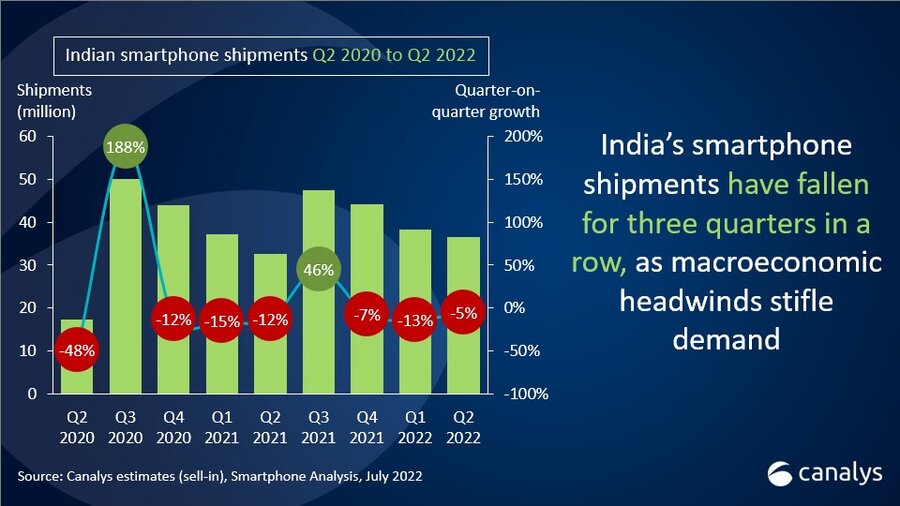

Indian smartphone shipments fall 5% sequentially in Q2 2022 amid tough conditions

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 20 July 2022

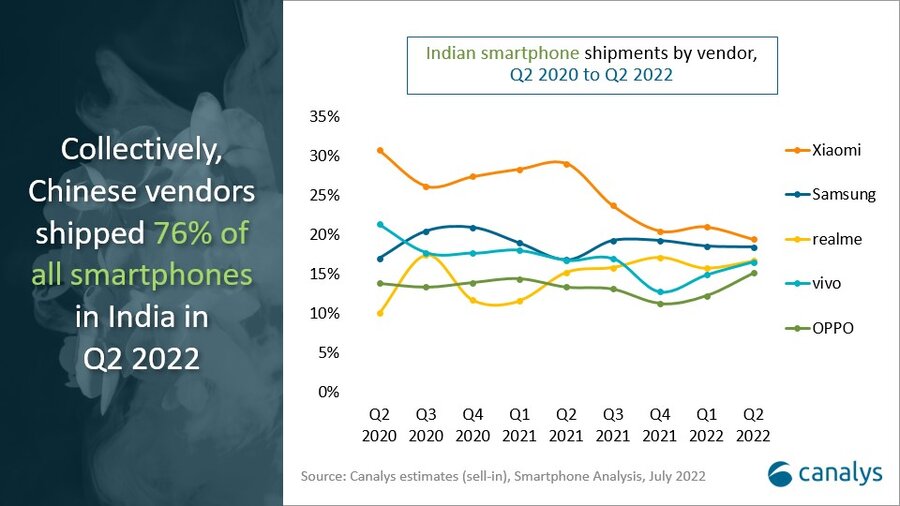

In Q2 2022, Indian smartphone shipments reached 36.4 million units, a 5% drop from the previous quarter, with major brands struggling to shift units as consumer demand dwindled. But as Q2 2021 was affected by the second COVID wave, the year-over-year comparison seems very positive, with shipments up by 12%. Xiaomi retained its market-leading position, shipping 7.0 million units, despite experiencing another quarter of both annual and sequential decline. With 6.7 million shipments, Samsung came second, pulling closer to Xiaomi. Remaining in third place, realme shipped 6.1 million units, while vivo and OPPO completed the top five, shipping 6.0 million and 5.5 million units respectively.

“Vendor activity remained muted in Q2, due to falling demand and government scrutiny of Chinese manufacturers,” said Canalys Analyst Sanyam Chaurasia. “Ballooning inflation hit consumers’ disposable income and vendors are struggling to cover their operating costs. Top Chinese brands, such as Xiaomi, vivo and OPPO, struggled with government scrutiny as well as financial problems. But the business impact remained limited, with no major changes in the vendor shares. Xiaomi maintained pole position, despite organizational changes owing to its revamped Redmi number series. OPPO and vivo continued to develop their omnichannel strategy, with the launch of the new K10 model and T1 series with their estores and eretailers. In the premium segment, Samsung’s positive reception for its flagship S series boosted its value share, while Apple is using India’s PLI scheme to make the iPhone 13 locally and support future aggressive pricing.”

“Vendors are looking to leverage strong channel collaboration as smartphone inventory is getting alarmingly high,” said Chaurasia. “Brands are using early deep discount sales, which began in June via the ecommerce channel, to get rid of stock before the holiday season kicks in. There will be more of these monsoon season sales on Flipkart and Amazon, with significant discounts to stimulate demand and prepare for upcoming launches in Q3. Simultaneously, vendors are supporting offline retailers’ margins, helping them provide better deals to end users. While the second half of the year will not see a surge in pent-up demand like last year, the rebound through the festival holiday season will be driven by replacement purchases. The weakening Indian rupee, rising retail prices and Chinese brands’ compliance risks are hindering growth in the sub-US$200 segment. The domestic economic environment remains cautious in the short term. A recovery in the mass market is contingent on proactive economic measures and adequate rains.

|

Indian smartphone shipments and annual growth |

|||||

|

Vendor |

Q2 2022 |

Q2 2022 |

Q2 2021 |

Q2 2021 |

Annual |

|

Xiaomi |

7.0 |

19% |

9.5 |

29% |

-26% |

|

Samsung |

6.7 |

18% |

5.5 |

17% |

23% |

|

realme |

6.1 |

17% |

4.9 |

15% |

22% |

|

vivo |

6.0 |

16% |

5.4 |

17% |

10% |

|

OPPO |

5.5 |

15% |

4.3 |

13% |

26% |

|

Others |

5.1 |

14% |

3.0 |

9% |

73% |

|

Total |

36.4 |

100% |

32.6 |

100% |

12% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO and OPPO includes OnePlus. |

|

||||

For more information, please contact:

Sanyam Chaurasia: sanyam_chaurasia@canalys.com +91 89820 33054

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.