Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Optimizing channel finance in a consumption-based world: a guide to channel finance, pricing and inventory strategies and tools

In a consumption and subscription-based world, where evolving customer needs and rapidly advancing technologies are changing the channel and partner landscape, optimizing channel finance, pricing, and inventory strategies is essential for growth. This report covers the complexities of managing these components, providing an overview of key technologies and considerations. By embracing data-driven strategies and leveraging advanced tools, vendors can enhance partner relationships, streamline operations, and adapt to evolving market demands.

As vendors navigate evolving customer needs, adopt new business and pricing models, and partner with a diverse range of partners, optimizing channel finance and pricing strategies has become more complex than ever. With 2025 planning upon us, vendors are asking how to effectively drive efficient growth at scale. This report breaks down what vendors should be thinking about when it comes to channel finance and pricing, and the emerging tools available to help them navigate this growing complexity.

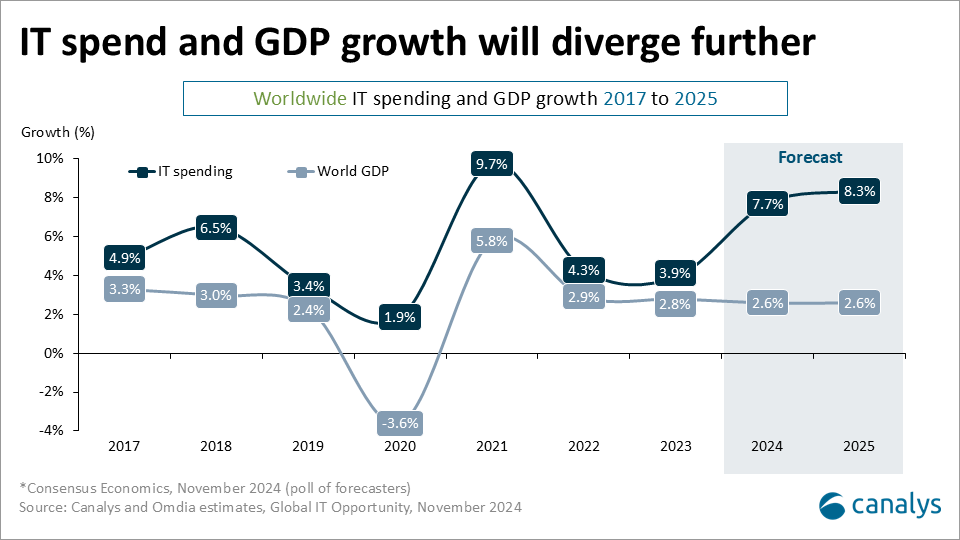

The convergence of rapid technological advancements and AI-driven innovation is reshaping vendor business and pricing models at an unprecedented pace. Traditional billing models and inventory management strategies are shifting quickly, moving from traditional product billing (the 1980s to 2000) to subscription (in the 2000s) to modern consumption models and GenAI pricing models based on outcomes or usage today.

Subscription hardware models, such as HPE GreenLake, Dell Apex, Lenovo TruScale and Cisco Plus are also redefining the channel landscape. These models shift the traditional hardware ownership paradigm to a consumption-based approach, allowing organizations to pay for IT resources as they use them. This flexibility allows businesses to scale their infrastructure up or down as needed, reducing upfront costs and optimizing resource utilization – fundamentally changing channel finance.

In alignment with shifts to subscription and consumption frameworks, partner business models are also adapting to as-a-service and consumption models by offering more consulting and managed services around the tech. A recent Canalys study indicates that 80% of partners now offer three or more services, with resell, managed services and consulting services topping the list.

This shift toward service-oriented and usage-oriented offerings introduces an additional layer of complexity when considering customer value and partner profitability for vendors. This necessitates new methods of pricing the tech and incentivizing and managing partners throughout the customer lifecycle.

Key considerations and implications for vendors as they approach channel finance, inventory and pricing models in this new environment of complexity:

- Transition to subscription and consumption: vendors must shift with the industry to consumption-based channel metrics and develop flexible financial strategies that align with these models and provide incentives for higher usage and renewals.

