Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Arm and Qualcomm’s licensing dispute could nudge market dynamics and future competition

Recent news about Arm notifying Qualcomm of its intention to terminate its technology licensing agreement has raised considerable concerns in the market.

If the license termination does indeed materialize, while it may not immediately disrupt short-term shipments, it would introduce a layer of legal concerns for vendors. There is a high likelihood that Arm will seek to prohibit vendors from using all Oryon-based SoCs, affecting products equipped with the Snapdragon X series and recently announced 8 Elite, which may lead to increased legal costs to device vendors. Moreover, if this legal dispute continues, it may compel vendors to consider shifting to competitor products or, at the very least, develop parallel alternatives to mitigate legal risks, hindering Qualcomm’s new product rollouts.

The short-term impact remains minimal and is unlikely to hinder the development of the AI PC market

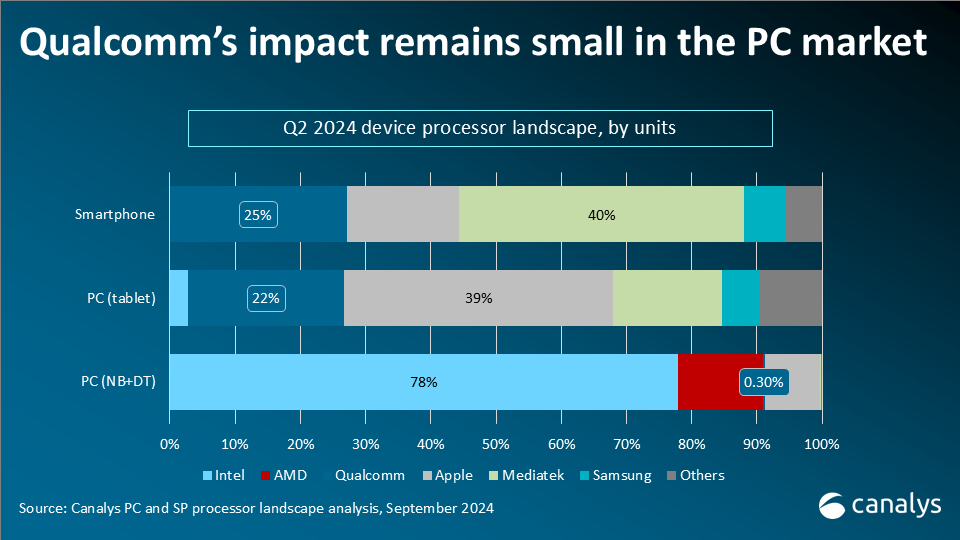

While the potential impact of the Arm-Qualcomm dispute on the AI PC market has garnered significant attention, it is important to consider that the potential termination of Qualcomm’s license – an unlikely scenario that would require further legal confirmation – would have a far more substantial impact on the smartphone, automotive and IoT markets (including XR and wearables) than on the PC sector. Though Qualcomm currently holds an early advantage in the CoPilot+ PC segment with its X series processors, Microsoft’s plans to introduce CoPilot+ support for x86 processors by the first half of 2025 could potentially mitigate Qualcomm’s advantage and shift the market dynamics back toward the x86-dominated market, which is likely to continue to drive the development of AI-capable PCs. To put this in perspective, Canalys anticipates that Qualcomm’s shipments in 2024 will account for less than 1% of the total notebook market, highlighting a significant volume gap compared with x86 systems.

On the contrary, Qualcomm maintains a dominant position in the tablet, smartphone and automotive sectors. As of Q2 2024, Canalys data indicates that Qualcomm holds a 22% share of the tablet market and a 25% share of the smartphone market. Furthermore, Omdia reports that Qualcomm led the automotive logic IC market in 2023 with a 20% share.

Qualcomm just introduced two significant new products based on its Oryon CPUs at the Snapdragon Summit 2024. In the smartphone market, Qualcomm has followed its typical product launch rhythm by introducing its new flagship, the Snapdragon 8 Elite, which incorporates the Oryon CPU and debuts a new naming convention. Though a few early models featuring the chip have already been launched, more are expected to be announced in the coming months, with shipments projected to ramp up from Q1 2025. Consequently, the short-term impact on the industry remains limited.

In the automotive sector, Qualcomm brought out the Snapdragon Cockpit Elite and Snapdragon Ride Elite automotive SoCs. Given the lengthy integration and design cycles, products using Oryon CPU-based automotive solutions are anticipated to reach the market by late 2025 or early 2026. This timeline suggests that there will be a minimal immediate impact on the market.

Arm could be increasingly motivated to deepen its collaboration with MediaTek across all fronts

But as Qualcomm gradually shifts away from Arm’s standard architecture, MediaTek is poised to become the largest user of Arm’s standard designs, transforming the competition between Qualcomm and MediaTek’s flagship smartphone chips into a performance showdown between Qualcomm’s Oryon CPU and Arm’s standard architecture. This intensifying legal dispute has also made Arm more inclined to strengthen its partnership with MediaTek, potentially enhancing Nvidia’s market entry abilities as it plans to join the PC CPU market in H2 2025, with notable interest already shown from various PC vendors. Together, these shifts introduce new dynamics across the mobile, automotive, IoT and PC markets.