China’s tablet market up 4% in Q2 2022 as PC market suffers worst annual decline since 2013

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 25 August 2022

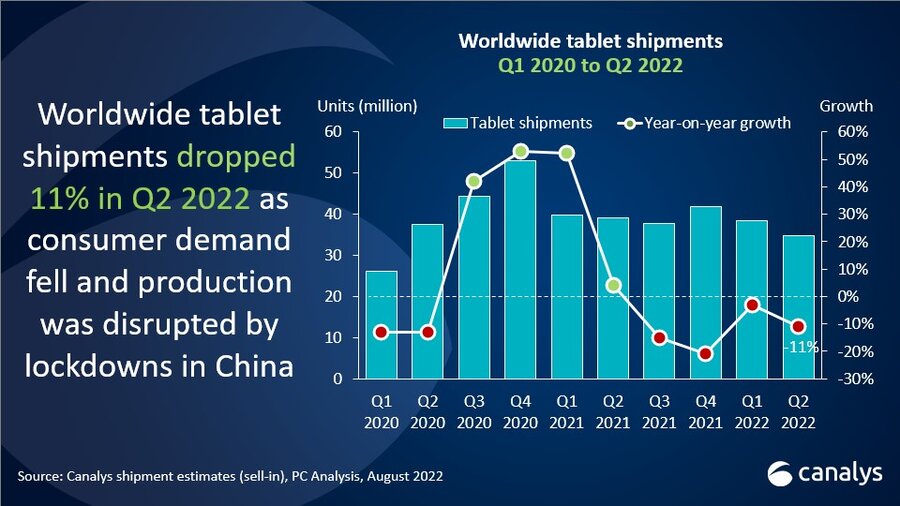

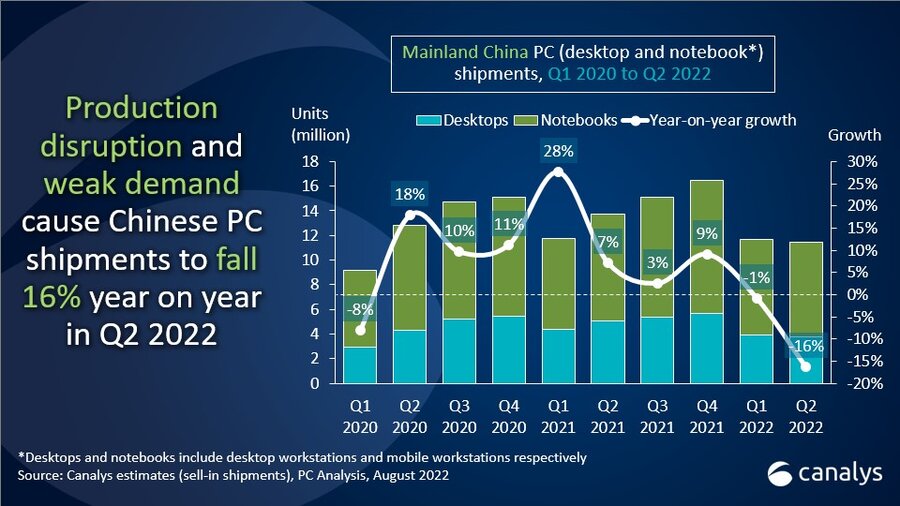

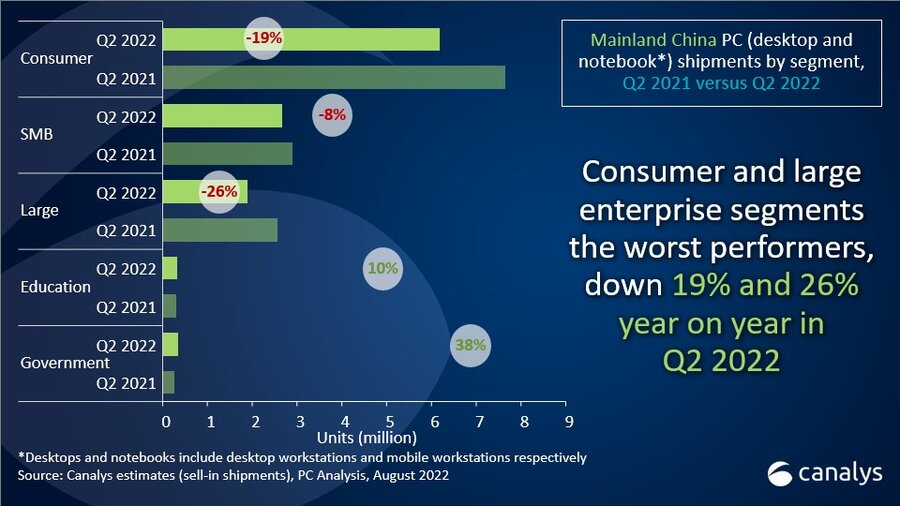

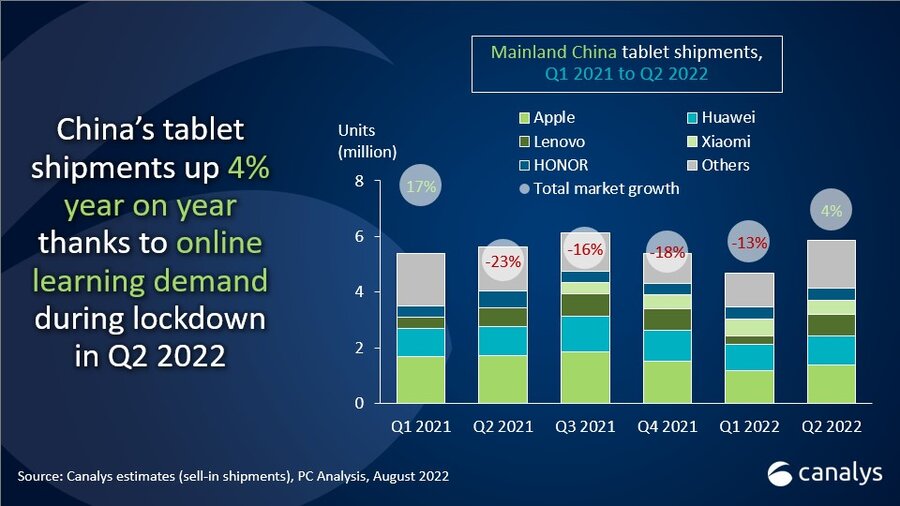

China’s PC (desktop, notebook and workstation) shipments fell by 16% in Q2 2022. Desktops (including desktop workstations) were down by 26% while notebooks (including mobile workstations) were down 10%. Both the consumer and commercial segments were hit by weak demand amid macroeconomic headwinds and a production halt in Q2, leading to 19% and 13% declines respectively. On the other hand, the tablet market recorded surprising 4% growth as the lockdown in Q2 again boosted demand for online learning.

“It was a very tough quarter for vendors in Mainland China’s PC market. The 16% fall in shipments was the worst decline in nine years,” said Emma Xu, Canalys Analyst. “Demand, both commercial and consumer, was hit hard by the strict pandemic control measures implemented across the country. In the commercial space, the biggest decline was among large enterprises. IT investment among large enterprises contracted as companies in manufacturing, real estate and the IT industry continued to face strong economic headwinds while the service sector’s recovery was still unstable as the stringent pandemic control policy continued. The only bright spots for PC vendors were the government and education, which grew 38% and 10% respectively thanks to renewal projects. But only local vendors benefited from these opportunities. On the consumer side, demand was hugely suppressed due to pandemic control measures in major cities, which affected retail traffic and willingness to spend. Consumer confidence hit rock bottom, given the macroeconomic uncertainty and job market worries, which dampened replacement demand, especially among those who use a PC as a secondary productivity tool or for leisure. In better news, demand for gaming PCs is still strong, boosting the segment by 45% year on year.”

As well as falling demand, vendors were hit by ongoing logistic and production disruption, which exacerbated supply shortages, especially for vendors such as Apple and Lenovo. Lenovo, Dell and HP kept their top three positions in the PC market in Q2, but all saw shipment declines. Huawei replaced Asus in fourth place. Asus completed the top five, shipping 0.7 million units in Q2 2022.

