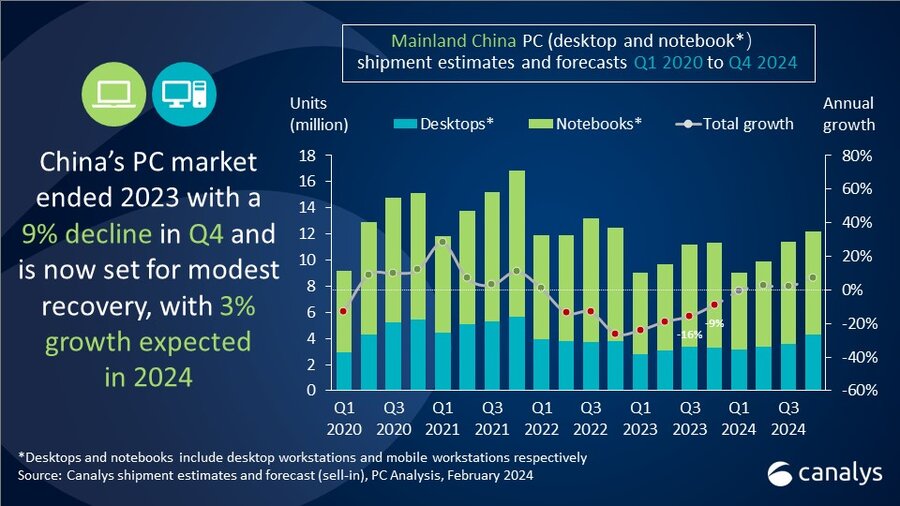

China’s PC market set for return to growth of 3% in 2024

Tuesday, 26 March 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

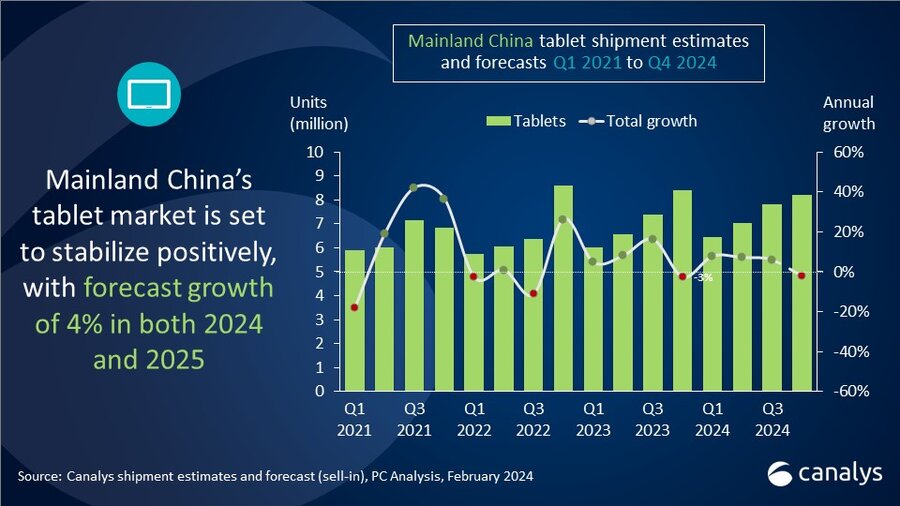

Canalys anticipates that China’s PC (excluding tablets) market will rebound to 3% growth in 2024 and 10% growth in 2025, primarily fueled by refresh demand from the commercial sector. The tablet market is expected to grow by 4% in both 2024 and 2025, benefiting from increasing penetration as digitalization deepens.

