Cloud services spend in China hits US$7.3 billion in Q1 2022

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 8 June 2022

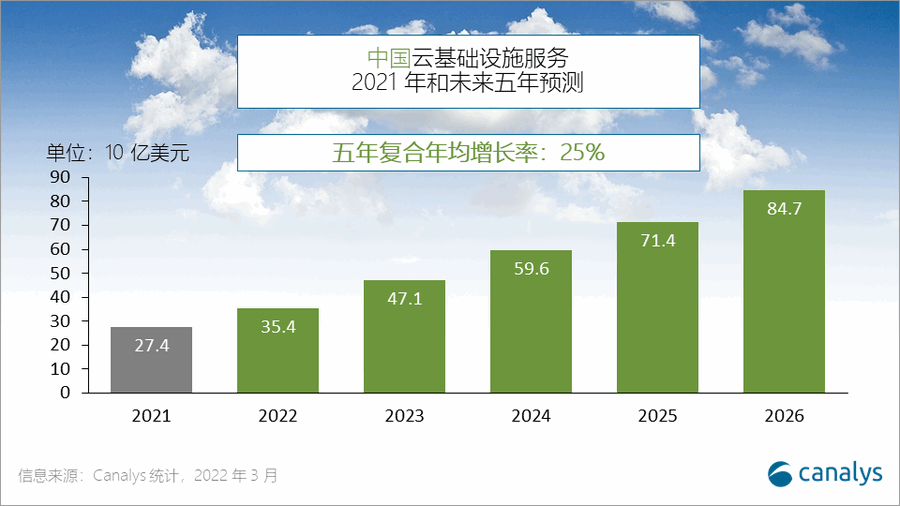

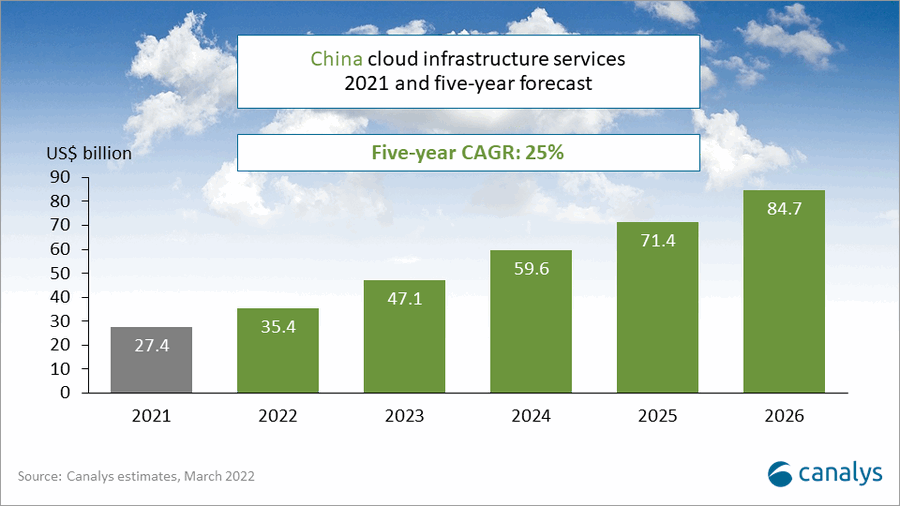

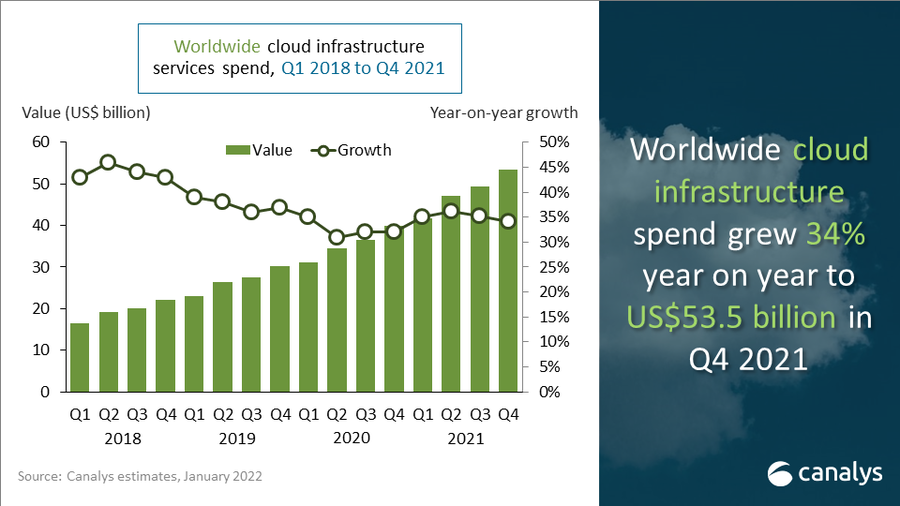

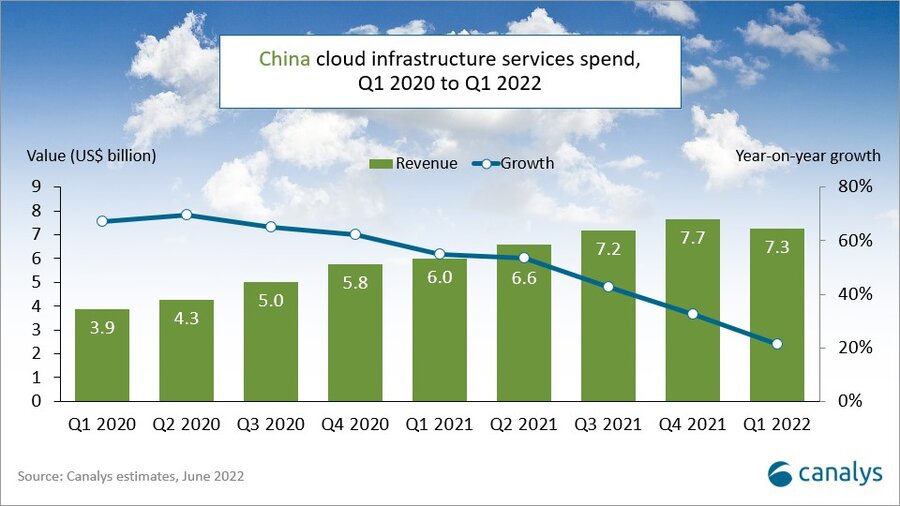

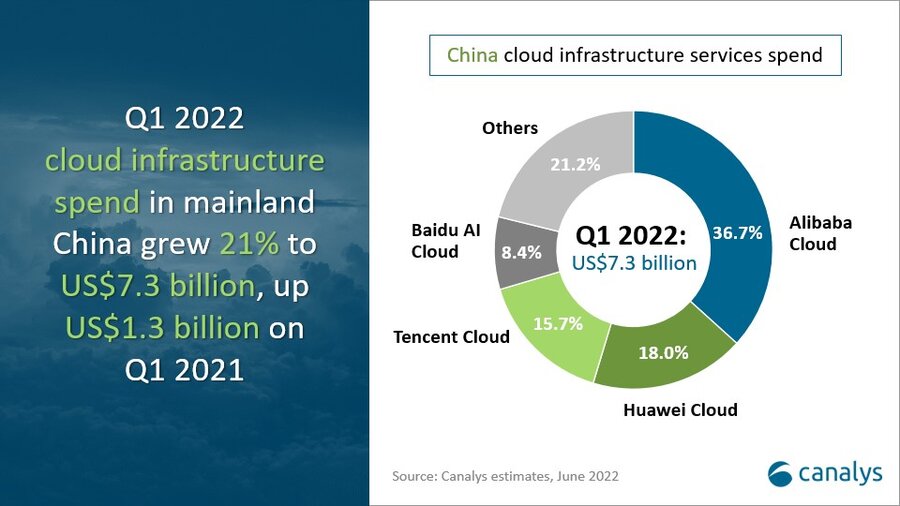

Cloud infrastructure services expenditure in mainland China grew 21% year on year to reach US$7.3 billion in Q1 2022, US$1.3 billion more than in Q1 2021, and 13% of global cloud infrastructure spend. Though spending was below expectations, China continues to be the leading growth market. Since March 2022, a resurgence of COVID-19 has hampered the delivery of both new and ongoing projects, resulting in a dampening of overall revenue in the Chinese cloud infrastructure services market. But with accelerated deployments due to China’s New Infrastructure plan and the increasingly urgent need for the digital transformation of enterprises, cloud service providers are still capturing new opportunities for their infrastructure services. The market leaders in China remained unchanged in Q1 2022, with the top four cloud service vendors being Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu AI Cloud. The top four providers have benefited from the expansion of cloud use and accounted for 79% of total expenditure in China, an increase of 19% year on year.