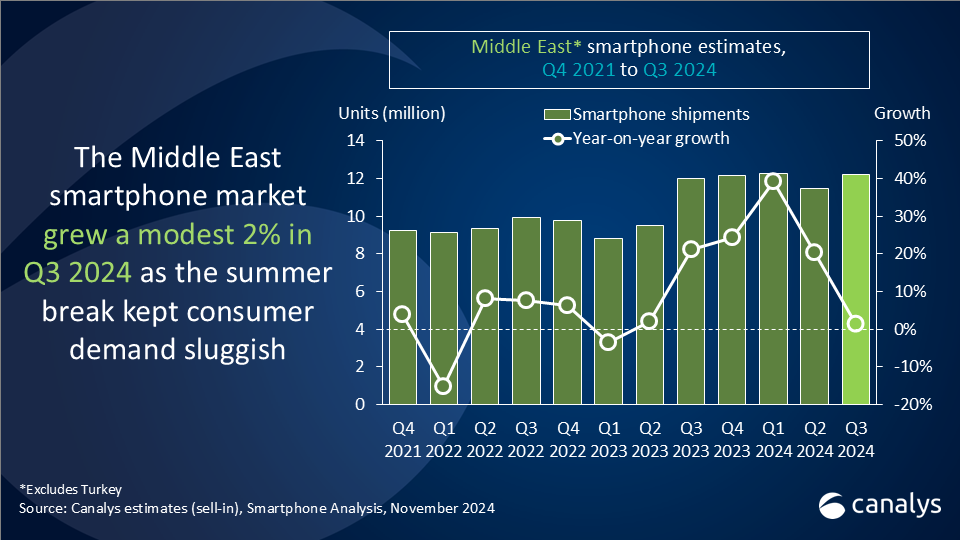

- Dynamic inventory management: vendors must implement advanced and dynamic inventory management systems to adapt quickly to fluctuating demand, changes in customer usage patterns, rapid IT advancements, and evolving partner needs.

- Enhanced customer engagement: vendors need to build end-customer satisfaction and retention into their channel finance strategies and models and incentivize partners to deliver value-added services so customers can derive maximum value from technology.

- Data-driven strategies: vendors must establish a centralized data repository for channel data with seamless integrations to other business systems to enable real-time insights and optimize channel performance. Machine learning and AI help vendors better predict demand, optimize pricing and improve inventory management.