“Demand for tablets grew in Q2, thanks to the mass adoption of online learning among children and college students during the lockdown,” said Xu. “Top vendors, such as Huawei and Apple, are pushing new features, such as bigger and eye-protective screens, pens and cross-device interoperability features to improve productivity. While chipset constraints limit Huawei’s position, vendors such as Xiaomi and HONOR see opportunities to compete at the low end with similar value propositions. Leading local vendors are moving away from low-margin entry-level segments, investing in the mid-to-higher-end segment, which could improve synergies with their other products, helping them compete in the connected device category.”

Hit hard by production disruption, Apple suffered a 19% year-on-year decline and its tablet market share dropped to 24%. Huawei held onto second place despite supply constraints, thanks to a solid and loyal user base in its home market. Lenovo recovered its market position with a 145% sequential increase in shipments. Xiaomi and HONOR completed the top five, with 8% and 7% shares respectively.

|

People’s Republic of China (Mainland) desktop and notebook shipments |

|||||||

|

Canalys PC Market Pulse: Q2 2022 |

|||||||

|

Vendor |

Q2 2022 shipments |

Q2 2022 |

Q2 2021 shipments |

Q2 2021 |

Annual |

||

|

Lenovo |

4,622 |

40.2% |

5,603 |

40.9% |

-17.5% |

||

|

Dell |

1,623 |

14.1% |

1,887 |

13.8% |

-14.0% |

||

|

HP |

915 |

8.0% |

1,107 |

8.1% |

-17.4% |

||

|

Huawei |

838 |

7.3% |

464 |

3.4% |

80.7% |

||

|

Asus |

773 |

6.7% |

937 |

6.8% |

-17.5% |

||

|

Others |

2,715 |

23.6% |

3,717 |

27.1% |

-27.0% |

||

|

Total |

11,485 |

100.0% |

13,716 |

100.0% |

-16.3% |

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys estimates (sell-in shipments), PC Analysis, August 2022 |

|

||||||

|

People’s Republic of China (Mainland) tablets shipments and annual growth |

|||||||

|

Canalys PC Market Pulse: Q2 2022 |

|||||||

|

Vendor |

Q2 2022 shipments |

Q2 2022 |

Q2 2021 shipments |

Q2 2021 |

Annual |

||

|

Apple |

1,397 |

23.8% |

1,724 |

30.7% |

-19.0% |

||

|

Huawei |

1,039 |

17.7% |

1,034 |

18.4% |

0.5% |

||

|

Lenovo |

785 |

13.4% |

695 |

12.4% |

13.0% |

||

|

Xiaomi |

487 |

8.3% |

- |

0% |

N/A |

||

|

HONOR |

434 |

7.4% |

600 |

10.7% |

-27.6% |

||

|

Others |

1,724 |

29.4% |

1,571 |

27.9% |

9.7% |

||

|

Total |

5,867 |

100% |

5,624 |

100% |

4.3% |

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys estimates (sell-in shipments), PC Analysis, August 2022 |

|

||||||

For more information, please contact:

Emma Xu: emma_xu@canalys.com +86 158 0075 6471

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.