Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

Motorola springs forward its premiumization strategy at the 2025 spring launch event

In its spring launch event held in New York City in April 2025, Motorola introduced a series of new features and devices. The announcements covered a large array of topics from AI to partnerships to ecosystem products to branding to the latest Razr flagship device, all being highly reflective of some of the key pillars within Motorola’s strategic direction.

Motorola introduced its latest generation of features and flagship devices in its spring launch event held in New York City on 23 to 24 April 2025. In an action-packed event, Motorola announced an ambitious expansion of Moto AI, new smart personal audio products and wearable bands, and stand-out designs in the latest generation of Razr and Edge smartphones, all presented through a series of partnerships. All of these are key components in Motorola’s strategy to reach its global scale and premium device growth ambitions. The announcements revealed several core strategic elements that Motorola is using to differentiate itself in a fiercely competitive industry.

Partnership-driven Moto AI signals agentic AI direction

Motorola’s agentic AI solution, Moto AI, took center stage in this event, closely aligning with the Lenovo group’s prioritization of AI. Moto AI targets a few core use-cases, in which Motorola aims to deliver consistent and reliable features to build user confidence and accelerate usage. Its AI features are cleverly named—for example, “Remember this” and “Catch-me-up”—outrightly defining the use case, which might turn out particularly beneficial to less tech-savvy users. After first being showcased at the Lenovo Tech World 2024 last year as proof of concept, these features are ready to be expanded to more devices.

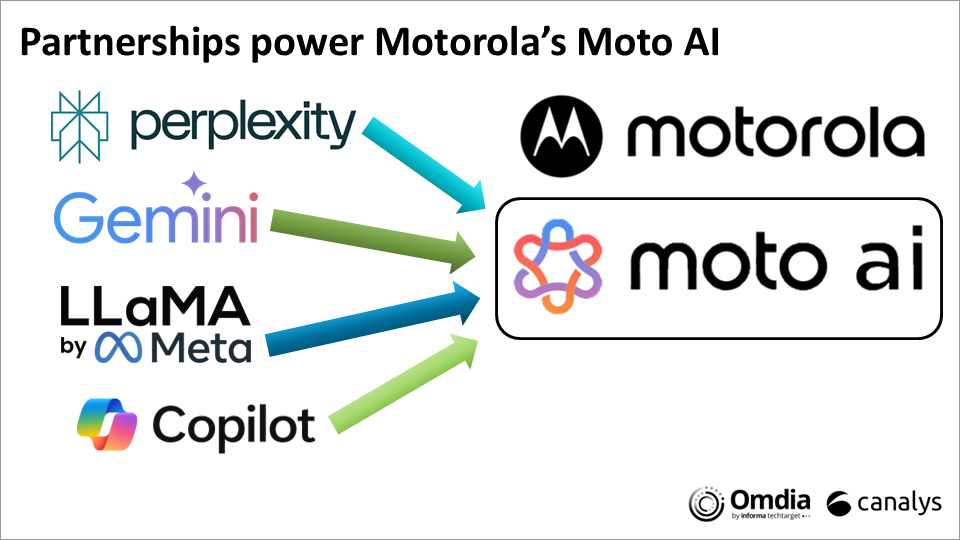

Unlike its major competitors, Motorola’s AI features are developed in partnership with Perplexity, Google Gemini and Meta Llama. Additional features from Microsoft Copilot are anticipated to be announced later this year. The partnerships will allow Motorola to utilize each partner’s expertise while also avoiding overdependence upon one provider alone.

However, it is still early days for Moto AI and it remains limited to a small selection of productivity and picture-editing features. Additionally, it will quickly become a question of when—not if—Lenovo will aim to create a cross-ecosystem agentic AI solution, making the current solutions key to matching the competition but without the need to thrive ahead.

Category expansion through Moto Buds LOOP and Moto Watch FIT

Motorola introduced two unique products to its connected device ecosystem (branded as Moto Things) with Moto Buds LOOP (open-ear-clip TWS) and Moto Watch FIT (RTOS-driven basic watch). Building a wide device ecosystem is a key pillar for both Lenovo and Motorola—to expand their value proposition to find cross-selling and bundling opportunities and in search of new revenue streams. Although Motorola is still in the early stages of expanding its in-house developed connected devices portfolio, its long-term ambition as a device vendor hints at the status quo only being the beginning. Leveraging Smart Connect effectively will be essential for Lenovo and Motorola to create consistent and interconnected user experiences powered by AI, particularly if the ecosystem expands into connected life products.

The new ecosystem categories further extend Motorola’s “lifestyle tech” brand repositioning. To support this shift, Motorola seeks to align closer with the fashion industry, exemplified over the last years by a strong color partnership with Pantone. Additionally, one SKU of the Moto Buds LOOP is designed with crystals from Swarovski, also marking another key partnership for Motorola to connect closer to fashion.

CMF is a strong differentiator in the new Razr generation

Motorola is among the few vendors using a flip-shaped flagship for its portfolio, as more and more vendors have defaulted to ultra-premium foldables. The new Razr 60 Ultra and Razr Ultra (2025) are the first flip-shaped models using Qualcomm’s Snapdragon 8 Elite. Additionally, Motorola introduced Razr 60, Razr (2025) and Razr+ (2025), expanding its flip-portfolio, partly to help volume growth and support broader channel coverage.

The focus on CMF (color-material-finish) continues to serve as a key differentiator and to gain attraction. As some of Motorola’s main competitors have brightened up their portfolios, Motorola is increasingly using alternative materials, such as actual wood and Alcantara, on its cover as well as delving deeper into how the materials have been created. The unique colors and materials integrate closely with lifestyle tech, to which Motorola also will lean further into exploring new use-cases on the front display.

Motorola’s premium ambition will be a gradual expansion with challenges

Canalys (now part of Omdia) forecasts Motorola to outpace the overall smartphone market in 2025, to exceed 60 million units following a strong 23% growth in 2024. For Motorola, its premium push is predominantly intended to drive ASP and revenue growth. However, strengthening its premium proposition is not solely intended to create Edge and Razr growth, but also to have externality effects on the wider portfolio. The latter point is particularly key as Motorola’s current business largely depends upon the sub-US$300 price segments, which it must prioritize to maintain stability. The 2025 spring launch event will be key for Motorola to take the next steps forward for this year.

Canalys (now part of Omdia) clients can access an in-depth report discussing Motorola and Lenovo’s strategic outlook in the smartphone industry in 2025, exploring:

- How Motorola and Lenovo are reaching for strong volume growth in the upcoming years.

- Why connected ecosystem devices are being introduced and how they sit within Motorola and Lenovo's value proposition.

- Key components in Motorola's premiumization ambitions, including Moto AI, lifestyle tech branding and CMF vision.

- The position of B2B and how Motorola is building its software and hardware ecosystem, closely aligned with Lenovo.