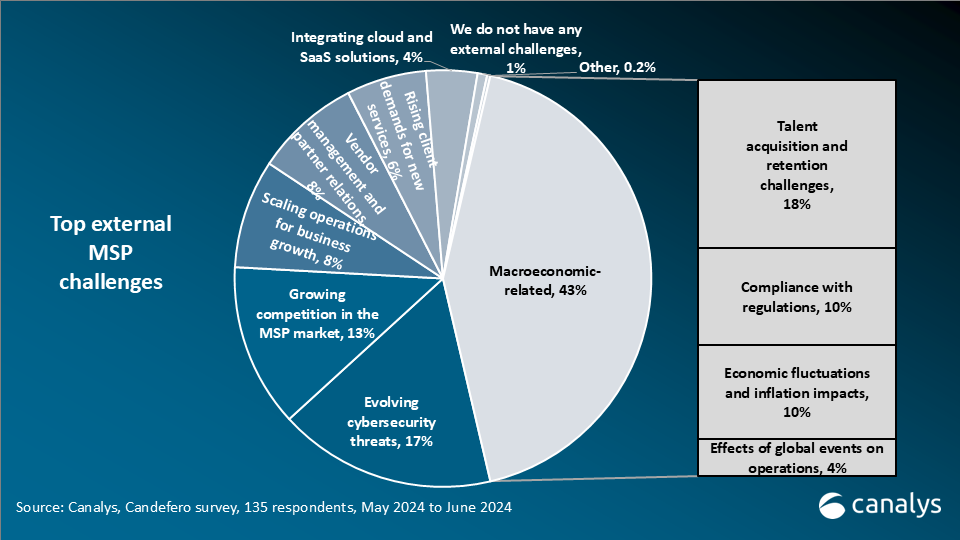

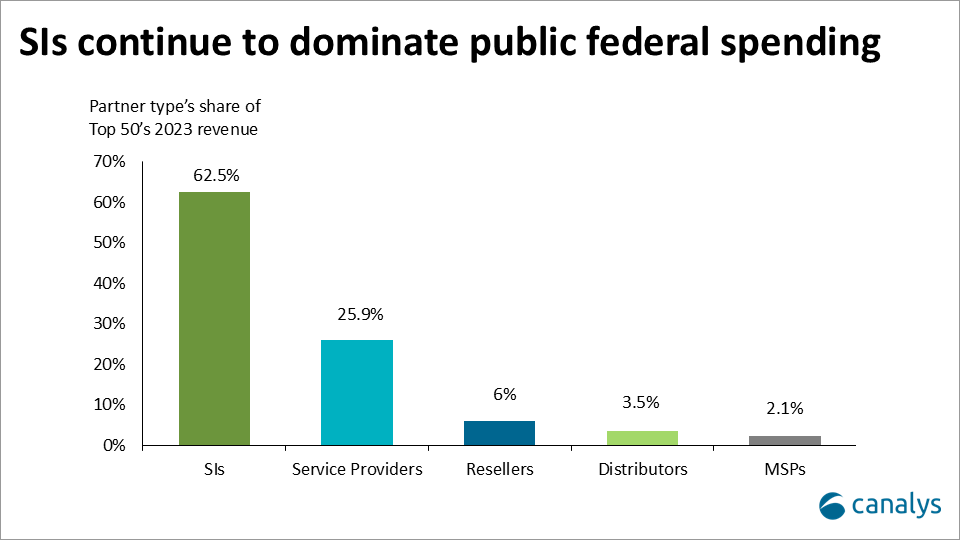

- Managing complex partner ecosystems: vendors must adapt their channel strategies to accommodate the evolving partner landscape. This includes embracing a diverse range of partner types that are growing in influence, from MSPs to GSIs to cloud marketplaces. By tailoring their finance and pricing strategies to each partner segment, vendors can further optimize growth.

To tackle these challenges, vendors must adopt a data-driven, agile approach to channel finance, pricing and inventory, and align strategies with evolving consumption-based models. By leveraging centralized data and AI-powered tools, vendors can optimize partner finance strategies and drive growth.

What are channel finance, pricing and inventory management tools?

Channel finance, pricing and inventory tools are designed to address these challenges and maximize business growth for both technology vendors and their partners. These platforms streamline complex financial and operational processes, enabling organizations to:

1. Effectively manage channel finance

- Govern indirect sales financials

- Automate and streamline finance, reporting, and partner payout processes routine

- Optimize forecasting and budgeting

- Utilize real-time data and analytics to make better business decisions

2. Optimize channel pricing strategies

- Implement dynamic pricing models

- Set and manage partner discounts and rebates

- Ensure consistent and optimized pricing across channels

- Optimize pricing strategies based on data

- Manage complex subscription and consumption pricing models

3. Optimize inventory management

- Optimize inventory levels to minimize costs

- Forecast demand

- Track and manage inventory

4. Optimize channel deal management

- Streamline quotes

- Track and manage recurring revenue, renewals, churn

- Calculate usage-based charges and prorate revenue

5. Enhance partner management

- Design and manage effective incentive and payout programs to motivate partners

- Provide real-time insights and reporting to partners

- Automate partner payouts and commissions

- Automate and streamline end-to-end deal management

By leveraging channel finance tools, vendors can improve operational efficiency, enhance partner relationships and ultimately drive growth.

The channel finance, pricing and inventory landscape

According to Canalys research, the broader ecosystem software industry boasts 233 active companies, generating US$5.3 billion in revenue. This number is projected to jump to US$11.8 billion by 2028 as more companies put an emphasis on data-driven ecosystem strategies.

There were 26 channel finance, pricing and inventory players in 2023, delivering US$753 million in revenue. The market is expected to grow to US$1.13 billion by 2028.

Key players

- 360insights (Whitby, Ontario): 360insights boosts partner engagement and management, and uses data to help vendors better manage partner ecosystems.

- AppXite (Riga, Latvia): AppXite is an ecosystem marketplace, subscription billing and management platform for distributors, vendors, MSPs, and sellers, enabling seamless buying, provisioning, and billing.

- Channel Mechanics (Galway, Ireland): Channel Mechanics automates channel program management, making it easier for partners to do business with vendors.

- Channeladvisor (Acquired by Rithum) (North Carolina, USA): Rithum is a leading e-commerce network platform that streamlines operations to drive profitable growth.

- Channelkonnect (India): ChannelKonnect is a channel management platform with channel stock, sales and order management capabilities.

