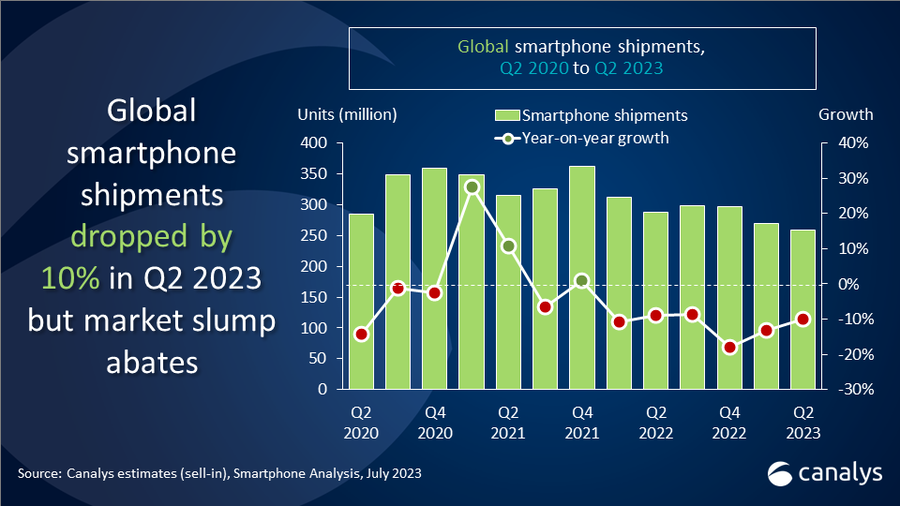

Global smartphone market decline softens as shipments drop 10% in Q2 2023

Thursday, 27 July 2023

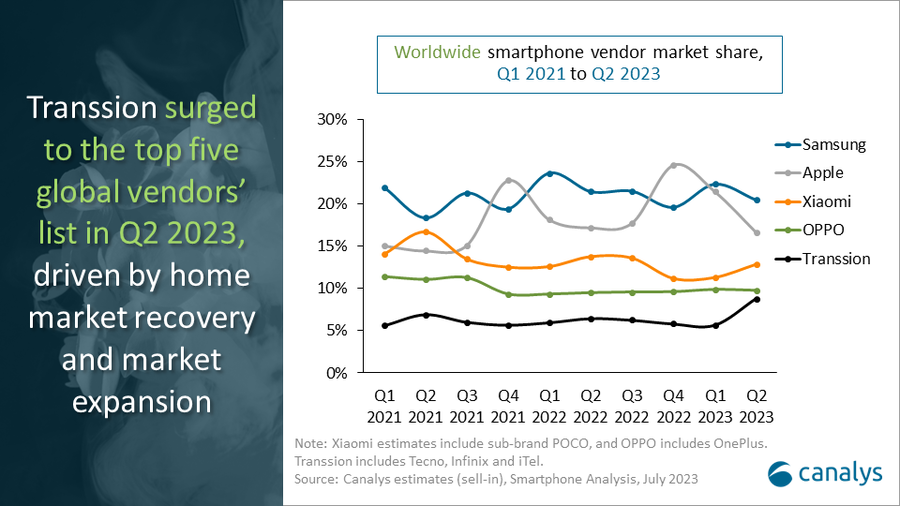

Canalys's latest research reveals that the worldwide smartphone market fell by 10% to 258.2 million units in Q2 2023, showing a slowdown in decline. Samsung secured the top spot by shipping 53.0 million units. Apple retained the second spot with 43.0 million units of shipments and a 17% market share. With a normalized inventory level, Xiaomi ranked third with 33.2 million units of shipments. OPPO (including OnePlus) defended its number four position with a 10% market share. Transsion Group (includes Tecno, Infinix and iTel brands), benefiting from recovery opportunities in the African market and other emerging markets they recently expanded into, leaped into the top five for the first time and shipped 22.7 million units, experiencing 22% annual growth.