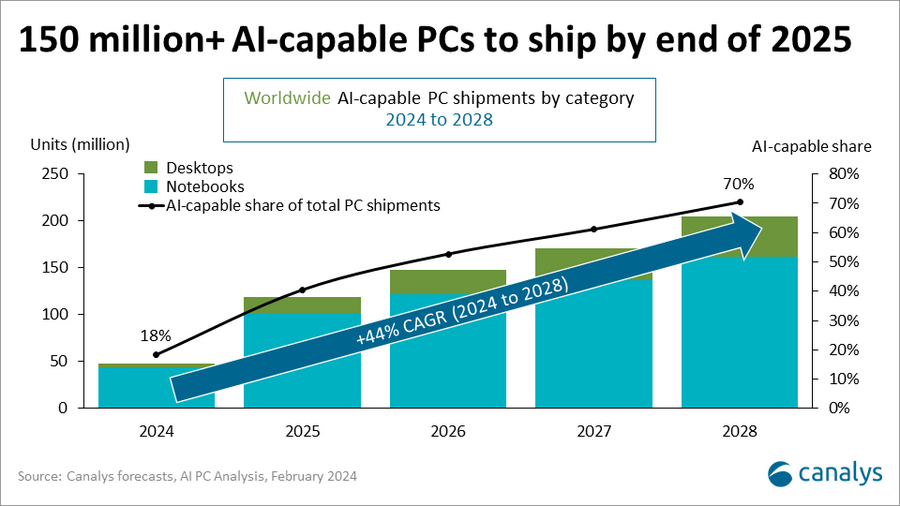

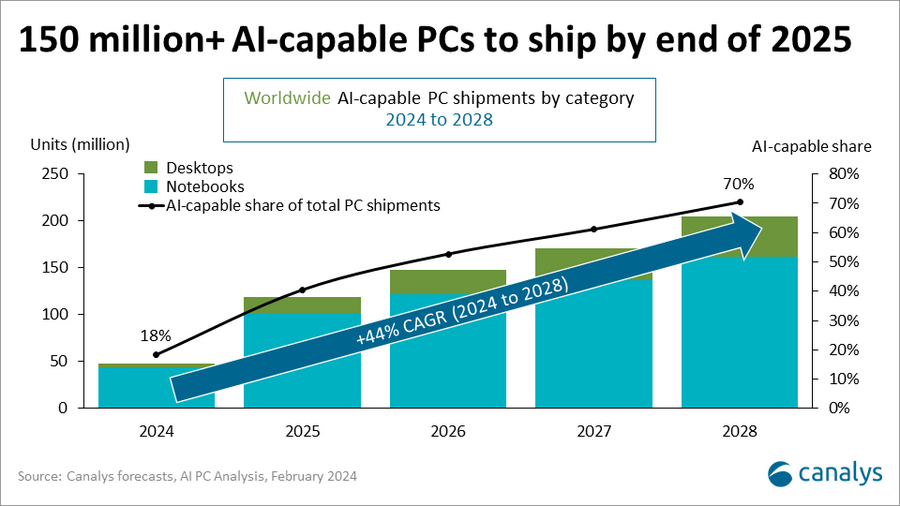

“2024 is expected to bring modest relief to a struggling PC market in China, but a challenging environment will remain,” said Canalys Analyst Emma Xu. “Ongoing economic structural adjustments are a key priority as the government seeks new avenues for economic growth, with a core focus on technology-driven innovation. AI emerged as a central theme during the latest ‘Two Sessions’ in China, with enthusiasm for AI spanning commercial entities and government initiatives aimed at establishing a domestic AI ecosystem across industries. Significant opportunities for the PC industry are set to arise from this commercial push, especially as it coincides with the upcoming device refresh and the emergence of AI-capable PCs.”

Canalys projects 3% growth in China’s PC market in 2024 and a further 10% expansion in 2025. Tablet growth is expected to reach 4% in both 2024 and 2025.

The PC (excluding tablets) market in Mainland China ended 2023 with a 9% year-on-year decline in Q4, with 11.3 million units shipped. Desktops experienced a 13% drop to 3.3 million units, while notebook shipments decreased by 7% year on year to 8.1 million units. This led to overall shipments of 41.2 million units in 2023, down 17% from 2022.

China’s tablet market saw a decline of 3% in Q4 2023 to reach 8.4 million units, with full-year 2023 shipments totaling 28.3 million in a year with increased competition as new entrants ramped up their focus on the category.

|

People’s Republic of China (Mainland) desktop and notebook forecast |

|||||

|

Canalys PC forecast: 2023 to 2025 |

|||||

|

Segment |

2023 shipments |

2024 shipments |

2025 shipments |

2024 annual growth |

2025 annual growth |

|

Consumer |

23,390 |

23,679 |

25,476 |

1% |

8% |

|

Commercial |

17,210 |

18,186 |

20,742 |

6% |

14% |

|

Education |

640 |

621 |

656 |

-3% |

6% |

|

Total |

41,240 |

42,486 |

46,874 |

3% |

10% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys PC forecast, February 2024 |

|

||||

|

People’s Republic of China (Mainland) tablet forecast |

|||||

|

Canalys PC forecast: 2023 to 2025 |

|||||

|

Segment |

2023 shipments |

2024 shipments |

2025 shipments |

2024 annual growth |

2025 annual growth |

|

Consumer |

23,755 |

25,187 |

26,441 |

6% |

5% |

|

Commercial |

3,731 |

3,495 |

3,448 |

-6% |

-1% |

|

Education |

836 |

843 |

802 |

1% |

-5% |

|

Total |

28,322 |

29,524 |

30,691 |

4% |

4% |

|

|

|

||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys PC forecast, February 2024 |

|

||||

|

People’s Republic of China (Mainland) desktop and notebook shipments (market share and annual growth) |

|||||

|

Canalys PC Market Pulse: 2023 |

|||||

|

Vendor |

2023 shipments |

2023 |

2022 shipments |

2022 |

Annual growth |

|

Lenovo |

15,536 |

38% |

19,253 |

39% |

-19% |

|

HP |

4,309 |

10% |

4,380 |

9% |

-2% |

|

Huawei |

3,986 |

10% |

3,576 |

7% |

11% |

|

Dell |

3,148 |

8% |

5,644 |

11% |

-44% |

|

Asus |

2,863 |

7% |

3,770 |

8% |

-24% |

|

Others |

11,399 |

28% |

12,876 |

26% |

-11% |

|

Total |

41,240 |

100% |

49,499 |

100% |

-17% |

|

|

|

||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys PC Analysis (sell-in shipments), February 2024 |

|||||

|

People’s Republic of China (Mainland) tablet shipments and annual growth |

|||||

|

Canalys PC Market Pulse: 2023 |

|||||

|

Vendor |

2023 shipments |

2023 |

2022 shipments |

2022 |

Annual growth |

|

Apple |

8,995 |

32% |

10,029 |

37% |

-10% |

|

Huawei |

6,460 |

23% |

3,924 |

15% |

65% |

|

Xiaomi |

3,267 |

12% |

3,811 |

14% |

-14% |

|

HONOR |

2,999 |

11% |

2,374 |

9% |

26% |

|

Lenovo |

2,316 |

8% |

2,249 |

8% |

3% |

|

Others |

4,286 |

15% |

4,376 |

16% |

-2% |

|

Total |

28,322 |

100% |

26,764 |

100% |

6% |

|

|

|

||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys estimates (sell-in shipments), PC Analysis, February 2024 |

|||||

For more information, please contact:

Emma Xu: emma_xu@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.