- Cleverbridge (Cologne, Germany): Cleverbridge is an all-in-one e-commerce for global subscription businesses, consolidating payments, subscription management, tax/VAT handling and regulatory compliance.

- CloudBlue (California, USA): CloudBlue, an Ingram Micro company, is a monetization platform powering digital ecosystems, subscription businesses and marketplaces.

- Computer Market Research (Nevada, USA): Computer Market Research empowers companies to efficiently manage channel partnerships, optimize programs, inventory and point-of-sale data, and drive ROI.

- Conga (Colorado, USA): Conga has a revenue lifecycle management solution that drives efficiency with order configuration, execution, fulfillment, contract renewal processes and more.

- DealHub.io (California, USA): DealHub is a complete quote-to-revenue solution designed to drive sales processes forward faster.

- demandbridge (Maryland, USA): demandbridge offers a platform that enables distributors to service customers across sales, inventory, business operations, procurement and marketing efforts.

- e2open (Texas, USA): e2open is a supply chain management platform, transforming how companies make, move and sell goods and services.

- iasset.com (Colorado, USA): iasset.com offers a platform for technology vendors, distributors, resellers and MSPs to streamline and automate critical sales and revenue operations.

- Model N (California, USA): Model N is a revenue management solution that automates pricing, incentive and contract decisions for tech, pharma, and semiconductor companies.

- OneBill (California, USA): OneBill helps vendors streamline complex billing, quote-to-cash, order fulfillment, provisioning, revenue management and channel partner enablement, and more.

- Oracle (Austin, Texas): Oracle PRM is an integrated partner portal solution designed to enhance the partner experience.

- Pricefx (Pfaffenhofen, Germany): Pricefx offers AI price management and optimization software to maximize margins and profits.

- PROS (Texas, USA): PROS provides AI-powered SaaS solutions for pricing, configure price quote (CPQ), revenue management and digital offers, serving both B2B and B2C companies.

- RebateMAX (Texas, USA): RebateMAX provides Intelligent Rebate Orchestration for digital supply chains, helping distributors, manufacturers and more to optimize B2B channel incentive programs.

- Renewtrak (Australia): Renewtrak is a renewals and subscription automation platform that empowers tech companies to control their recurring revenue streams and automate quoting through complex distribution channels.

- Salesforce (San Francisco, CA): Salesforce PRM includes tools for partner management, deal management, automation of partner lifecycles and partner sales processes, and analytics, with benefits tied to the overall Salesforce platform.

- SAP (Germany): SAP is a leading Enterprise Resource Planning (ERP) platform, offering channel and partner finance, planning and management tools.

- servicePath (Canada): servicePath automates the CPQ process to make building quotes easier, faster, more streamlined and sophisticated. It helps tech vendors, software companies, MSPs, SIs and VARs enhance quote velocity/governance and revenue.

- Vendavo (Colorado, USA): Vendavo helps global manufacturers and distributors drive predictable, profitable outcomes with the most robust B2B price, CPQ, and rebate management solutions.

- Vistex (Illinois, USA): Vistex provides financial planning, incentive management and pricing tools for industries like distribution, manufacturing, agriculture, tech, and more.

- Yagna iQ (Texas, USA): Yagna Channel Ecosystem Platform connects vendors, distributors, resellers and end customers for secure and seamless channel transactions.

Future of channel finance, pricing and inventory category

Looking ahead, channel finance tools will continue to incorporate more AI and machine learning to better optimize the changes in partnering that are underway. Seamless integrations with other business systems will improve data-driven, real-time decision-making and provide deeper insights and improved analytics.

The channel and partner technology ecosystem will continue to grow and evolve. Larger platform players are poised to acquire smaller, specialized solutions to create more powerful platforms, and new startups will innovate in these areas, causing the channel tech stack to expand. This will drive the development of more robust ecosystem management platforms, offering a broader spectrum of services and capabilities that include channel finance, pricing, and inventory tools as a foundational layer.

Conclusion

By leveraging robust channel finance, pricing and inventory tools, vendors are better armed to navigate the complexities of channel and partnership finance today. These tools provide the data-driven insights and automation capabilities needed to optimize partnerships and profitability. As the channel landscape continues to evolve, these tools will become even more essential for maximizing profitability and driving sustainable growth.