“The decline in the global smartphone market has once again narrowed, helped by an industry-wide inventory reduction and signs of demand recovery in certain regional markets,” commented Amber Liu, Analyst at Canalys. “Samsung has adopted a conservative strategy amid profitability pressure and slow recovery in the semiconductor industry. With the second quarter being a low season with fewer new launches, Samsung has seen its lowest Q2 performance since 2013. With the high-profile release of its latest Galaxy Z Flip and Fold models, it has clearly demonstrated its ambition to compete with Apple in the luxury market. This strategic move is crucial for its anticipated recovery over the next nine to 12 months. Transsion, on the other hand, rapidly captured the pent-up low-end demand in the Middle East and African markets where the stabilizing foreign exchange also supported channel partner confidence. Additionally, its expansion in Latin America in the past few quarters has allowed the vendor to capture low-end demand in some under-penetrated markets.”

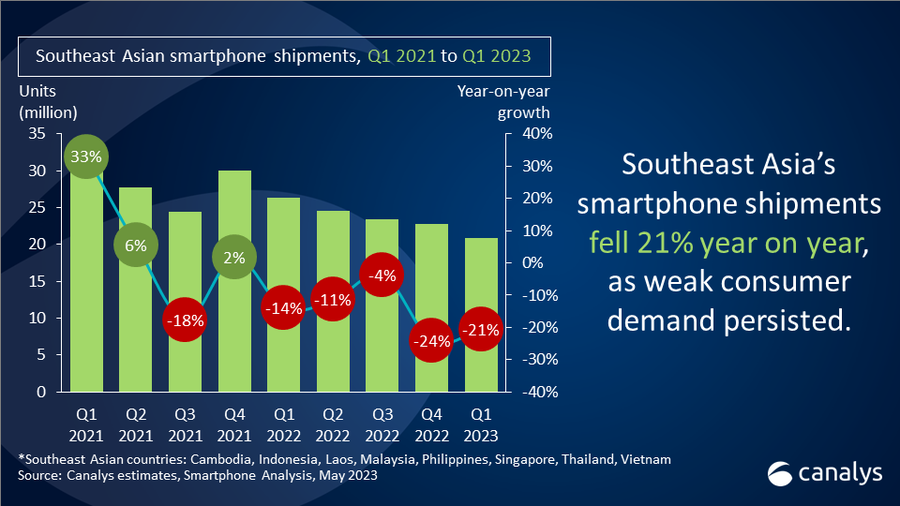

“The pace of recovery varies significantly across regional markets,” said Sanyam Chaurasia, Analyst at Canalys. “The increasing vendor investments and recovery in consumer demand are driving forces in regions such as the Middle East and Southeast Asian markets. On the other hand, the Latin American market exhibited steady shipment recovery as vendors are pushing into open channels. This has put pressure on leading operators facing pressure in the core subscription business.”

“We anticipate a moderate decline in the global smartphone market in 2023,” added Liu. “In the first half of the year, the smartphone supply chain has seen order and margin warming up, helped by increased component prices and reduced channel inventory levels. Emerging vendors are more agile and open to new market opportunities. We expect a healthier business environment in the second half, creating a more positive vibe across industry players. Companies that can balance short-term market spike and long-term structural changes will come out strong from this round of downcycle.”

|

Global smartphone shipments and annual growth |

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

Samsung |

53.0 |

21% |

61.8 |

21% |

-14% |

|

Apple |

43.0 |

17% |

49.5 |

17% |

-13% |

|

Xiaomi |

33.2 |

13% |

39.6 |

14% |

-16% |

|

OPPO |

25.2 |

10% |

27.3 |

10% |

-8% |

|

Transsion |

22.7 |

9% |

18.5 |

6% |

22% |

|

Others |

81.1 |

31% |

90.7 |

32% |

-11% |

|

Total |

258.2 |

100% |

287.4 |

100% |

-10% |

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. Transsion includes Tecno, Infinix and iTel. |

|

||||

For more information, please contact:

Amber Liu: amber_liu@canalys.com

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other parameters. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.