The negative impact of the resurgence of COVID-19 on overall spending on cloud services is temporary. The pandemic has changed the long-term business model for most enterprises, with more organizations relying on ecommerce and remote working to complete transactions. Coupled with policy guidance in China, the urgency for enterprises to migrate to the cloud is higher than ever. The difference in service capabilities among the cloud service providers is shrinking, leading to a state of “involution” and accelerating competition. In response to this dynamic, China’s cloud titans are enhancing their abilities to combine specific industry experience with cloud services by developing their service ecosystems, focusing on those partners with experience in key verticals.

“Cloud has become a popular choice for IT enterprises and cloud services are moving up the stack from data center offerings to more industry-specific solutions,” said Canalys Research Analyst Yi Zhang. “Strategies of multi-cloud deployments and multi-service provider delivery are common in the market, and cloud vendors and ISVs from vertical industries are increasingly looking to build more flexible portfolios.”

“Currently, China’s hyperscalers are rapidly expanding their abilities to provide solutions for specific industry customers,” said Canalys VP Alex Smith. “But they are not doing this alone. Instead, they are growing their bases of specialized ecosystem partners across different vertical industries to achieve both technical and industry-specific problem-solving capabilities.”

Canalys defines cloud infrastructure services as services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact:

Yi Zhang (China): yi_zhang@canalys.com +86 158 217 33391

Alex Smith (US): alex_smith@canalys.com +1 650 308 6687

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.