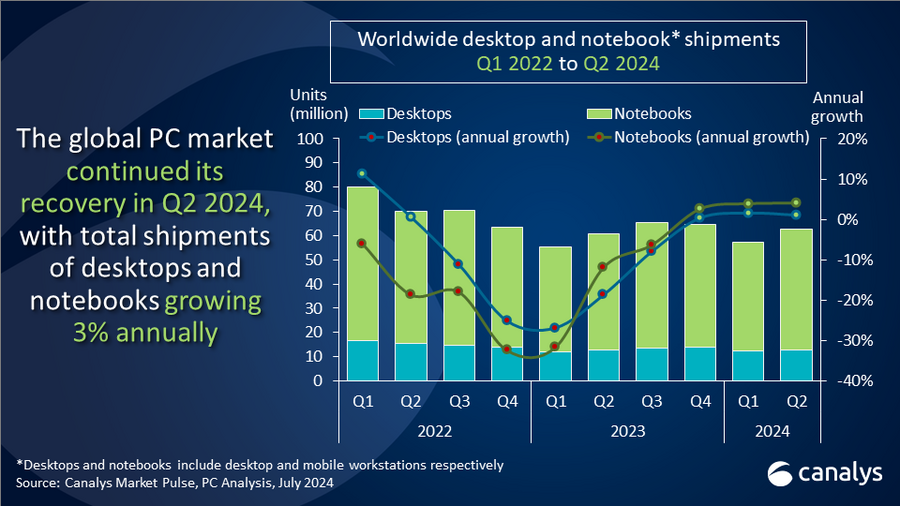

“All the major regions grew in Q2, but maintaining competitive products will become increasingly challenging,” said Canalys Senior Analyst Toby Zhu. “Since the end of Q1, vendors have consumed the remaining stocks of low-cost components. This will pose a challenge for mass-market brands as demand for competitive specifications, such as improved storage, displays and cameras, remains high. To navigate this, emerging brands should refine regional strategies and optimize retail investment to balance market expansion under high operational costs. Effective channel inventory management is vital to prevent disruptions in pricing and operational losses. Following a prolonged market downturn, maintaining operational health remains a top priority for brands and channels.”

“Despite seasonal demand in the second half of the year, the smartphone market is unlikely to see double-digit growth in full-year 2024,” said Zhu. “In the short term, the volume driver segment is facing operational challenges, but smartphone vendors should enhance their competitiveness in the latter half of the year via targeted regional product planning. Notably, consumers and channel partners have adapted to promotions and cost-effective products in the fragile economic environment of the past two years. Overall, the smartphone market is set to grow in the mid-single digits in 2024, driven by recovering inventory levels, eased import restrictions and a better economic climate. In 2025, with consumer demand remaining uncertain, especially in mature markets, vendors should focus on delivering innovative smartphone experiences to attract upgrade buyers, build a distinctive brand image and strengthen local operations to seize emerging opportunities.”

|

Global smartphone shipments and annual growth |

|||||

|

Vendor |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

Samsung |

53.5 |

19% |

53.0 |

21% |

1% |

|

Apple |

45.6 |

16% |

43.0 |

17% |

6% |

|

Xiaomi |

42.3 |

15% |

33.2 |

13% |

27% |

|

vivo |

25.9 |

9% |

21.7 |

8% |

19% |

|

TRANSSION |

25.5 |

9% |

22.7 |

9% |

12% |

|

Others |

96.2 |

33% |

84.6 |

33% |

14% |

|

Total |

288.9 |

100% |

258.2 |

100% |

12% |

|

Note: Xiaomi estimates include sub-brand POCO; TRANSSION includes TECNO, Infinix and iTel; percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Toby Zhu: toby_zhu@canalys.com

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other specifications. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.