LATAM’s short-term economic and political outlook: Chile, Colombia, Mexico and Peru

20 July 2022

The economic deterioration caused by the pandemic in Latin America, combined with a very small number of social protection measures, accelerated the protests that started in Chile in 2019. This brought to power a new wave of left-wing leaders in traditionally right-wing countries.

The economic deterioration caused by the pandemic in Latin America, combined with a very small number of social protection measures, accelerated the protests that started in Chile in 2019. This brought to power a new wave of left-wing leaders in traditionally right-wing countries, such as Peru, Chile and Colombia. This has quelled the protests. But the upper-middle and upper classes are concerned about structural changes to their democratic systems and economic models.

Even as inflation hits around the world, Latin America has been able to cope better than historically low-inflation economies. Commodities, along with a history of inflationary periods and currency depreciations have prepared the region for one of the most challenging periods in recent history. Each market, government and central bank will decide its position in a new global order. Considering the varied evolution of each Latin American economy, we will take a closer look, market by market.

Argentina: Inflation in Argentina is expected to reach new heights in 2022, with a yearly inflation rate until June 2022 of 64% for the last 12 months. For the first time since 2013, Argentina’s cumulative inflation from January to May 2022 overtook that of Venezuela, though most forecasts point to yearly inflation ending up at about 79% by the end of 2022. This has been further fueled by the escalating appreciation of the US dollar and the non-stop depreciation of the Argentinian peso.

The rising cost of energy is affecting the US dollar reserves of the Argentinian Central Bank. The government is now limiting imports from large distributors of non-capital goods. This will affect consumer goods imports and prices for end users. Large distributors may need to turn to the informal currency market to acquire dollars, where the exchange rate is almost double the official one.

Despite this hyperinflationary situation, consumption is growing, supported by fears of further rocketing prices toward the end of the year and an increasing number of financing options. These include cards, apps and, especially, Mercado Pago, which is commonly used to buy electronics goods. The Qatar World Cup could help push consumption of electronic goods up toward the end of the year, which will help maintain GDP growth at around 3.5% in 2022.

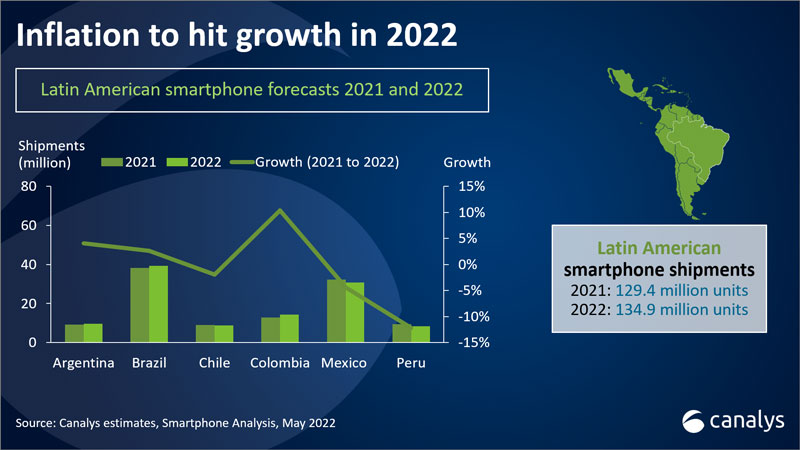

In the short term, Argentina’s smartphone shipments will grow by 4% year on year in 2022 to reach 9.7 million units.

Brazil: Consumption is slowly picking up in Brazil. The initial appreciation of the Brazilian real helped to contain inflation, though a soaring US dollar is making this harder due to the US Federal Reserve System hiking up interest rates.

Families are using credit cards to finance themselves and pay in instalments to avoid long-term debt, given the current political and economic uncertainty. Government stimuli are helping to maintain momentum and contain inflation by raising interest rates, along with the appreciation of the real.

The delay of 5G roll-out in Brazilian state capitals, moving closer to the end of the year, along with the late 2022 World Cup, is delaying the recovery of consumer electronics in Brazil. A bounce back is now expected in Q4, right after the elections.

Canalys expects the Brazilian smartphone market to grow by 2.6% year on year to 39.2 million units in 2022.

Markets are more volatile than ever, so it is vital to keep up to date with the latest information. In the next blogpost, Chile, Colombia, Mexico and Peru come under the spotlight as we continue our analysis of the short-term evolution of Latin America’s key markets.