Global tablet market ends tough 2023 with 11% decline in Q4

Monday, 5 February 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

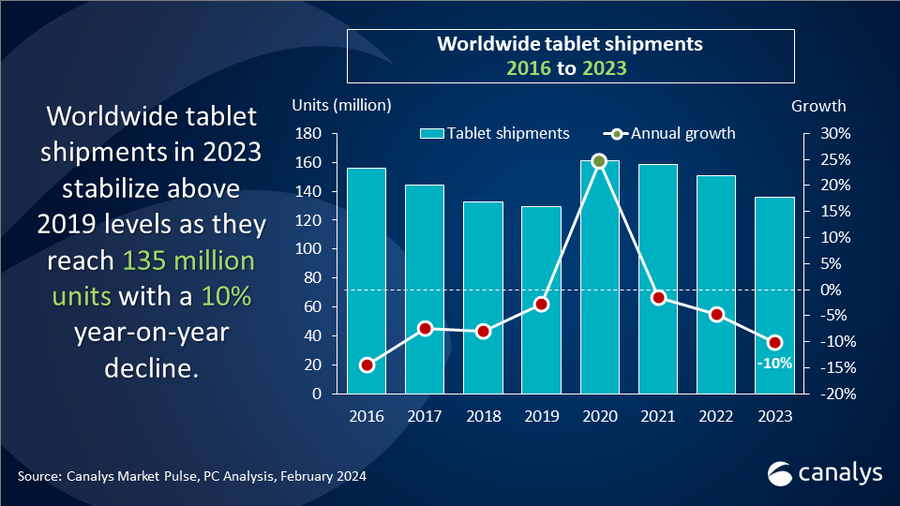

According to the latest data from Canalys, global tablet shipments experienced a drop of 11% year-on-year in Q4 2023, totaling 37.8 million units. This resulted in a full-year 2023 figure of 135.3 million tablets shipped, a 10% decrease from 2022. China and India were key markets driving tablet adoption, helping to counter the prevailing stagnation in other parts of the world.

“The latest holiday season saw a significant surge in tablet promotions and bundled offers, but this wasn’t enough to reverse the market’s fortunes, “said Himani Mukka, Research Manager at Canalys. “Aggressive promotional strategies have been implemented globally to address longstanding elevated tablet inventories. In certain markets in Asia Pacific, for example, there have been instances of old tablet models being bundled with newly launched smartphones to expedite inventory clearance. With healthier inventory levels and further scope for government and commercial deployments, tablet sell-in is expected to rebound in 2024. New models announced by TCL and Lenovo at CES 2024 and anticipated updates to Apple’s iPad portfolio early this year will help provide a boost to the tablet refresh opportunity.”

“The innovation gap between tablets and other personal computing devices is something for key tablet vendors to pay attention to”, said Kieren Jessop Analyst at Canalys. “Plans around on-device AI integration in tablets trail behind those in PCs and smartphones. Bringing this functionality across devices will be crucial for vendors aiming to deliver a unified and seamless experience on ecosystems. Elsewhere, this year will see a greater focus on foldable tablet form factors. Although shipment volumes will likely remain restricted due to the premium pricing of these models, they will provide an opportunity for vendors to showcase user-experiences benefits for content consumption, learning and productivity.”

In Q4 2023, the tablet market was aided by the robust performance of Chinese vendors. Huawei experienced stellar shipment growth of 95%, as it surged to third place in the rankings. Apple maintained its leading position despite a 24% year-on-year decline, shipping 14.8 million iPads in the quarter. Samsung secured second spot with 6.8 million units shipped, posting an 11% annual decrease. Lenovo dropped to fourth place but posted healthy shipment growth of 15%, gaining over 2 points of market share year-on-year. Amazon rounded out the top five with a 44% annual decline and 2 million tablets shipped globally.

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q4 2023 |

Q4 2023 |

Q4 2022 |

Q4 2022 |

Annual |

|

Apple |

14,801 |

39.2% |

19,479 |

46.1% |

-24.0% |

|

Samsung |

6,816 |

18.0% |

7,612 |

18.0% |

-10.5% |

|

Huawei |

2,815 |

7.5% |

1,441 |

3.4% |

95.4% |

|

Lenovo |

2,682 |

7.1% |

2,334 |

5.5% |

14.9% |

|

Amazon |

2,001 |

5.3% |

3,566 |

8.4% |

-43.9% |

|

Others |

8,663 |

22.9% |

7,859 |

18.6% |

10.2% |

|

Total |

37,778 |

100% |

42,291 |

100% |

-10.7% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2024 |

|

||||

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

2023 |

2023 |

2022 |

2022 |

Annual |

|

Apple |

54,038 |

40.0% |

60,843 |

40.4% |

-11.0% |

|

Samsung |

25,674 |

19.0% |

29,024 |

19.3% |

-11.5% |

|

Lenovo |

9,310 |

6.9% |

11,558 |

7.7% |

-19.4% |

|

Huawei |

8,308 |

6.1% |

6,287 |

4.2% |

32.1% |

|

Amazon |

7,796 |

5.8% |

13,646 |

9.1% |

-42.9% |

|

Others |

30,128 |

22.3% |

29,400 |

19.5% |

2.5% |

|

Total |

135,254 |

100.0% |

150,759 |

100% |

-10.3% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2024 |

|

||||

Join our analyst breakfast with rapid-fire insights from Canalys and go into your MWC meetings fully prepared for more meaningful discussions.

Register now as seats are limited - https://canalys.com/mwc

For more information, please contact:

Himani Mukka : himani_mukka@canalys.com

Kieren Jessop : kieren_jessop@canalys.com

Ishan Dutt : ishan_dutt@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor, and channel, as well as additional splits, such as GPU, CPU, storage, and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.